Pound-Franc Showing Bullish Continuation Pattern

Image © Pavel Ignatov, Adobe Images

- GBP/CHF trading sideways after prior rally

- More upside likely if trend extends

= Swiss Franc to be moved by global investor risk appetite

The Pound-to-Franc exchange rate is trading at 1.2792 at the time of writing, after rising 0.30% so far this week. Studies of the charts suggest the pair is likely to continue higher as it is forming a bullish price pattern.

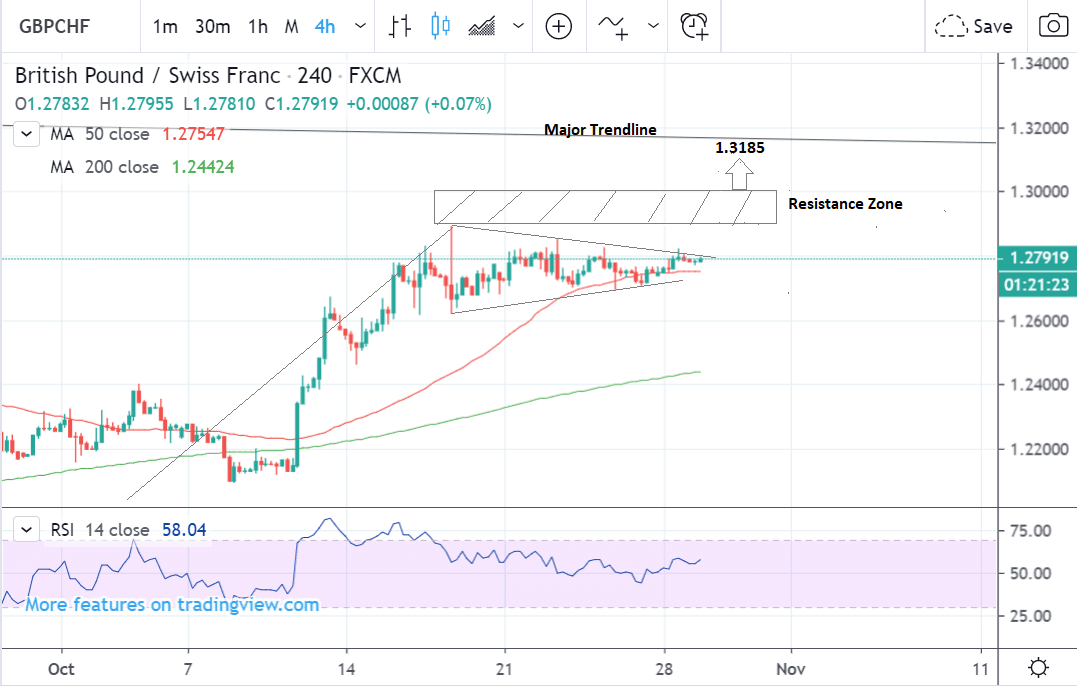

The 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows the pair trading in a sideways trend in the 1.27s after recently peaking at the October 17 highs, following a sharp rally.

Because the pair is in an established uptrend the balance of probabilities favours a continuation higher to a target at and the upper trendline.

A break above the October 17 highs at 1.2893 would provide confirmation of a continuation higher to a target at 1.3185.

Tough resistance just above the price pattern, however, could act as a barrier preventing further gains, and for more confidence, we advocate waiting for a break above 1.3000.

