Bitcoin Forecast at 200K by Standard Chartered

- Written by: Gary Howes

-

Image © Pound Sterling Live.

A major global bank says 2025 could see the price of bitcoin double.

Standard Chartered paints a positive outlook for Bitcoin, with institutional investments playing a key role.

"In 2025, we expect institutional flows to continue at or above the 2024 pace," says Geoff Kendrick, Global Head of Digital Assets Research at Standard Chartered Bank.

The call comes after the world's biggest cryptocurrency breached 100K amidst U.S. political tailwinds, with President-elect Donald Trump nominating Paul Atkins as the new SEC Chair.

A Goldman Sachs report suggests that the market interprets Paul Atkins' nomination as the new SEC Chair as a signal of potential easing in cryptocurrency regulations.

This positive outlook stems from the belief that Atkins might adopt a more crypto-friendly regulatory approach, creating a more favourable environment for the industry.

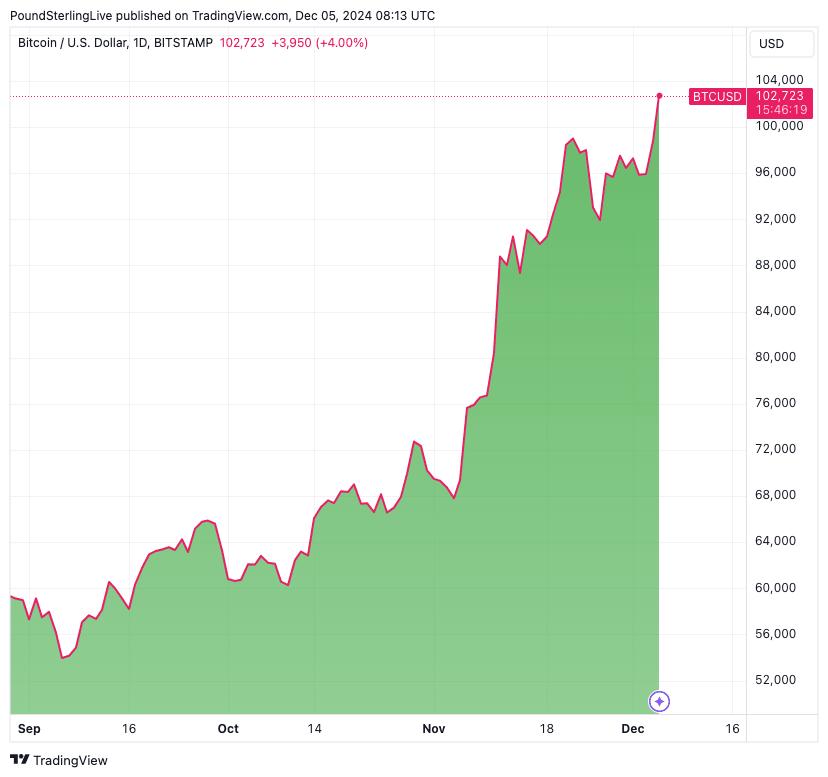

Above: BTC broke the $100K marker this week.

Looking ahead, Standard Chartered sees several factors that point to ongoing BTC gains:

