Soaring Core Inflation to Seal ECB Rate Hikes: Economists

- Written by: Gary Howes

Image © Adobe Stock

The Eurozone's economy is seeing growth slow and inflation rise, but analysts say the European Central Bank might have to prioritise its fight against inflation at the expense of growth by raising rates.

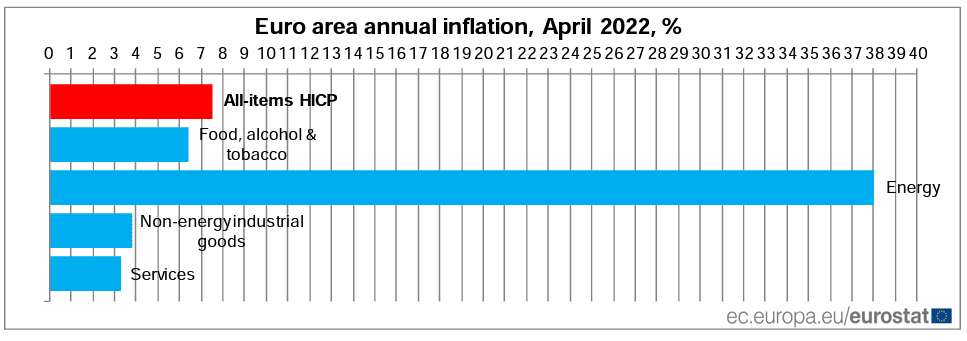

The calls come in the wake of the release of a tranche of key economic statistics that showed annual inflation in the Eurozone had reached its highest level since the introduction of the euro,

Eurostat also said GDP growth had slowed in the first quarter when compared to the final quarter of 2021.

The headline inflation and growth figures are:

- CPI (YoY) for April: 7.5%, expected: 7.5%, previous: 7.4%.

- Core CPI (YoY) April: 3.5%, expected: 3.2%, previous: 2.9%.

- GDP (QoQ): 0.2% in Q1, expected: 0.3%, previous: 0.3%.

Economists appear to be focussed on the jump in core inflation as it would potentially have more of a bearing on the European Central Bank (ECB) than the other elements of today's data.

"As the ECB looks through the seemingly temporary spike in energy inflation, the sharp uptick in core inflation driven by broadening price pressures will be much more worrying to the central bank," says a flash note from the Global Strategy team at TD Securities.

Headline inflation prices are still largely driven by external drivers, such as gas, oil and other commodities, which are clearly out of the remit of the ECB.

But, bubbling core inflation will catch the attention of Frankfurt's policy makers.

"Core inflation jumped to 3.5%, indicating that second-round effects are coming in more quickly than expected. This adds to pressure on the European Central Bank to act sooner rather than later," says Bert Colijn, Senior Economist for the Eurozone at ING Bank.

ING says the ECB seems keen to battle second-round effects and keep inflation expectations anchored around 2%.

Second-round effects explains inflation that arises when businesses and individuals begin to raise their own expectations for future inflationary rises.

Currently inflation appears to be largely imported via the effects of supply chain disruptions and higher energy and commodity prices.

But when businesses start raising the prices of their own goods and services purely in anticipation of future inflationary rises and workers start demanding higher wages, inflation starts to become embedded.

Consumers meanwhile tend to become more cautious, exacerbating an economic slowdown.

But the ECB and other central banks see raising interest rates as sending a strong signal that inflation will come down again, thereby pushing back against entrenched expectations.

"While the economy remains weak and this definitely is not an environment in which the ECB can hike as much as the Federal Reserve, don’t expect the ECB to wait much longer. A first hike should come in September though July could come into the frame if the economic outlook doesn’t worsen materially from here on," says Colijn.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Current expectations are for up to 80 basis points of interest rate hikes to come from the ECB in 2022.

Given central bank interest rate differentials are an important driver of foreign exchange rates, what happens to these expectations has a direct bearing on the Euro.

Had core inflation underwhelmed there was a chance that markets would have priced out some of their rate hike expectations, potentially further heaping pressure on the Euro.

But the beat on expectations signals the ECB will likely act, keeping rate hike expectations in the ascendency and offering a brow-beaten Euro some welcome support.