Oil Price Fall "Too Fast, Too Furious" - Barclays

- Written by: Gary Howes

Image © Adobe Stock

The WTI oil price has now registered a 13.50% decline in a matter of just seven days in a move deemed to be "too fast, too furious" by energy analysts at Barclays.

Analysts say a recovery back to Barclays's forecast price target for the second quarter can be expected.

WTI oil prices slipped from a peak of $93.94/barrel on Thursday, September 28 to a low of 81.24 at the time of writing Friday. Brent crude has fallen from 95.10 to 83.46 in the same timeframe.

"The recent correction in oil prices has been too rapid and was largely unwarranted in our view," says

Amarpreet Singh, an analyst at Barclays.

Singh says the bulk of the move followed the EIA's weekly petroleum status report which showed a large build in gasoline inventories.

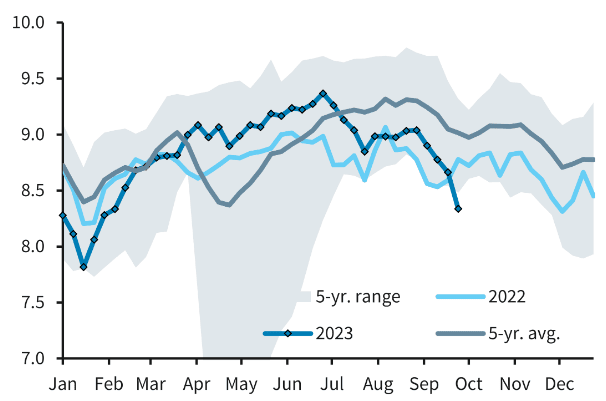

"The agency's implied demand estimate for gasoline (four-week average) stood below the 2020 level for this time of the year, stoking a fresh round of demand concerns among market participants," he explains.

Above: EIA's weekly implied demand estimate for gasoline has plunged recently. Chart: Four-week average, mb/d. Source: EIA, Barclays Research. Image courtesy of Barclays Research.

However, Barclays thinks the move has been "too fast and too furious" for three reasons:

- Weekly implied demand estimates are known to be noisy and the latest data point seems to suggest a disproportionate weakening in demand;

- The move in time spreads and WTI-Brent spread doesn't align with the narrative of a sudden sharp weakening in demand; and

- Incremental data suggest demand in China, which is generally a relative blind spot, continues to hold up better than expected.

"The narrative of price-driven demand destruction does not stand in the face of the fact that very little of the recent run up in oil prices has been passed on to the consumers," says Singh.

Despite the recent decline, Barclays maintains a fair value forecast for brent crude at $92/barrel in the final quarter of 2023.

"We see the recent correction in oil prices as an overreaction," says Singh.

As such, Barclays recommends going long the $85-$90/b call spread on the February 2024 WTI futures contract.