Pound-Swiss Franc Rate seen Advancing Near-Term, 1.28 a Potential Target

Image (C) Adobe Images

- GBP/CHF is technically poised for a breakout higher

- Resistance at 1.2800 provides the next target

- SNB meeting dominates CHF calendar this week

The Pound punctuated its long downtrend against the Swiss Franc last week with the strongest weekly rise since the beginning of April.

We see further gains for GBP/CHF from easing risks, in the week ahead, as the latest news suggests the EU is making concessions on one of the most important sticking points in negotiations - the question of the Irish border.

The exchange rate rose from an open of 1.2514 to a high of 1.2743 in the previous week, before ending the at 1.2654. Most of the gains were made on one day - the 10th of September - the rest of the week was pretty flat.

The Franc is a safe-haven currency and the recovery in Sterling came on the back of lessening chances of a 'no-deal' Brexit after negotiators said they were finally making some headway. The Franc probably weakened a little too from the loss of safety flows due to Brexit.

It appears Barnier and co are willing to consider the government's proposal for a high-tech soft border between north and south rather than their preferred backstop of a border in the Irish sea.

This could lead to some significant headway being made towards a deal in a very short amount of time and suggests risks skewed in favour of sterling in the short-to-medium term.

From a technical standpoint the outlook is also bullish in the short-term, dovetailing elegantly with the fundamentals.

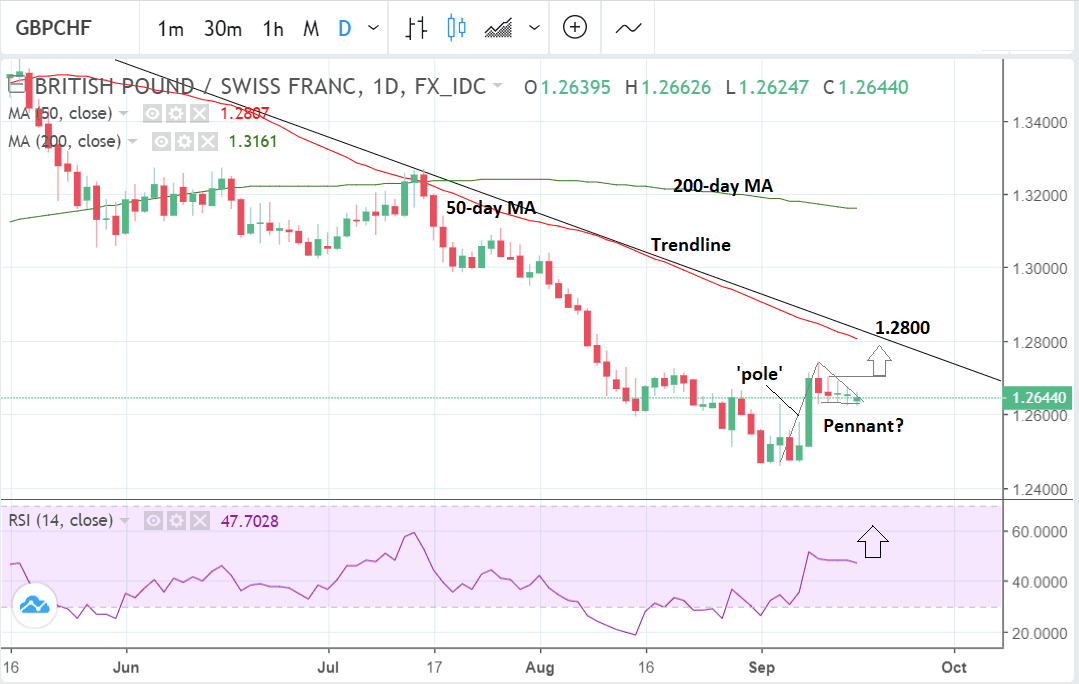

The daily chart strongly suggests gains on the horizon as the pair appears to have formed a bullish pennant pattern on the daily chart, and this is an indicator that the exchange rate is likely to rise the same distance as the pennant's pole after breaking out to the upside.

This would take it up to the level of the down-sloping trendline at roughly 1.2800 and the level of 50-day moving average (MA) nearby. At the resistance cluster around 1.2800 the pair would probably stop and at the very least pause, although there is also the possibility that it could reverse and start going lower again.

A bullish move would gain confirmation from a break above the 1.2704 highs.

