Swiss Franc 'Fit For Fondue' Suggest the Technicals

Image © kasto, Adobe Stock

- CHF could be about to turn after meeting major resistance levels

- The overvalued Franc is at risk of a return to 'fairer' estimates

- CHF at risk as US and Mexico begin push against currency manipulators

The Swiss Franc is showing signs of vulnerability, charts suggest.

The currency could also be 'skewered' by the fallout from the anti-currency manipulation clause in the new US-Mexico trade treaty.

The Franc is also the most overvalued in the G10, indicating an underlying risk of a devaluation back to 'fair-value'.

Charts Show Franc Could Be Turning

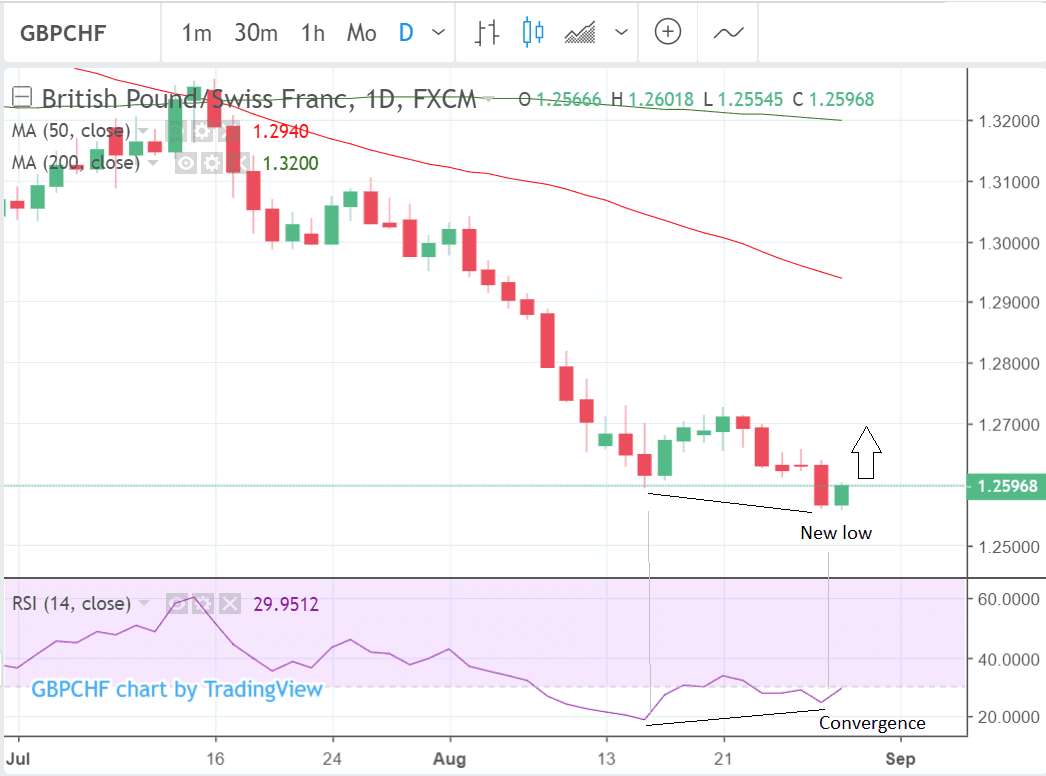

Analysis of price charts has revealed that both GBP/CHF and USD/CHF are potentially poised for a recovery, suggesting a drop in the value of the Franc could be on the cards.

GBP/CHF is in a downtrend but is showing a bullish phenomenon called 'convergence' which is when prices reach new lows but momentum does not, resulting in a converging of momentum and price; it forecasts a rebound is probably in the offing.

The RSI is also about to move out of the oversold zone in a further indication of a bullish rebound.

When the indicator moves out of oversold it is a signal to buy.