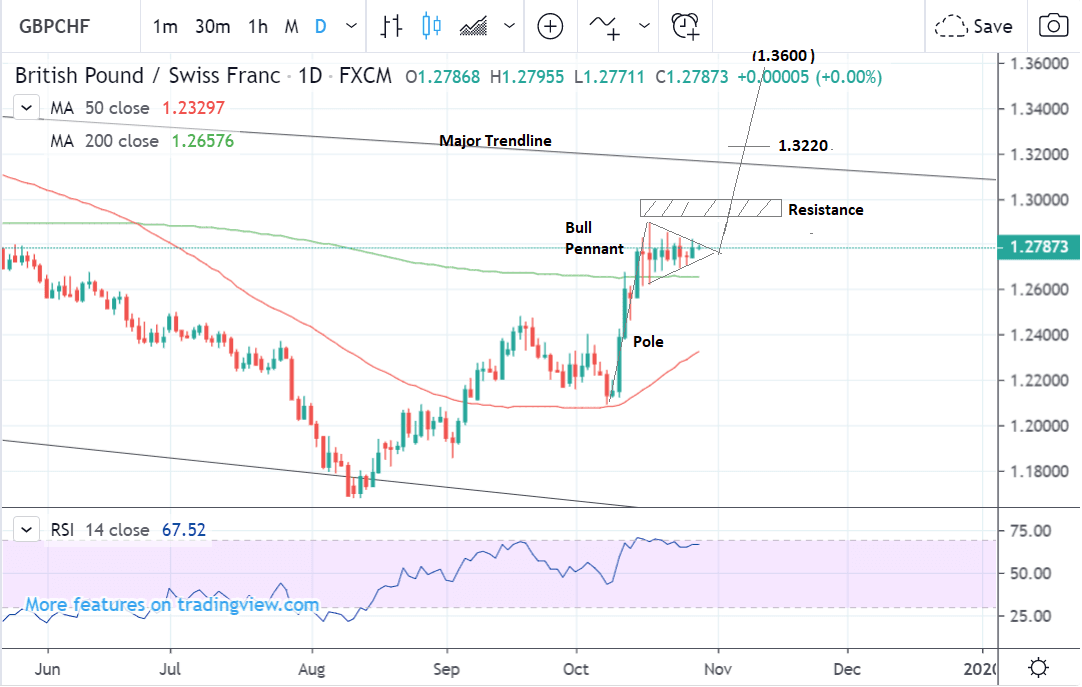

The daily chart is showing the formation of a bullish pattern called a ‘bull pennant’.

This pattern gets its name from the triangular flags which flew from medieval castles. It is made up of a steep rally called a ‘pole’ followed by a sideways consolidation called a ‘pennant’.

Confirmation normally comes from a break above the pattern highs at 1.2893 but in this case, resistance just above, could still prevent further upside.

Greater assurance would come from a clear break above the resistance, confirmed by a move above 1.3000.

Pennant patterns usually rise to a target which is equal to the height of the pole extrapolated from the tip of the pennant higher, which in this case gives an eventual target at 1.3600, and a conservative target at 1.3220.

The daily chart is used to give an indication of the outlook for the medium-term, defined as the next week to a month ahead.

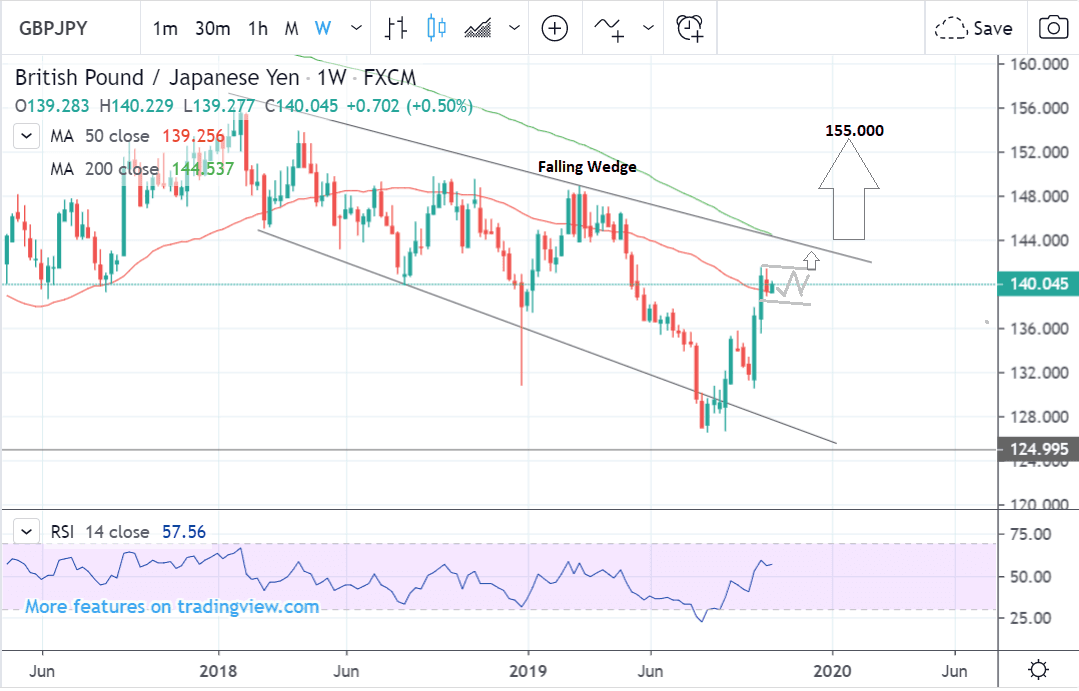

The weekly chart shows the pair rising up within a falling wedge pattern.