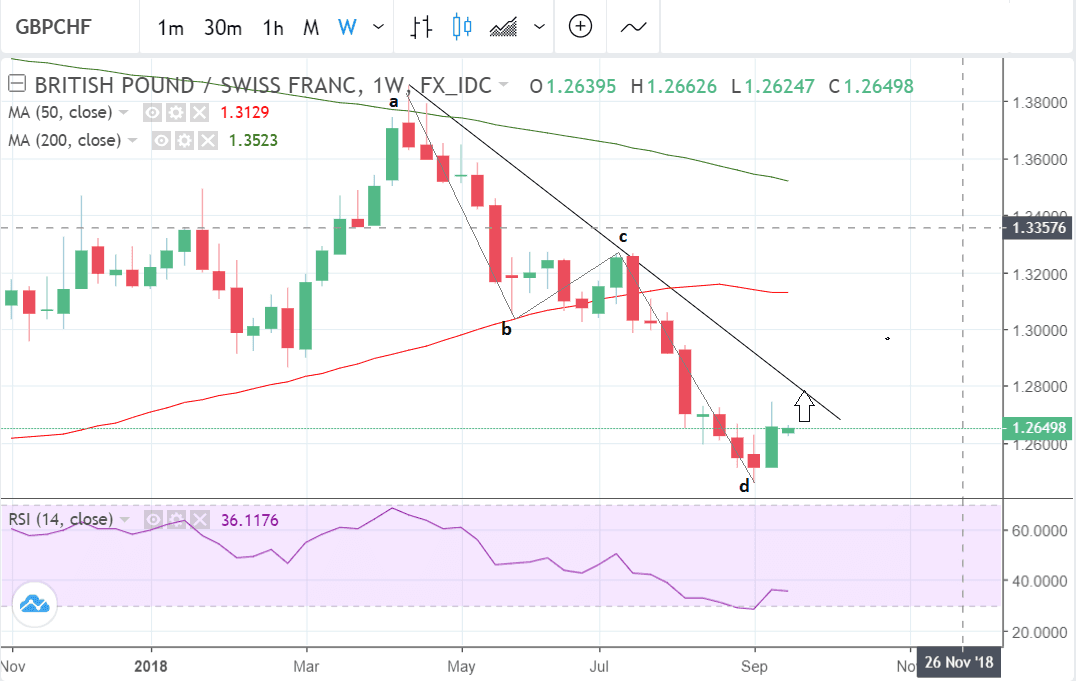

We think there are broader bullish signs which suggest a bullish medium-term technical outlook too, however, from the abcd pattern which looks like it has unfolded on the weekly chart.

These patterns are usually very symmetrical with waves a-b of a similar length to c-d, and this also seems to be the case with the one on GBP/CHF. If the abcd is now complete, as we think it probably is, more upside is likely as the market turns and starts going higher in the next wave.

It would then take a break above the trendline to signal yet more gains, as might be the case should the exchange rate break above 1.2850. Such a break would then bring into focus a new target at 1.3000.

Advertisement

Lock in Sterling's September recovery: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Swiss Franc: What to Watch

The main event in the week ahead for the Franc is the meeting of the Swiss National Bank (SNB) on Thursday, September 20 at 8.30 B.S.T.

The Franc has appreciated strongly in recent weeks due to increasing risk aversion on the back of fears about Turkey, Argentina and South Africa as well as political fears in Europe after the government in Italy threatened to announce a budget which broke EU fiscal rules.

Some of these risks have now diminished, however, with the Italian government seeming to think again about pushing the boundaries of its borrowing limits and the Turkish national bank intervening to prop up its currency.

Although the Lira has fallen sharply again on Monday and this has pushed up the Franc - and risks remain - the Franc is now at fairly elevated levels already making it a less attractive buy for investors seeking safety.

The strong Franc means the SNB is highly unlikely to modify its ultra loose monetary policy stance and negative interest rates for fears of appreciating the currency even more.

If anything traders probably see a risk of the SNB intervening in markets to weaken their currency as they have had to do countless times in the past especially following the GFC. According to site deposit data this does not seem to have been the case so far and because of the stigma of manipulating the market - and the fear now of being branded a "manipulator" by the US Treasury, they are unlikely to come out and say they are going to intervene.

One option is that the SNB may use verbal intervention in order to 'talk down' the Swissie. This usually done by referring to the Franc as "highly overvalued" or some other similar description.

"The best they can do is to introduce verbal intervention and the obvious one is shifting back the language on the Swissie. Their latest statement mentions that the franc is "highly valued" and a shift back to the "significantly overvalued" or anything more substantial will at least help to threaten markets with possible intervention if the franc remains at current levels," says Justin Low, an analyst at Liveforex.

Those who argue the SNB would prefer not to intervene because it has such a large 'balance sheet', by which they mean so many assets, are misguided in our opinion.

These present no financial stability risk to the SNB or the country at the moment despite amounting to 102% of GDP.

Most of the assets are either FX reserves in the form of US Dollars, which have gone up in value recently, Euros, or US equities - which have also seen large gains. In fact, the SNB actually made a profit on its reserves of 5bn CHF last year suggesting they are a boon rather than a risk!

We do not see this, therefore, as a bar to them entering the market and selling CHF.