Bitcoin: Just Getting Started?

- Written by: Sam Coventry

-

Image © Adobe Images

Bitcoin, the pioneering cryptocurrency, celebrated its inception in January 2009 by Satoshi Nakamoto, who proposed a revolutionary idea of a decentralised digital currency.

Over the years, Bitcoin's journey has been characterised by volatility, a growing community of users, and increasing acceptance as a form of asset and medium of exchange. As we look toward the future, many experts and enthusiasts speculate: Is Bitcoin just getting started?

This article examines current price trends, potential future scenarios, and the diverse use cases of Bitcoin, ultimately arguing that Bitcoin may still have untapped potential ahead.

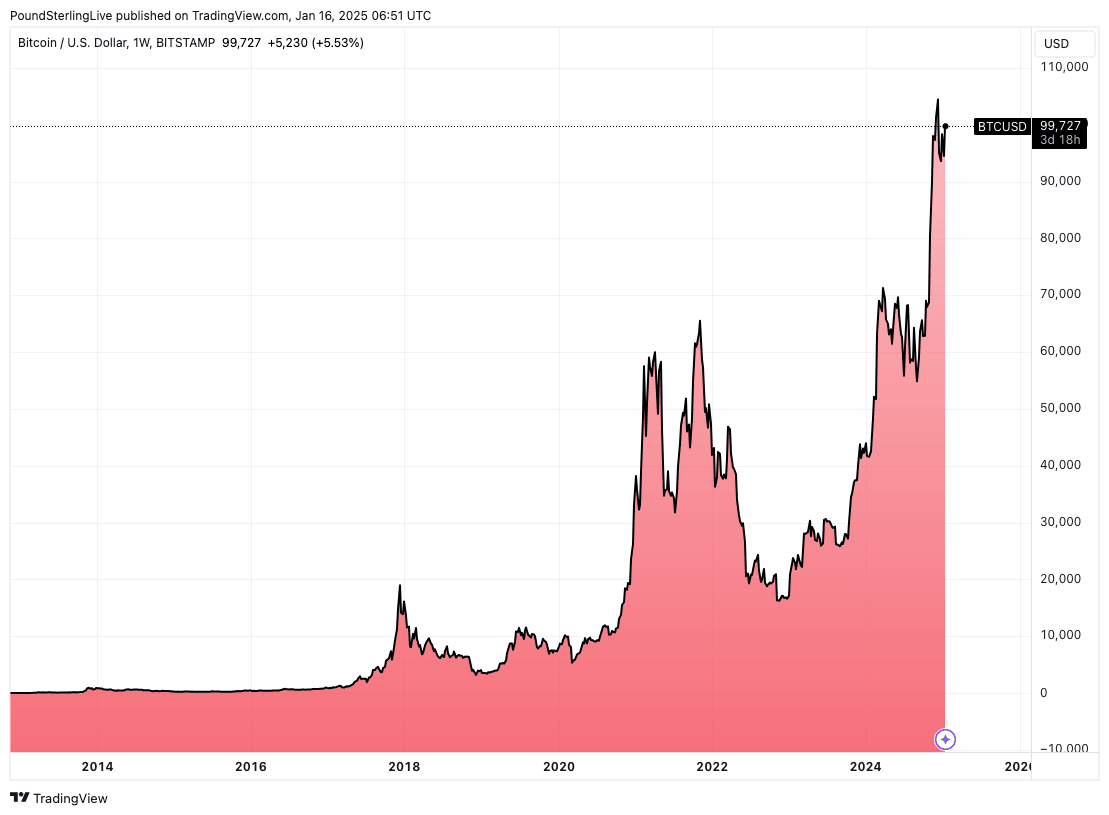

Bitcoin's Price Journey

Bitcoin's price history is a tale of highs and lows, marked by periods of dramatic growth and significant corrections in cryptocurrency trading.

Bitcoin was initially valued at virtually nothing, trading for pennies in 2010. The first significant price surge occurred in late 2013 when Bitcoin broke the $1,000 barrier, driven by increasing awareness and speculative trading.

The coming years saw Bitcoin navigate turbulent waters. It reached nearly $20,000 in December 2017 during a speculative frenzy, followed by a steep drop in 2018, which saw the price sink to around $3,000. This rollercoaster phase indicated market unpredictability as investors grappled with the nascent asset's speculative nature and regulatory uncertainties.

In late 2020, Bitcoin experienced yet another meteoric rise, fueled by institutional interest and acceptance, reaching an all-time high of approximately $69,000 in November 2021.

The pandemic';s economic conditions and increased adoption by corporate entities like Tesla and MicroStrategy led many to regard Bitcoin as "digital gold", a store of value resistant to inflation.

As of October 2024, Bitcoin's price has fluctuated between $95,000 and $108,000.

While Bitcoin's price history exhibits volatility, evaluating its value beyond mere price points is essential. The question arises—are we witnessing the early stages of a much broader adoption and utilisation of Bitcoin?

Use Cases for Bitcoin

Bitcoin is more than just an investment vehicle; it serves various purposes that can redefine its utility in the global economy.

Bitcoin has increasingly been viewed as a store of value akin to gold. In an era of economic uncertainty and inflation, many investors use Bitcoin to hedge against traditional market fluctuations and potential currency depreciation. The fixed supply cap of 21 million coins bolsters this perception, maintaining scarcity that parallels precious metals.