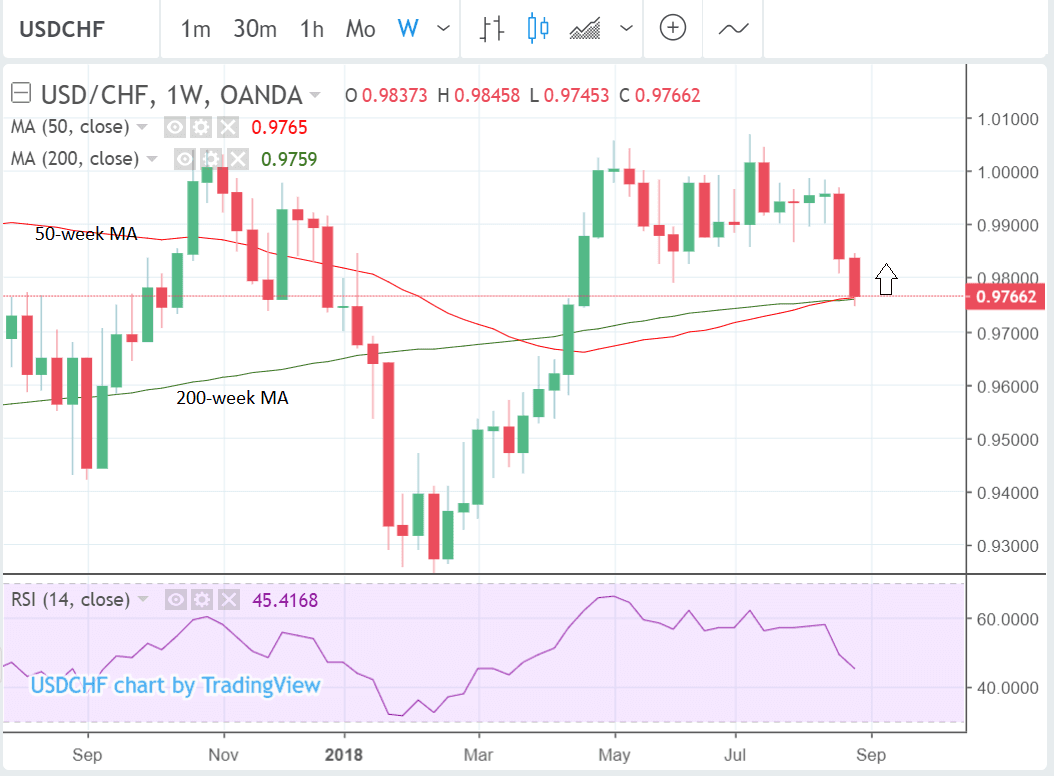

The USD/CHF weekly chart is showing that the pair - which has been selling off over the last two weeks - has reached a major support level at the current 0.9745 lows where it has met both the 50 and 200-week moving averages (MA); this is likely to lead to a recovery-bounce.

Normally, just touching down on one major MA is enough to lead to a bounce but two provides an even stronger support level and a rebound from here is highly anticipated.

Traders tend to use large MA's as places to fade the market and prices often pause, pull-back or even reverse trend at or near them. Thus the combination of the 50 and 200 week is highly likely to lead to a move higher from the current level, even if it is just a temporary bounce. This indicates further CHF weakness.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Manipulation in the Spotlight

The Swiss authorities are one of the most active manipulators of their currency globally.

"It is very important that we continue our expansionist monetary policy. So we have the negative interest rates of minus 75 basis points, but also our willingness to intervene in foreign exchange markets if necessary," said Swiss National Bank President Thomas Jordan following a mid-year bout of CHF strength.

With this activist approach to currency manipulation in mind, a potential drive to crack down on manipulation is likely to impact on the Franc.

The issue of manipulation to enhance an edge in trade was brought to the fore after the recent trade deal agreed between Mexico and the US included a clause designed to prevent it.

"The U.S. and Mexico will commit to maintain transparency over how they manage their currencies as part of their trade deal, a move that could establish a precedent for dealing with nations that have manipulated their exchange rates," said a report by Andrew Mayeda and Eric Martin, correspondents for Bloomberg News.

According to recent comments from Ildefonso Guajardo, the Mexican Economy Minister, the new currency transparency clause could become the 'blueprint' for other global treaties.

Guajardo said the exchange rate clause could become a "signal" to other countries that manipulation would not be tolerated in the future, adding, "This is more or less to say, ‘Listen, the new standard for international treaties is going to be looking at this," according to an interview with Bloomberg.

The Swiss National Bank has usually intervened to weaken the Franc, therefore a crack down could lead to a stronger Franc.

There may be concerns, however, that trading partners will impose tariffs or sanctions on Swiss goods, adding a premium onto their already 'expensive' price tag. Such a situation would actually probably see the Franc devalue, if anything, at least in the short-term.

