Is Hedge Fund GAM a Risk to the Swiss Franc?

image © DragonImages, Adobe Stock

- GAM blocks redemptions following dismissal of firm's bond fund manager

- Could redemptions eventually pose a risk to the Franc?

- CHF one of the weakest performers on the day - GAM a headwind for FX?

Swiss hedge fund GAM had to take the drastic step of blocking fund redemptions this week after investors sought to remove their money from its absolute returns bond fund (ABRF).

The move came after it emerged the fund's manager, Tim Haywood, had been suspended, "after an internal probe found flaws in his risk-management and record-keeping procedures," according to the Wall Street Journal.

From an FX perspective the attempted 'run' on GAM suggests the possibility of a headwind for the Swiss Franc (CHF). Further redemptions would result in massive outflows of potentially billions from Switzerland, no-doubt weakening the Franc in the process.

Whilst the fund's decision to block outflows will stem the tide temporarily they cannot hold the money back indefinitely as investors ultimately have a right to getting it back.

GAM can only block redemptions in situations where requests amount to more that 10% of the assets under management. The rationale is that larger outflows could materially disadvantage investors who decide to keep their money in the fund.

The fund in question, GAM's flagship ABRF, has an estimated CHF 7.8bn under management, which suggests redemption requests reached over 780m after the news of his suspension broke.

Yet the Heywood saga is not the only problem facing GAM.

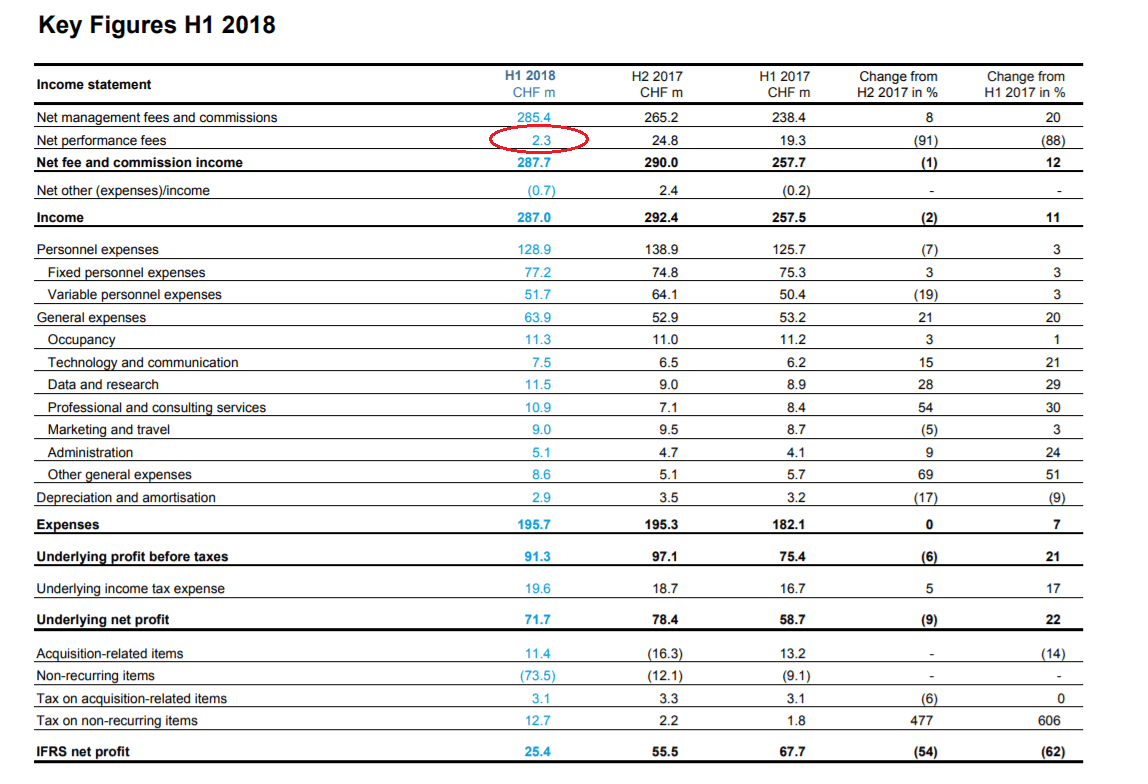

The firm is already in the doghouse after reporting an extremely poor first half performance in which it saw its performance fees share of profits nosedive to only CHF 2.3bn (circled below) from 24.8bn in H2 2017 and 19.3bn in H1 2017.

The suggests the company only really made money from management fees side, or basic administration.

GAM blamed its poor performance on, "volatile and directionless market conditions”, and some have speculated this may be as a consequence of a wider malaise in fixed income caused by years of QE since the financial crisis.

Yet GAM suffered a further blow earlier in July from the news of the failure of its recent aquisition, Cambridge-based Cantab Capital Partners, which led the parent company to write-off $59m in 'goodwill' following the fund's poor performance in H1. GAM paid $217 million to acquire the fund in October 2017.

Cantab uses 'quant' trend-following strategies which have performed poorly in recent 'directionless' conditions too.

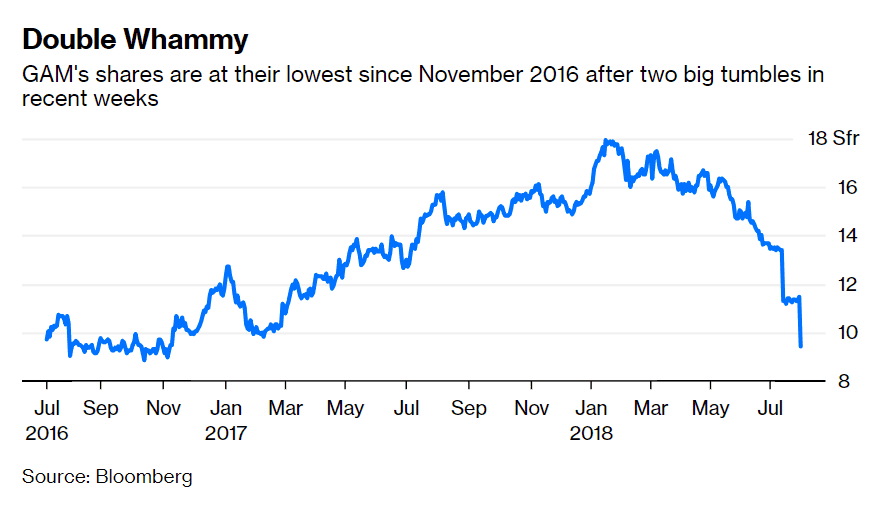

All-in-all it doesn't paint a pretty picture for GAM's outlook and, not surprisingly, shares in the company have tumbled.

Nor does the company expect the situation to improve as it sees the same "volatile and directionless" conditions enduring.

The environment is “likely to continue in the second half of this year, which may affect clients’ risk appetite and the group’s flows,” said GAM in a statement.

Commenting on GAM's misfortune in an opinon piece, Mark Gilbert, a columnist for Bloomberg said:

"In other words, there’s little prospect of the fund making money, and customers will probably withdraw funds. That’s not a good combination."

From an FX perspective it may also not be a "good combination" for the Swiss Franc, given the fund handles over 84.4bn in total assets - with a big potential for wider redemption outflows in general.

Whether coincidentally or not the Swiss Franc happened to be one of the worst performing currencies versus the Dollar on Thursday, falling over 0.22% versus the Dollar to 0.9937 at the time of writing.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here