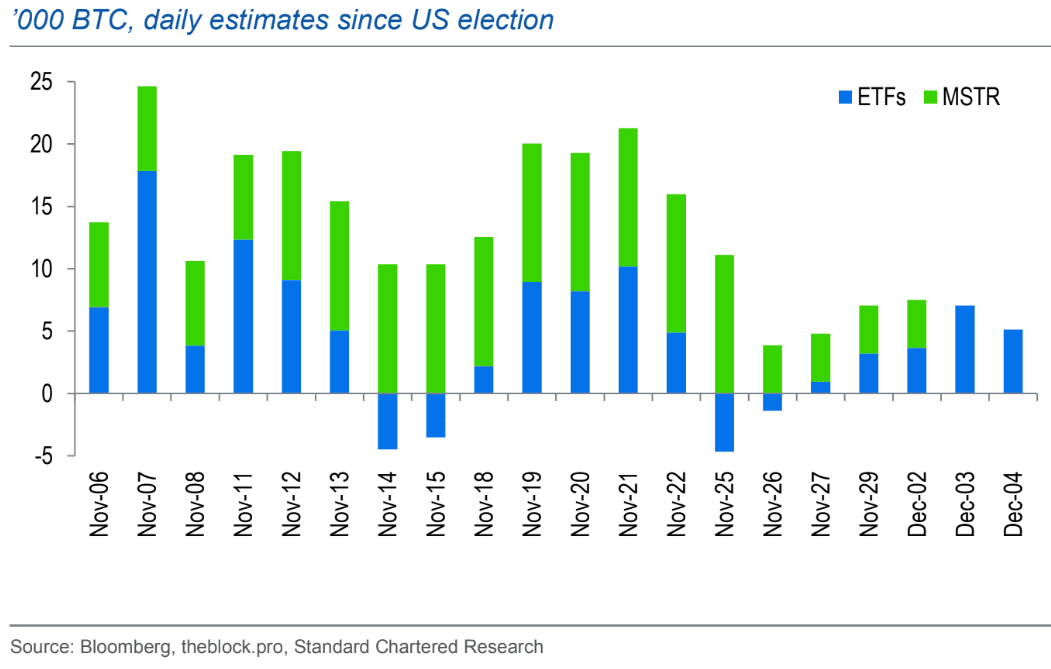

Strong Institutional Inflows in 2024: Institutional investors, particularly through US spot ETFs and purchases by MicroStrategy, have driven significant Bitcoin inflows in 2024.

"In 2025, we expect institutional flows to continue at or above the 2024 pace," says Kendrick.

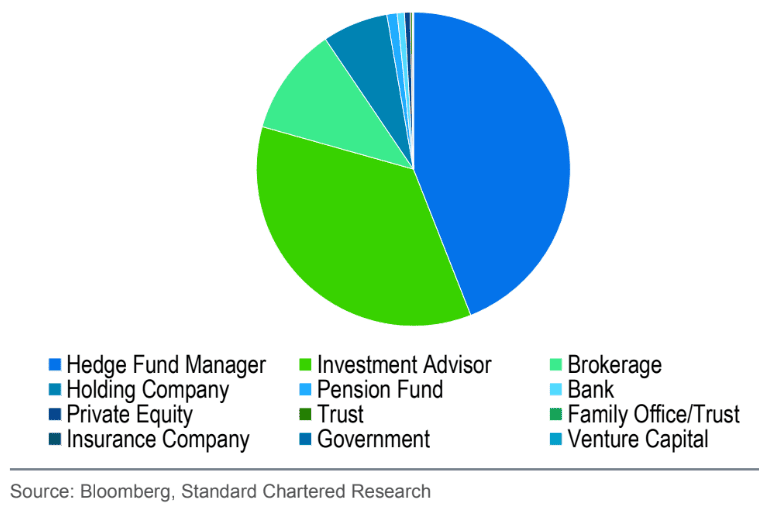

Above: Holders of the nine new ETFs, by investor category (%).

Continued Institutional Interest Anticipated in 2025: The report expects this trend to continue in 2025, further bolstering Bitcoin's price.

Regulatory Changes Expected to Facilitate Institutional Participation: Anticipated regulatory shifts under the Trump administration are likely to make it easier for traditional finance institutions to engage with digital assets, potentially unlocking substantial investments.

Potential Entry of US Retirement Funds: Even a small allocation from the massive US retirement fund pool could significantly impact Bitcoin prices.

Above: US spot ETF + MicroStrategy buying of Bitcoin has surged.

Global Sovereign Wealth Funds and Strategic Reserve as Potential Catalysts: The report suggests that Bitcoin adoption by global sovereign wealth funds, or the creation of a US strategic reserve fund, could further propel prices.

MicroStrategy's Aggressive Bitcoin Accumulation: MicroStrategy's ongoing Bitcoin purchases, exceeding their initially announced plans, signal strong demand and confidence in the cryptocurrency.

MicroStrategy's Market Cap to Bitcoin Holdings Ratio as a Demand Indicator: The report views the increasing ratio of MicroStrategy's market capitalisation to the value of its Bitcoin holdings as a measure of excess demand for Bitcoin.

Standard Chartered's Bitcoin Forecasts

The bank sets a price target of around USD 200,000 for Bitcoin by the end of 2025 and says there is the potential for Even Higher Prices.

The report emphasises that factors like faster adoption by retirement funds, sovereign wealth funds, or the establishment of a US strategic reserve fund could drive prices even higher than the projected target.

"We think our end-2025 BTC price target around the USD 200,000 level is achievable. We would turn even more bullish if BTC saw more rapid uptake by US retirement funds, global sovereign wealth funds (SWFs), or a potential US strategic reserve fund," says Kendrick.