Swiss Franc Alert: SNB Hikes 50BP

- Written by: Gary Howes

Image © Adobe Images

The Swiss National Bank has just delivered one of the biggest surprises in the history of central banking courtesy of a surprise 50 basis point interest rate hike that takes the policy rate to -0.25% .

The move is a significant intervention in that the SNB was expected to be one of the last major central banks to hike given a long-held policy of negative rates and stable domestic inflation.

But more surprising is the scale of the hike as 50 basis points is not the incremental move most central banks kick off their hiking cycle; just 2 of 26 respondents to a Reuters survey had predicted a 25bp hike today.

"The SNB is tightening its monetary policy and is raising the SNB policy rate and the interest rate on sight deposits at the SNB by half a percentage point to −0.25% to counter increased inflationary pressure," said the SNB in a statement.

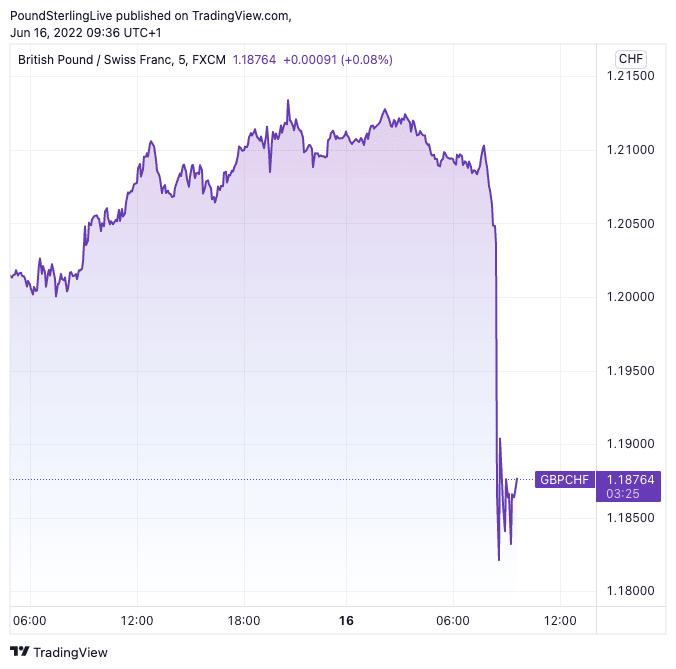

The Swiss franc is understandably surging higher on the move: the Pound to Franc exchange rate is nearly 2.0% higher on the day at 1.1883.

The Dollar to Franc exchange rate is a percent higher at 0.9850.

The all-important Euro to Franc exchange rate is nearly 2.0% lower at 1.0192.

"The tighter monetary policy is aimed at preventing inflation from spreading more broadly to goods and services in Switzerland. It cannot be ruled out that further increases in the SNB policy rate will be necessary in the foreseeable future to stabilise inflation in the range consistent with price stability over the medium term," said the SNB.

Above: GBP/CHF at 5 minute intervals.

Compare GBP to CHF Exchange Rates

Find out how much you could save on your pound to Swiss franc transfer

Potential saving vs high street banks:

CHF 2,825.00

Free • No obligation • Takes 2 minutes

"While the consensus was for the SNB to use today’s meeting to signal a policy change in September, last week’s hawkish ECB meeting coupled with a more hawkish Federal Reserve last night likely forced the SNB into earlier action," says Simon Harvey, Head of FX Analysis at Monex Europe.

The Dollar was broadly stronger in the wake of the decision by the Fed to hike interest rates by 75 basis points on Wednesday June 16, a move aimed at tackling high and persistent U.S. inflation.

The strengthening Dollar is proving a headache outside of the U.S. as the vast majority of countries pay for energy and commodities in USD.

The SNB will be aware that underpinning the Franc via higher interest rates therefore acts as a buffer to imported inflation and confirms central banks are now fighting for stronger currencies.

"With much of Switzerland’s current inflation coming through the trade channel, the Swiss National Bank is unofficially targeting a stronger inflation-adjusted CHF rate (real exchange rate) in order to reduce the level of imported inflation," explains Harvey.

"Widening monetary policy differentials threatens this objective, hence warranting an earlier than expected rate hike," he adds.

Looking ahead, further SNB rate hikes are likely.

"Given its history of making unscheduled policy announcements, we think it more likely than not that the Bank will raise interest rates again, to zero over even into positive territory, before the next scheduled meeting, in September," says David Oxley, Senior European Economist at Capital Economics.

Capital Economics forecast the franc will reach parity with the Euro by year-end.

Compare GBP to CHF Exchange Rates

Find out how much you could save on your pound to Swiss franc transfer

Potential saving vs high street banks:

CHF 2,825.00

Free • No obligation • Takes 2 minutes