Assuming a bullish breakout higher, as indicated on the daily chart, the pair is likely to rise strongly out of the price pattern.

An initial long-term target would be at the 1.3600 level, followed by a target at 1.4000.

The weekly chart is used to give us an indication of the outlook for the long-term, defined as the next few months.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Swiss Franc: What to Watch this Week

The main driver of the Swiss Franc in the short-term is likely to be investor risk appetite because the currency is a favoured safe-haven currency for investors, which means it is bought in times of crisis, like gold.

The Swissie has, therefore, weakened recently due to the improved outlook for world trade as a result of the expected ratification of the ‘Phase 1’ trade deal between the U.S. and China.

“There is a slow drip feed of constructive newsflow surrounding the negotiations for “Phase One” of the US/China trade agreement. Discussion has turned to extending a set of tariff exemptions due to expire in December. Every little helps and this is allowing markets to position with increased appetite for risk,” says Richard Perry, an analyst at Hantec Markets.

The deal is now expected to be signed at the APEC summit in Chile on November 16-17 in line with earlier optimistic expectations.

Indeed, Donald Trump sounded optimistic on Monday when he said they (the negotiators) are “ahead of schedule” on preparing the trade agreement with China for signing at APEC summit in Chile on November 16-17. He said “we’ll call it Phase One but it’s a very big portion.” Also, the deal would “take care of the farmers” and “also take care of a lot of the banking needs.”

There is a good chance there may be further positive news on trade, as it appears the U.S. is now also considering whether to both widen the scope of and delay the suspension of tariff exemptions on $34bn of Chinese imports scheduled for December 28. News that they have, would have a major impact on risk markets and push down the Swiss Franc.

This may not be such an issue for the Chairman of the Swiss National Bank (SNB), Thomas Jordan, who is scheduled to speak at 11.30, on Thursday. He has had the task of keeping the Franc from overvaluing in the years since the financial crisis so as to maintain swiss export competitiveness. So for him, a weaker Franc is good news.

Investor risk appetite and therefore the Swissie are likely to be sensitive to Chinese PMI data on Wednesday at 21.00 which will provide further insight into how the global slowdown is impacting on its economy, and by extension the global manufacturing base.

China’s PMI data will provide an early clue as to the performance of the economy in Q4. Analysts see a chance the data could be potentially brighter if the upbeat tone of September carries over.

“We get an early read of the state of the Chinese economy in Q4 next week, with the release of the manufacturing and services PMIs for October. Although China’s economy slowed further in Q3, the quarter seemed to end on a brighter note with a firming in retail sales and industrial output in September. The October PMI surveys may show some of that momentum carried over into Q4,” says Wells Fargo.

There is also important U.S. payroll and manufacturing data on Friday and the Fed meeting on Wednesday at 19.00.

The Fed will provide an assessment of the U.S. and global economy at their policy meeting and this could also impact on broader risk markets and the Swissie.

A more negative assessment (unlikely given the breakthroughs on trade) would strengthen the Franc; a more positive assessment, on the other hand, would weigh on the Swissie.

The Fed could deliver a more ‘hawkish’ or positive message.

“If anything, it might be a slightly more hawkish message than the markets are expecting,” says Marios Hadjikyriacos, an analyst at FX broker XM.com.

This would have the effect of supporting risk appetite and weakening the Franc.

Overnight Index Swaps (OIS) which measure market expectations of Federal Reserve easing are suggesting the chances of more stimulus beyond Wednesday's meeting are waning.

“Future rate cut expectations have been pared back with futures markets now implying only around one further 25bp rate cut by the Fed by the end of 2020,” says Nick Smyth of BNZ Bank.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement