OBR UK Economic Forecasts Show Record Fall in Living Standards

- Written by: Gary Howes

- Sizeable inflation upgrades

- Growth downgrades

- But big fall in inflation seen in 2023

- 4% boost in tax receipts noted

- Public finances remain solid

Image © Adobe Stock

Surging inflation means UK living standards are to suffer a record decline in 2022, according to the Office for Budget Responsibility (OBR).

The findings were released alongside the OBR's latest suite of economic forecasts, made available during the 2022 budget presentation.

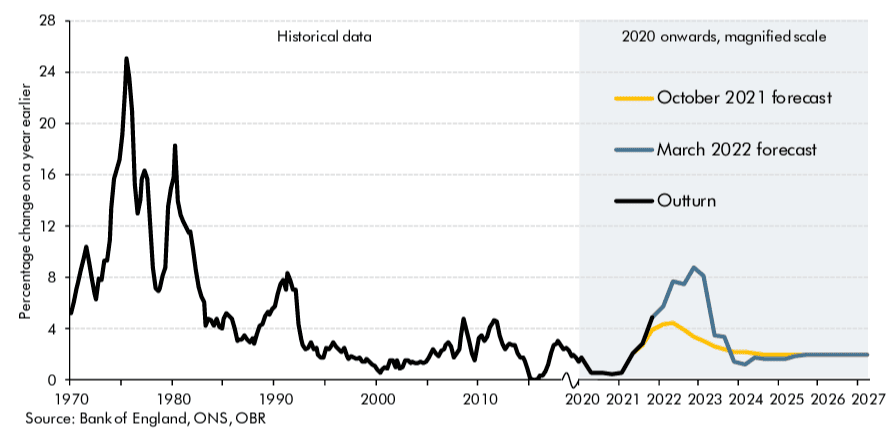

The OBR forecasts inflation will now average 7.4% this year which is a remarkable forecast given the Bank of England's inflation target is set at 2.0%.

However inflation is forecast to fall back to 4.0% in 2023 as the OBR finds wholesale energy futures prices are consistent with a significant fall in the energy price cap in 2023.

The source of the inflation largely lies with the war in Ukraine which has pushed up the cost of energy while further disrupting global supply chains which were already dislocated by the Covid pandemic.

Above: The OBR's latest inflation forecasts show a significant upgrade.

The OBR says Russia’s invasion of Ukraine will push inflation to a 40-year high peak of almost 9%.

"As a net energy importer with a high degree of dependence on gas and oil to meet its energy needs, higher global energy prices will weigh heavily on a UK economy that has only just recovered its pre-pandemic level," said the OBR.

With inflation outpacing growth in nominal earnings and net taxes due to rise in April, real livings standards are set to fall by 2.2% in 2022-23 – their largest financial year fall on record.

Above: Change in real household disposable income per person

The OBR says the increase in nominal wage growth this year, driven by high inflation and a tight labour market, should flow through to the prices of non-tradable goods and services.

This is illustrative of how imported inflation can embed itself into domestic inflationary dynamics and become self sustaining.

It is this type of inflation the Bank of England tries to keep in check by raising interest rates, which it has committed to continue pursuing over coming months.

The OBR said the Bank of England was amongst the other organisations it consulted when creating its latest Economic and Financial Outlook, and the following line has a similar thrust to the Bank's own forecasts contained in the minutes for the March policy update:

"Inflation then falls below target to 1.5 per cent in 2024 as energy prices fall further and the opening up of a small amount of excess supply lessens domestically generated inflation pressures."

The Bank said on March 17 inflation would lower domestic activity to the extent that inflation falls back notably in 2024.

But, a look at the OBR's inflation forecasts shows that inflation then rises back to the 2.0% target by 2026 as energy price volatility falls out of the annual calculation.

Therefore, dips below the Bank's 2.0% target now look to be an exception and not the rule, suggesting the era of low inflation and low interest rates is truly over.

The slump in disposable incomes in 2022 will weigh on consumer and business sentiment and slow economic activity accordingly.

