Inflation Report: Growth and Inflation Forecast Downgraded

- Bank of England inflation report downgrades Q2 2018 growth by 0.4%

- Sterling falls over a cent versus the Dollar after the news

- Most other forecasts for key economic measures also cut by BOE

© Simon Dawson, Bloomberg, Bank of England

The Pound fell like a knife on Thursday after the release of the Bank of England (BOE) inflation report which slashed its latest GDP growth forecasts for the second quarter of 2018 from 1.8% to 1.4%.

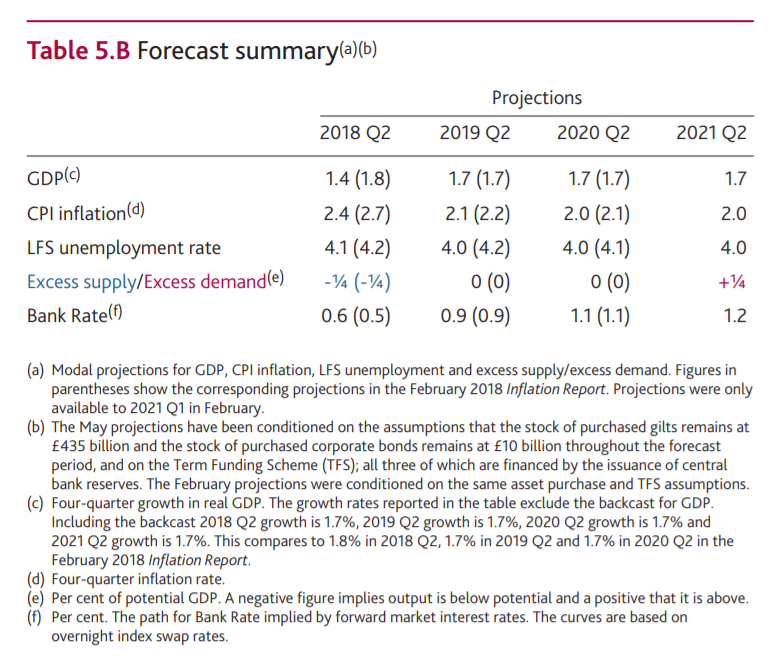

Despite the large downgrade to Q2 growth forecasts, the Bank did not change it's Q2 2019 and 2020 forecasts, however, which remained at 1.7% (see table below).

The inflation report also reduced inflation forecasts to 2.4% in Q2 - from 2.7% previously - and by a basis point in the following years.

The unemployment rate forecast was cut to 4.1% in Q2 and then 4.0% in the next two years. This was lower than the previous forecast.

The BOE continued to see an output gap of -0.25% in Q2 rising to zero thereafter, which means it sees the economy underperforming its potential marginally in Q2 before fulfilling potential after.

The Bank reported the forecast for the expected official interest rate using market-based rates derived from the price of overnight index swaps, and these showed a slight increase in market expectations of interest rates in Q2 of 0.6%, from 0.5% previously, implying a greater possibility of a hike.

The outlook beyond then remained at February's levels of 0.9% in Q2 2019 and 1.1% in 2020.

GBP/EUR fell from 1.1450 to 1.1380 after the release of the report. GBP/USD, meanwhile, fell a whole cent from 1.3615 to 1.3515.

"It’s clear the doves remain firmly in charge on Threadneedle Street," said David Lamb, head of dealing at FEXCO Corporate Payments.

“With inflation falling fast, and the Bank predicting it could soon be falling faster, the inflationary imperative for a rate rise has all but gone," added Lamb.

“Given the increasingly parlous state of Britain’s economy, the Bank’s tacit mandate will now trump its overt one. ‘Thou shalt not imperil economic growth’ suddenly seems much more important than worrying about reining in inflation," said the FEXCO dealer.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.