The 'Bubble' Valuation

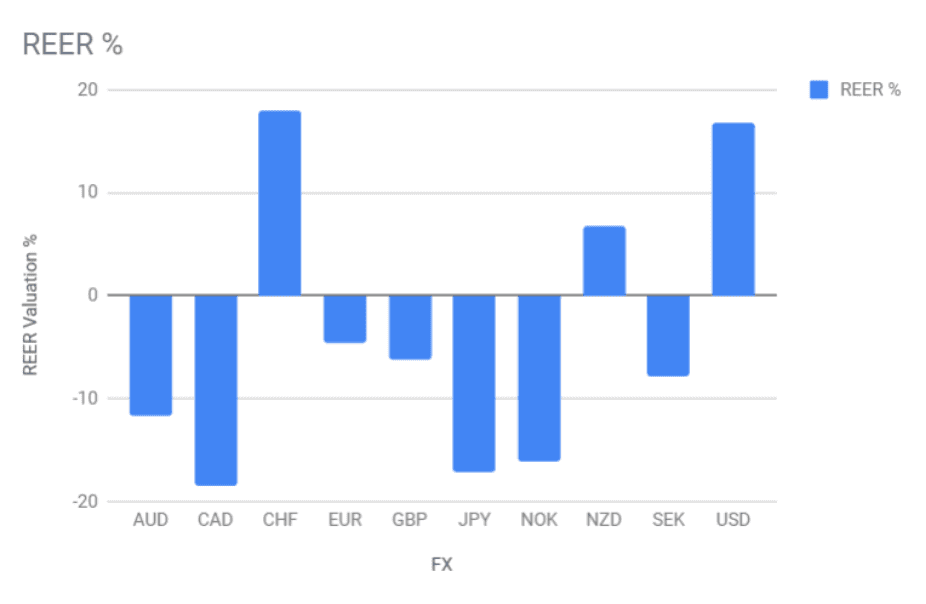

Shakespeare talked about the 'bubble reputation' being at risk of suddenly popping, similarly in the case of the Swiss Franc it is the 'bubble valuation' which is at risk, at least according to the two most commonly used valuation models REER and PPP.

When a currency is overvalued it is often a sign it may drift back down to fair value over time, though the exact timing can be difficult to establish.

The Real Effective Exchange Rate (REER) model is a measure of how fairly a currency is priced against a basket of its most highly traded peers.

According to REER the Franc is 17.9% overvalued.

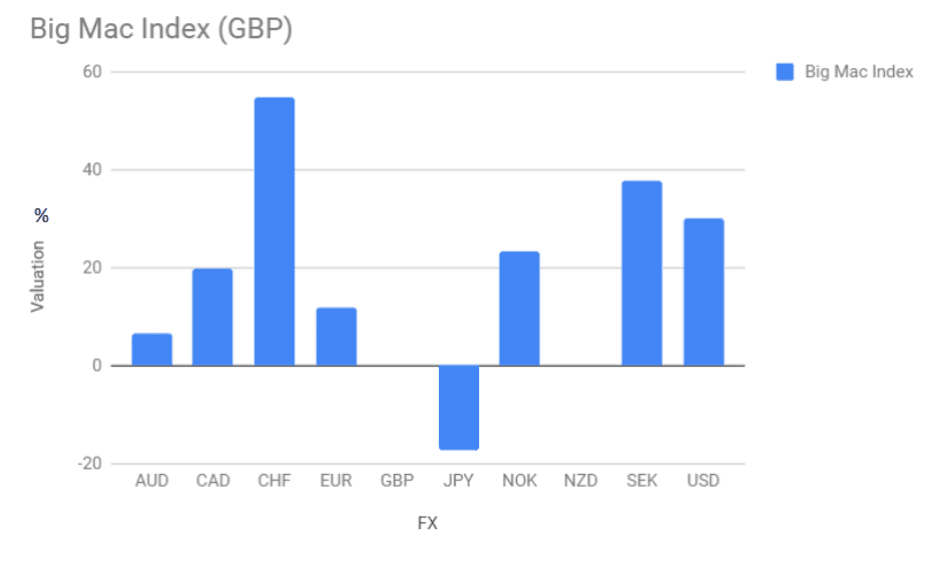

The Purchasing Power Parity (PPP) model uses the difference in cost of a basket of similar goods in two different currencies to determine currency valuation.

A useful proxy for the basket of comparable goods is the 'Big Mac Index', which evaluates an exchange rate according to the difference in the price of a McDonald's Big Mac hamburger in two countries. Although it may sound like a joke, the Big Mac Index is actually quite a serious tool, developed by the Economist magazine, for evaluating currencies.

According to the Big Mac Index (on a USD basis), CHF is 18.8% overvalued.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here