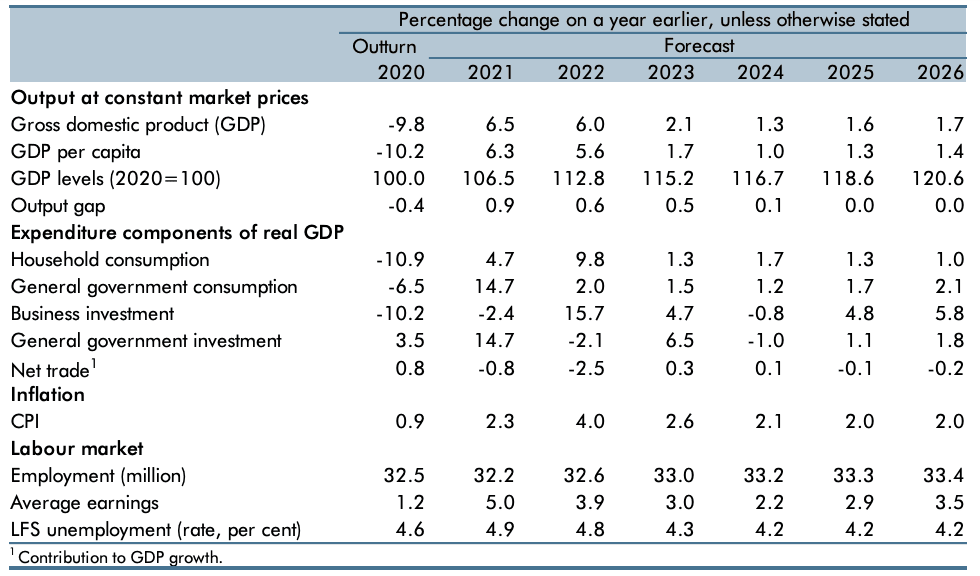

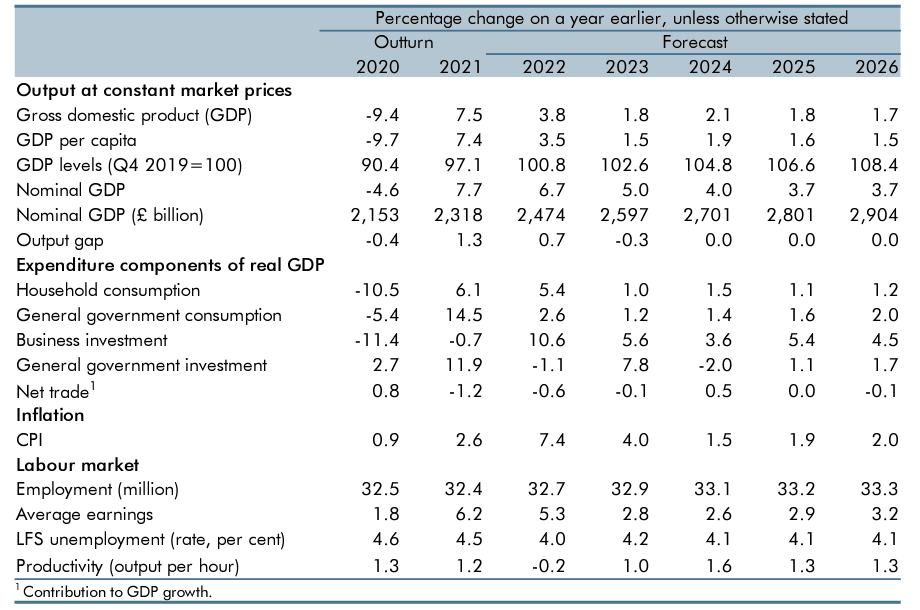

As a result the OBR has downgraded its 2022 GDP forecast from 6% to 3.8%.

Below: The OBR's October 2021 forecasts:

Below: The OBR's March 2022 forecasts:

Amongst the good news presented by the OBR is that public finances have continued to recover from the pandemic more quickly than expected.

They note tax receipts this year have been revised up by 4% thanks to strong growth in tax paid by higher earners and by companies.

Despite higher inflation pushing up debt interest costs, borrowing is set to more than halve from its post-World War II high of £322BN (15.0% GDP) in 2020-21 to £128BN (5.4% of GDP) in 2021-22.

This is £55BN less than the OBR forecast in October.

But borrowing in 2022-23 is forecast to be £16BN higher than forecast in October, at £99BN (3.9% of GDP).

This is largely a result of record-high debt interest costs of £83.0BN, given much of the UK's debt issuance is linked to inflation.

The OBR says business investment is expected to grow rapidly this year and to continue to outpace GDP growth.

But they find no reason to revise previous assumption about the negative effect of Brexit on UK trade flows, indeed they continue to forecast little growth in export and import volumes and a fall in the trade intensity of the economy over the medium-term.

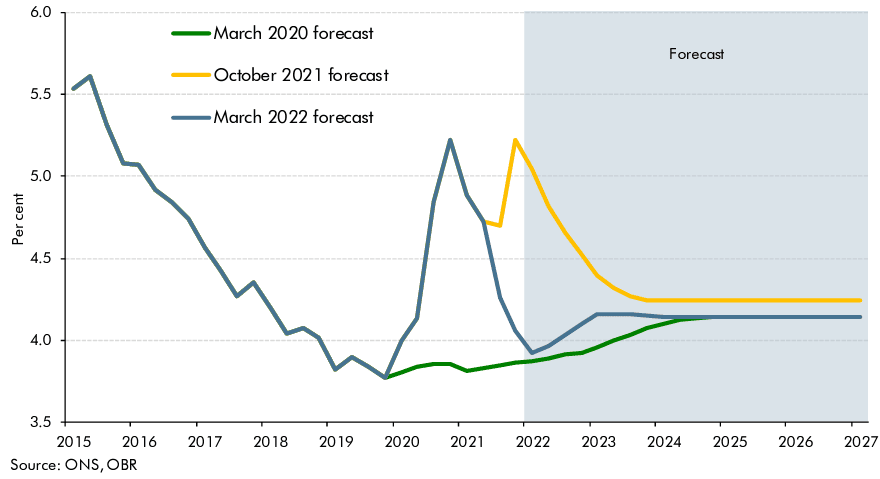

The OBR's employment forecasts meanwhile see a rise in the unemployment rate back above 4.0% in the future:

Above: Unemployment rate forecasts from the OBR.

Note in the above the OBR was significantly off target when forecasting the outlook for unemployment back in October.

They assumed the end of the government's furlough support scheme would result in a material pick up in unemployment, which did not occur.

Expectations for earnings is meanwhile not optimistic, with the OBR expecting an extended period of stagnation in wages.

They anticipate nominal earnings to rise by 5.3% in 2022, 1.4 percentage points faster than forecast in October as a result of tight labour market conditions and high labour market churn in an environment of rising inflation.

But wage growth is not expected to fully compensate for higher inflation meaning that real wages fall in both 2022 and 2023.

Thereafter, earnings growth eases a little further, but inflation drops back more rapidly, resulting in a partial recovery in real wages in the final three years of the forecast.

But on a post-tax basis, "real wages stagnate over much of the forecast period," says the OBR.