While Bitcoin was created as the first decentralised currency intended for peer-to-peer transactions, its function as a medium of exchange has evolved.

The growing number of merchants accepting Bitcoin, particularly in the tech and retail sectors, paves the way for Bitcoin to be utilised in everyday transactions, supporting various platforms dedicated to facilitating Bitcoin payments.

Traditional remittance services often involve high fees and lengthy processing times. Bitcoin can facilitate seamless and cost-effective cross-border transactions. As a borderless currency, Bitcoin enables users to send money internationally without the bureaucratic hassles or currency conversion fees that plague traditional financial systems.

Beyond serving as a speculative investment, Bitcoin offers diversification for traditional investment portfolios.

Institutional and retail investors view Bitcoin as a non-correlated asset that may provide returns distinct from equities and bonds. This characteristic can make Bitcoin an attractive option during economic downturns.

Bitcoin's scalability challenges have led to the development of Layer-2 solutions like the Lightning Network. This technology enables faster and cheaper transactions by creating off-chain channels that can settle back to the Bitcoin blockchain, thus addressing its limitations.

Furthermore, the potential to integrate smart contracts into Bitcoin's ecosystem could expand its utility, enabling decentralised applications and services.

Bitcoin can also facilitate identity management and verification through decentralised applications. By leveraging blockchain technology, individuals can control their identity securely, reducing the risk of data breaches and identity theft.

The blockchain's transparency allows for the traceability of donations, increasing donor trust.

Bitcoin has been utilised in various charitable endeavours, offering organisations a means to receive donations in a cost-effective, secure manner, allowing funds to reach their intended destinations more directly.

What Lies Ahead for Bitcoin?

While Bitcoin's use cases are already developing, is it realistic to consider that it is just getting started? Several factors point towards an optimistic future for Bitcoin.

As more institutions and corporations embrace Bitcoin, it could lead to mainstream acceptance and an influx of capital. High-profile endorsements from companies like Square, Tesla, and others, including investment firms buying significant amounts of Bitcoin, have changed perceptions of Bitcoin as merely speculative, positioning it as a legitimate asset class.

This trend will continue as financial institutions establish Bitcoin-related products, such as ETFs (Exchange-Traded Funds).

As governments gradually develop more precise regulatory guidelines for cryptocurrencies, this can lend credibility to Bitcoin. Regulations can provide an environment where institutional players feel safe participating in the market.

While the regulatory landscape can be challenging, sensible legislation might enhance Bitcoin's adoption, fostering consumer protection and promoting innovation within the sector.

Ongoing technological advancements and the Bitcoin network can enhance its functionality and appeal. Improvements such as second-layer scaling solutions (e.g., the Lightning Network) enable faster transactions with lower fees, making Bitcoin more practical for everyday use as a currency. Additionally, security and user interface developments could enhance accessibility for new users.

Many economic experts project that the challenges of inflation, currency devaluation, and geopolitical instability will drive individuals and nations to seek alternatives to traditional currencies.

In such scenarios, Bitcoin's fixed supply and decentralised nature may appeal to those seeking alternative stores of value, positioning it as an attractive option amid traditional financial system failures.

In regions where the financial infrastructure is weak or where inflation is rampant, such as in many parts of Africa and Venezuela, Bitcoin presents a viable alternative. Its accessibility as a digitally native currency can empower unbanked individuals, allowing them to participate in a global economy without needing traditional banking services.

The rise of mobile internet penetration in these regions further enhances the potential for Bitcoin adoption.

The vibrant global community surrounding Bitcoin, including developers, advocates, and users, continues to push forward with innovations and public awareness efforts.

Strong community support often catalyses Bitcoin development, proposing new use cases and enhancing the technology. As more people engage with the network and understand its potential, this creates additional momentum for its adoption.

The Behavioral Economics of Bitcoin: Hype vs. Reality

The psychological and behavioural aspects of investing in Bitcoin also play a vital role in its future trajectory.

The concept of 'FOMO' (Fear of Missing Out) can lead many retail investors to jump in during bullish periods, further driving the price upward. Conversely, panic selling can lead to sharp price declines during bearish trends. Understanding these behavioural economics will be crucial for potential investors navigating the market.

Investor sentiment can influence Bitcoin in ways that diverge sharply from other financial markets. Given its relatively nascent stage compared to established assets, Bitcoin is still susceptible to speculative trends fueled by social media, news events, or influential endorsements. As the market matures, we may see a reduction in this volatility, allowing for a

more steady growth pattern that could affirm Bitcoin's status as a long-term investment.

Challenges Ahead

As much as Bitcoin has potential for growth, it still faces several challenges. Governments worldwide scrutinise cryptocurrencies more closely, which could lead to stringent regulations that might impact Bitcoin's price and usability. Central banks in various countries are also exploring Central Bank Digital Currencies (CBDCs) that could compete with Bitcoin.

The Bitcoin network still grapples with scalability, especially regarding transaction times and fees during periods of high demand. Although Layer 2 solutions and other technological advancements are being developed, whether these changes can keep pace with user growth remains to be seen.

Despite growing interest, a considerable educational gap remains regarding Bitcoin's functions and risks. Misinformation can hinder mainstream acceptance, prompting scepticism among potential users and investors.

Bitcoin predominantly holds the top position in the cryptocurrency market; however, the landscape is crowded with numerous alternative cryptocurrencies (altcoins) that offer unique features. Some may leverage faster transaction speeds, contracts, or other functionalities that could compete directly with Bitcoin.