Wages No Smoking Gun for An August Interest Rate Cut at Bank of England

- Written by: Gary Howes

Image © Adobe Images

There remains a chance the Bank of England raises interest rates on August 01, but the final wage and labour market report ahead of the decision was no smoking gun, making it a fine call.

The Bank of England was already close to cutting interest rates in June and would not have taken much to push them into a cut next month.

However, neither Wednesday's inflation report nor Thursday's wage report gave the green light. The signal is still amber, which means the Bank's decision will have a surprise factor for markets.

The 19K rise in employment in the three months to May was broadly in line with the consensus forecast of 18K. Unemployment is steady at 4.4%.

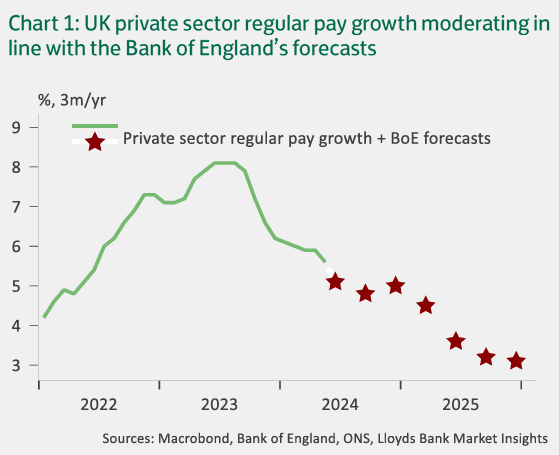

More importantly, both regular pay and pay+bonuses rose 5.7% in the three months to May, which was in line with consensus estimates.

The consensus also sees less than a 50% chance of an interest rate cut on August 01, suggesting a belief that wage growth and services inflation (also +5.7% y/y) risk pushing inflation higher again in the coming months.

"This labour report probably puts the final nail in the coffin for the August rate cut. Potentially there is some doubt over the September meeting, never mind August, with some likely to need a clear downward trend in services and wages by then," says Kyle Chapman, FX Markets Analyst at Ballinger Group.

With inflation down to 2.0% y/y, real pay is now increasing 2.2% y/y, the highest level since July to September 2021. This will ensure robust demand, keep the economy growing, and halt inflation's decline, reducing the need for the Bank of England to intervene with tighter policy.

Wages are the biggest cost burden for services sector firms, suggesting they might have to continue raising their prices, potentially stalling the broader disinflation process.

Image: Lloyds Bank.

Following this week's inflation and wage figures, Capital Economics says it has adjusted its forecast for the timing of the first interest rate cut from 5.25% from August to September in the wake of the data.

The National Institute of Economic and Social Research (NIESR) says the labour market is cooling and total wage growth will fall to 4.4% in the second quarter of 2024, opening room for rate cuts.

But, "the persistence of high wage growth together with sticky underlying inflation means the Bank of England may remain cautious," says Monica George Michail, Associate Economist at the NIESR.

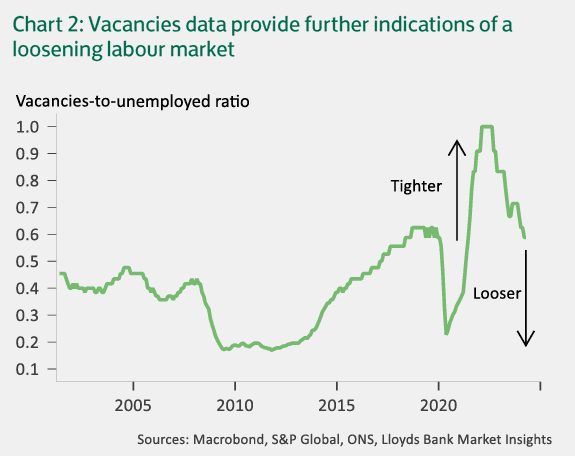

Economists at Lloyds Bank think the ongoing disinflation in the UK economy will continue in the coming months as the labour market softens. They note the number of unfilled vacancies fell by 30K in the three months to June.

The vacancies-to-unemployed ratio, which allows economists to consider the number of unfilled vacancies available to every job seeker, fell further and is now close to where it was prior to the pandemic.

Image: Lloyds Bank.

Such observations could yet convince more members of the Bank of England to vote for a cut next month.

Nikesh Sawjani, Senior UK Economist at Lloyds Bank, says the Bank of England will soon be able to cut interest rates, but questions still remain as to whether it is appropriate to move as early as August.

Gabriella Dickens, G7 economist at AXA Investment Managers, says May’s labour market release will bring some comfort to the MPC, which will most likely cut interest rates.

"Today’s labour market data has arguably increased the chances of the first cut being pushed through in August," she says.

She points out that the unemployment rate held steady at 4.4%, putting it above the 4.3% forecast made by the MPC in May’s Monetary Policy Report. She cites the PAYE measure of employee numbers as increasing by just 16K – or 0.1% month-on-month – in June.

This is well below the 2023 average monthly increase 35K.

AXA thinks pay growth is slowing more materially now that the near-10% increase in the National Living Wage has largely filtered through. "We think employment will continue to tick up over the rest of the year, given the strength of the recovery in broader activity," says Dickens.