Citi Sees Potential for Ethereum Rebound Despite Early 2025 Struggles

- Written by: Sam Coventry

-

Image © BruceG1001, reproduced under CC licensing

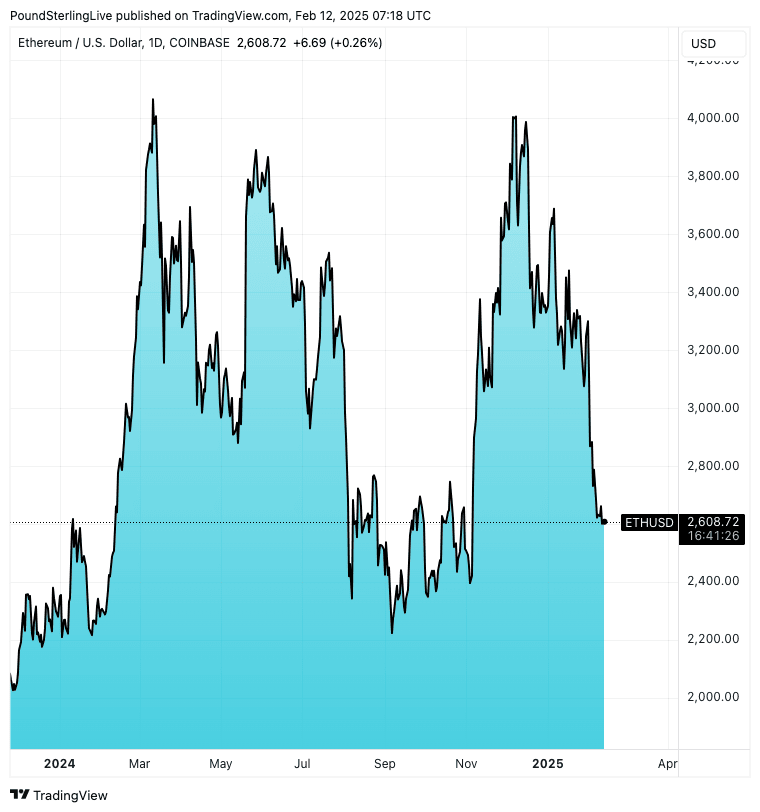

Ethereum has had a difficult start to 2025, underperforming Bitcoin by about 25% and shedding approximately 22% of its value since the beginning of the year.

But despite this weak price action, Citi Research suggests that the outlook for ETH is far from dire.

In its latest Digital Asset Bi-Weekly report, Citi analysts point to several fundamental indicators - rising total value locked (TVL), increasing ETF inflows, and renewed search interest - that could signal a turnaround for the world’s second-largest cryptocurrency.

"While user activity has been volatile in recent weeks, the fundamental backdrop is not all that murky," Citi’s analysts wrote.

Above: ETH has failed to emulate BTC and deliver a series of new highs over the course of the past year.

"Total value locked has risen sharply, ETFs continue to see inflows, and search interest is picking up." The report suggests that ETH’s performance may serve as a gauge for industry confidence in the future of U.S. crypto regulation, with altcoins often reflecting optimism or pessimism about regulatory clarity.

Ethereum’s weakness has coincided with Bitcoin dominance reaching multi-year highs of around 61%, a level not seen in years.

The past year has seen significant user migration to Layer 2 (L2) networks as well as rising adoption of alternative blockchains like Solana, raising questions about Ethereum’s competitive advantage.

However, Citi notes that Ethereum’s core DeFi ecosystem remains strong, with TVL rising sharply and decentralised exchange (DEX) volumes historically elevated.

One of the biggest factors supporting Ethereum’s potential for a rebound is the increasing interest from institutional investors. While Bitcoin spot ETFs have amassed $40.6 billion in net inflows since their launch in early 2024, Ethereum ETFs—which debuted later in July 2024—have seen $3.2 billion in net inflows.

"Following the election, ETH ETF flows turned distinctly positive," Citi’s analysts noted, highlighting that institutional interest in Ethereum is strengthening despite price underperformance.

Beyond institutional flows, search interest for Ethereum is on the rise, often a strong indicator of renewed retail engagement. Citi notes that search trends tend to correlate with price action and major industry events, and the renewed attention could signal a broader shift in market sentiment.

While on-chain activity remains mixed—with large wallets selling and smaller wallets staying quiet—there are signs of strengthening fundamentals.

Stablecoin market cap, a measure of liquidity in the crypto ecosystem, resumed its strong growth after a brief pause, signaling an increase in capital inflows. Ethereum staking yields, while fluctuating, have seen a brief spike, though they remain less attractive relative to U.S. Treasury yields at around 4.5%.

Ethereum’s resurgence may also depend on broader regulatory and macroeconomic factors.

Citi suggests that the political environment in the U.S. could play a crucial role, especially given that Trump-linked World Liberty Financial holds over $200 million in ETH. If the new administration moves toward pro-crypto policies, Ethereum could benefit from a shift in market confidence.

For now, Citi’s outlook remains cautiously optimistic.

The firm expects Ethereum’s price action to remain choppy in the near term, with Bitcoin dominance staying elevated. However, if ETF inflows sustain their momentum, on-chain activity improves, and regulatory clarity emerges, Ethereum may stage a comeback in the latter half of 2025. "Ethereum’s price action is expected to remain choppy," Citi said, "but if ETF inflows remain positive and regulatory uncertainty eases, Ethereum may see stronger performance."

Ethereum may be the laggard of the crypto market today, but Citi’s analysis suggests that the network’s underlying strength in DeFi, institutional adoption, and evolving regulatory landscape could position it for a rebound. With growing interest from both institutional and retail investors, Ethereum’s trajectory could shift—if the right catalysts align.