UK Manufacturing Fortunes Improve in September, but Industry Still Caught in Contraction

- Written by: James Skinner

© freepeoplea, Adobe Stock

- UK manufacturing PMI surprise on the upside in September.

- After new orders and 'stock of purchases' balance creep higher.

- Purchases balance suggests firms are Brexit stockpiling again.

- Stockpiling could aid GDP growth in Q3 says Capital Economics.

- But Brexit delay would see stocks fall in Q4, weigh on economy.

UK manufacturers remained on the back foot in September but conditions in the industry became less challenging than in the prior month, according to the monthly IHS Markit Manufacturing PMI, amid signs that firms are again stockpiling finished products ahead of the latest Brexit deadline.

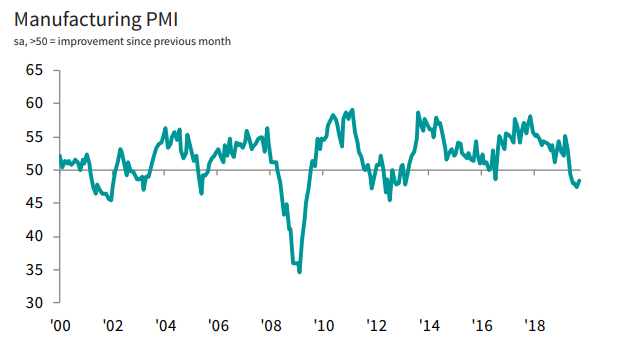

The IHS manufacturing PMI rose to 47.4 to 48.3 in September when consensus had been for a decline to 47.0. Economists had anticipated that the industrial downturn would deepen during the recent month but higher output, stronger order inflows and signs of fresh stockpiling activity prevented what would have been a third consecutive decline in the index. The PMI has been falling steadily since February 2019.

"The increase was driven by a rise in the new orders balance from 44.4 to 46.4 and a jump in the stocks of purchases balance from 49.8 to 53.6. The latter could suggest that firms have started stockpiling again in case of a no deal Brexit on 31st October," says Thomas Pugh at Capital Economics. "The big picture is that manufacturing is on track to contract for a second consecutive quarter, and a meaningful recovery is unlikely given the ongoing struggles of global manufacturing."

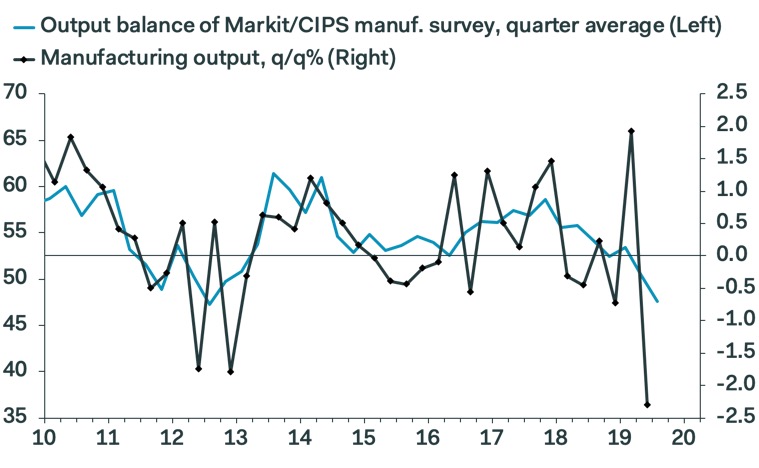

PMI surveys measure changes in industry activity by asking respondents to rate conditions for new orders, production, hiring intentions, prices and inventories. A number above 50.0 indicates industry expansion while a number below 50 is suggestive of contraction. The survey results often correlate with official measures of output, although they can often be wide of the mark too.

The UK manufacturing PMI has zig-zagged lower since February and generally been in decline through much of the time since the 2017 year, which ushered in a short boom for international trade as the global manufacturing sector benefited from anticipated tax cuts in the U.S., the effect of which has since faded, and a brief pickup in Eurozone economic activity that has long since disappeared.

Above: IHS Manufacturing PMI index reading.

"The modest increase in the manufacturing PMI in September was driven partly by renewed stockbuilding ahead of October Brexit deadline," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. "The boost from stockpiling is much smaller than in Q1, when the stocks of purchases balance peaked at 66.2....Setting aside the volatility created by Brexit, it is clear that underlying demand is very weak."

The global manufacturing sector has been in retreat for more than a year now as international trade declines in the face of President Donald Trump's trade war against China, which has damaged the world's second largest economy but arguable, hurt the trade-sensitive Eurozone even more than the two protagonists in the story. However, UK manufacturers are also contending with the nation's twice-delayed exit from the EU, which risks placing tariffs between the UK and some of its largest export markets.

MPs are currently warring in Westminster over the UK's path out of the European Union and a near-immediate general election is now widely assumed to be inevitable, which could see the main parties as well as the insurgent Brexit Party facing off with competing proposals for the UK's post-Brexit future in a process that would risk producing a government that has an explicit mandate to pursue a 'no deal' Brexit

"Demand potentially also is being boosted temporarily by overseas firms stockpiling U.K. goods again. In addition, manufacturers remain downbeat about the outlook—optimism about future production levels still is below its 12-month average—and they cut headcounts at the fastest rate since February 2013. So when the October Brexit deadline has passed without event, production looks set to fall sharply, mirroring the downturn in the Eurozone," Tombs says.

Above: Pantheon Macroeconomics graph showing correlation of IHS PMI with official sector output.

The UK economy has slowed in recent years amid elevated inflation that's at times crimped consumer purchasing power, slowing business investment and more recently, a global economic slowdown that's put the German economy on the door of recession and left the Eurozone at risk of stagnation. Amid that latter slowdown, central banks the world over have rushed to support their economies with lower interest rates and other assistance measures, although the Bank of England (BoE) is yet to follow suit.

UK GDP growth was 0.3% in July, up from 0% previously and marking a strong start to the third quarter for an economy that shrank by 0.2% in the three months to the end of June. The earlier result had seen economists fret about the prospect of a technical recession, which is defined as two consecutive quarters of contraction, although the probability of that happening is now tipped as being low. Manufacturing is believed to account for around a tenth of UK economic output, depending on the measure used.

"It’s worth remembering that the manufacturing sector represents only around 10% of the UK economy, but the much wider service sector is also coming under pressure," says James Smith, an economist at ING. "UK growth is still likely positive, albeit pretty lacklustre. While we are sceptical the Bank of England will follow the Fed and the ECB towards policy easing right now, all of this emphasises that any prospect of policy tightening is a long way off."

Above: Car production and Pantheon Macroeconomics forecast of sector output. Click to enlarge image.

Tombs and some other economists had been tipping an increase in growth for the months ahead because of anticipated increases in stockpiling of finished goods ahead of the October 31 Brexit deadline, with firms likely keen to insure themselves against any potential disruption at the ports in the event of a 'no deal' Brexit. The ONS said that all main industries expanded that month, although most notable was the increase in manufacturing. Sector output rose 0.3% in July after falling -0.2% in June.

However, data from trade bodies has recently led Tombs to temper his optimism on the likely extent of the anticipated third quarter rebound in growth. This is after the Society of Motor Manufacturers and Traders reported August production data that lead the Pantheon team to believe the official measure of output from the sector will increase by 10% for that month, which is a slightly lesser pace of expansion than had been anticipated.

"We’re revising down our forecast for quarteron-quarter GDP growth in Q3 to 0.3%, from 0.4%, in response to signs that the rebound in industrial production is shaping up to be smaller than we had anticipated. Nonetheless, our forecast still exceeds the MPC’s 0.2% expectation and likely would be sufficiently strong to persuade the Committee that lower interest rates are not warranted," Tombs wrote, in a recent note to clients.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement