Bitcoin has Further to Run: LMAX

Image © Adobe Stock

Bitcoin has an added advantage on gold of being decentralised and far scarcer says David Mercer, CEO of LMAX Group, who believes the cryptocurrency can go yet higher.

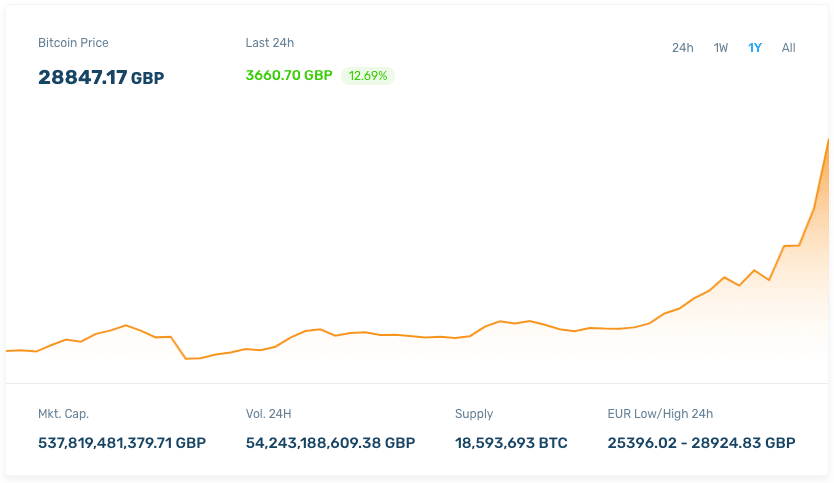

2020 has seen Bitcoin move further into the mainstream – despite a rally of some 300% in 2020, we still remain bullish and believe the market has further to run.

Whilst encouraging progress has been made in an unprecedented year for markets, we think there is still a way to go before the asset class reaches maturity.

In a year dominated by coronavirus, mounting debt and volatility in equity markets, investors have started to turn their attention to some of the qualities that makes Bitcoin such an attractive proposition.

In short, it offers a store of value, not unlike gold (which rallied strongly in 2020).

Whilst critics argue Bitcoin’s intrinsic value might be hard to understand, we would argue this value is largely in the technology it rests on, the blockchain.

Ultimately, the economics of Bitcoin and gold are more or less the same, though Bitcoin has the added advantage of being decentralised and far scarcer than gold.

Let’s not forget that cryptocurrencies can be traded 24/7, which helps ameliorate big market dislocations driven by news events compared with other traditional asset classes which trade 5 days a week.

In terms of our outlook for Bitcoin, whilst we think the future is very bright for the asset class, we still anticipate some bumps along the way.

This year we’ve seen the price move up past the $30,000 area due to the uncertainty gripping markets and whilst we do anticipate further dips, potentially down to the $15,000 mark, we do not think it is unreasonable to suggest Bitcoin could push towards $50,000 in 2021.

In our view, Bitcoin is also the most stable cryptocurrency, despite Ethereum’s strong run in 2020, which lends credence to our bullish stance.

In short, the market fundamentals bear out the assumption that with huge uncertainty globally bought on the pandemic and its primacy in the cryptocurrency sphere, Bitcoin should continue to make gains in 2021.

Let’s not forget that Bitcoin originates in anticipation of the global financial crisis of 2008, where central banks were compelled to respond in a way that was unattractive to the preservation of wealth, with huge monetary stimulus and quantitative easing.

The market has come a long way since then, with major financial institutions starting to allocate towards Bitcoin.

In our view, the case for Bitcoin and the market fundamentals point to another positive year for the asset class in 2021.