Swiss Franc Seen Rising Near Parity Against Euro in 2022

- Written by: James Skinner

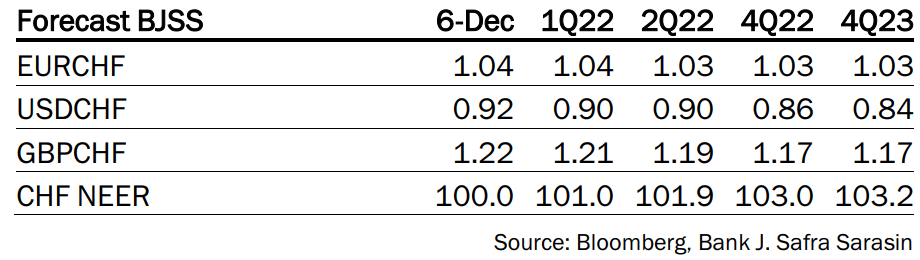

- EUR/CHF seen making attempt on parity next year

- GBP/CHF tipped for slide below 1.20, move to 1.17

- On CHF’s safe-haven appeal, EUR & GBP weakness

Image © Adobe Images

The Swiss Franc has risen through the major currency rankings in recent months but some forecasters see it advancing further as the new year unfolds in price action that could push EUR/CHF near parity and GBP/CHF back below 1.20.

Switzerland’s Franc had been one of the poorer performers among major currencies until the final quarter when European countries were again submerged beneath escalating waves of coronavirus infections, prompting politicians to reimpose economically damaging restrictions on activity.

Throughout this time the Swiss Franc has appreciated against all major counterparts with the exception of the U.S. Dollar, Japanese Yen and Chinese Renminbi, while the safe-haven currency had pushed the EUR/CHF exchange rate to its lowest since the onset of the coronavirus crisis by Wednesday.

“The Swiss franc has strengthened as European PMI readings have softened further,” says Dr. Claudio Wewel, an FX strategist at J. Safra Sarasin, a private bank headquartered in Basel, Switzerland.

“The Swiss franc should remain strong on the back of the currency’s real yield advantage over most DM currencies. Moreover, the currency should perform well against the backdrop of continued pandemic uncertainties, while benefiting from weakening global macro momentum,” Wewel also said.

Above: Pound-to-Franc exchange rate shown at daily intervals alongside EUR/CHF.

- Reference rates at publication:

GBP/CHF: 1.2188 - High street bank rates (indicative): 1.1760-1.1850

- Payment specialist rates (indicative: 1.2078-1.2127

- Find out more about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

Wewel and colleagues at Swiss asset manager J. Safra Sarasin said this week that safe-haven demand and the weakening fundamentals of the Euro could push EUR/CHF “closer towards parity” in 2022 and that it will likely take intervention from the Swiss National Bank (SNB) to keep it afloat.

They’ve assumed in their 2022 forecasts that moves below 1.03 would be likely to prompt the SNB into action, hence why they see the exchange rate bottoming out around that level by the end of next year.

The Pound-to-Franc exchange rate is, on the other hand, tipped to break beneath 1.20 by the middle of next year before ending 2022 at 1.17.

“We are convinced that the SNB will continue to monitor the development of the Swiss franc closely, while excessive currency gains should re-engage the SNB in the FX market. This could happen if the EUR-CHF pair risks dropping below 1.03 in the coming weeks,” Wewel said in a Tuesday note.

“Given that markets have priced a very hawkish BoE, we expect rate expectations to moderate somewhat, which should cap the pound's near term upside. Moreover, we expect Brexit-related supply bottlenecks to weigh on UK growth in 2022, which should act as a headwind,” Wewel also said.

The Pound-to-Franc exchange rate had slipped more than seven percent from its early April highs by Wednesday while EUR/CHF had fallen more than five percent between the middle of September and early December in price action that has so far gone largely overlooked by the SNB.

Above: J. Safra Sarasin forecasts.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“The fact that the SNB has not intervened heavily in recent weeks suggests that it may be comfortable with letting the franc push higher against the euro from here,” says David Oxley, a senior Europe economist at Capital Economics.

“We suspect that the SNB’s “line in the sand” may now be closer to CHF 1.025, and that it could live with the franc rising to parity with the euro over the coming years,” Oxley and colleagues wrote in a research briefing this week.

The SNB has long used sales of Swiss Francs in its attempts to slow or prevent the multi-year decline in EUR/CHF because the cheapening impact the exchange rate has on the cost of imported goods frustrates the bank’s ability to deliver “price stability” by sapping inflation from the economy.

But the weekly disclosures of changes in “sight deposits” held at the bank have suggested that up until December 03 at least it hadn’t made any attempt to prevent the ongoing appreciation of the Franc.

“We also think the franc will strengthen further into next year, as fundamentals continue to work against the euro, reversing recent days’ strength,” says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

“Our forecasts for core inflation in the EZ and Switzerland point to the FX rate reaching parity by the end of next year but we doubt the central bank would let this happen,” Vistesen wrote in a December forecast review.

Above: EUR/CHF shown at weekly intervals alongside GBP/CHF.