French Economy Defies the Gloom to Beat Expectations with 0.3% GDP Growth

- Written by: James Skinner

© Adobe Stock

- French economy grows faster than expected in Q4 2018.

- In what economists say will be a fillip for Eurozone GDP too.

- Risks to market's gloomy view of EUR to the upside says ING.

The French economy demonstrated resilience in the face of multiple challenges when it grew faster than was expected during the final quarter of 2018, with economists saying the performance bodes well for Eurozone figures due out later this week.

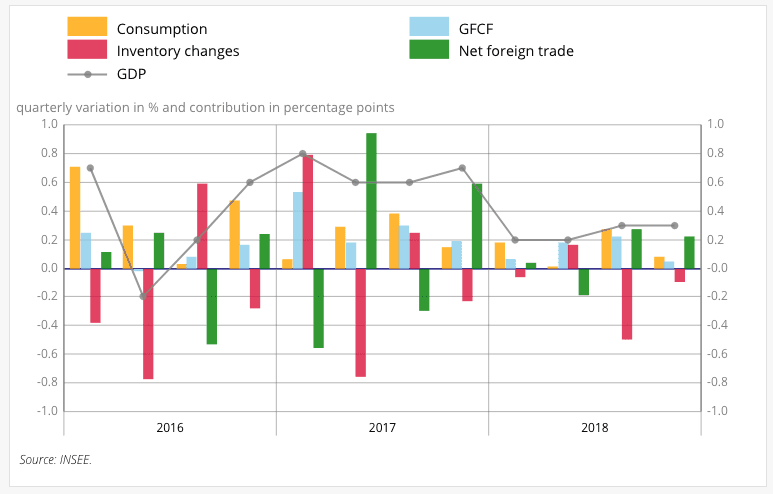

France's economy grew by 0.3% during the final quarter of last year, unchanged from the pace of expansion seen in the prior quarter, although the annual growth rate still fell from 2.3% in 2017 to just 1.5% for the year overall.

Household spending and business investment stagnated heading into year-end, acting as a weight around the ankles of the economy, although the impact wasn't enough to offset a surprise pick-up in exports and higher government spending. Markets had been gloomy heading into the release noting a broader Eurozone economic slowdown over recent months.

"A much welcome surprise, indicating that the “yellow vests” protests were less of a drag on growth than we feared, based on the overall horrible survey data," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics. "The details suggest that net exports saved the day."

Markets care about the GDP data because it reflects rising and falling demand within an economy, which has a direct bearing on consumer price inflation which is itself important for questions around interest rates. And interest rates themselves are a raison d'être for most moves in exchange rates.

Changes in interest rates, or hints of them being in the cards, are only made in response to movements in inflation but impact currencies because of the push and pull influence they have on international capital flows and their allure for short-term speculators.

"France’s economy performed a little better than expected in Q4," says Jack Allen, an economist at Capital Economics. "Following today’s data for France, the risks to our forecast that euro-zone GDP rose by only 0.2% in Q4 perhaps lie slightly to the upside."

Wednesday's data from France comes at a time when concerns over the health of the Eurozone economy has been mounting, with Germany's economy seen teetering on the brink of recession, Italy's economy likely in recession and the French economy previously also expected to slow due to months of large protests in the country.

German GDP data for the final quarter will not be released until the middle of February although Eurostat will publish its own initial estimate of Eurozone GDP growth last year on Thursday at 10:00 London time. The German economy contracted by -0.2% in the third quarter while the Eurozone grew by 0.2%.

Eurozone industrial production fell toward year-end as an economic slowdown in China crimped demand for goods made in the bloc's factories and as new EU rules on testing the emissions output of cars stifled output from the automotive sector.

2019 has however gotten off to a poor start with IHS Markit PMI surveys suggesting the manufacturing and services sectors contracted in January.

Indications that Eurozone growth is slowing led the European Central Bank (ECB) to hint last week that it could delay the timing of its first interest rate rise, pushing it back from late 2019 into the 2020 year. The bank is also widely expected to downgrade its forecasts for the bloc's economy at its next meeting.

"In the first piece of positive European news in a long time, French 4Q18 GDP surprised on the upside at 0.3% QoQ. Investors are underweight Europe and completely priced out the normalisation of ECB policy in 2019, thus any upside surprises could gain some traction," says Chris Turner, head of currency strategy at ING Group.

The ECB needs economic growth to be sufficient enough for it to lift the consumer price index and core inflation back toward the target of "close to but below 2%", if it is to be able to justify raising interest rates. That's what the currency market wants to see.

But core inflation is currently at just 1%, unchanged from it's January 2016 levels and only 0.4% higher than it was in January 2015 when the ECB was planning a record amount of economic stimulus designed to lift consumer prices.

Changes in interest rates are only normally made in response to movements in inflation but impact currencies because of the push and pull impact they have on capital flows. Rising rates are positive for a currency and vice versa.

The market knows all too well the ECB will not be able to raise its interest rate any time soon so what will matter most for the Euro over the coming months is whether economic data for the first quarter points to a more protracted slowdown, or if it signals that an economic recovery is in the pipeline.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.