Pound-Franc Rally Tipped to Continue

Image © Albert Czyzewski, Adobe Images

- GBP/CHF in strong move higher on optimism

- Further upside likely say charts

- Main driver of Swiss Franc is Brexit and trade talks

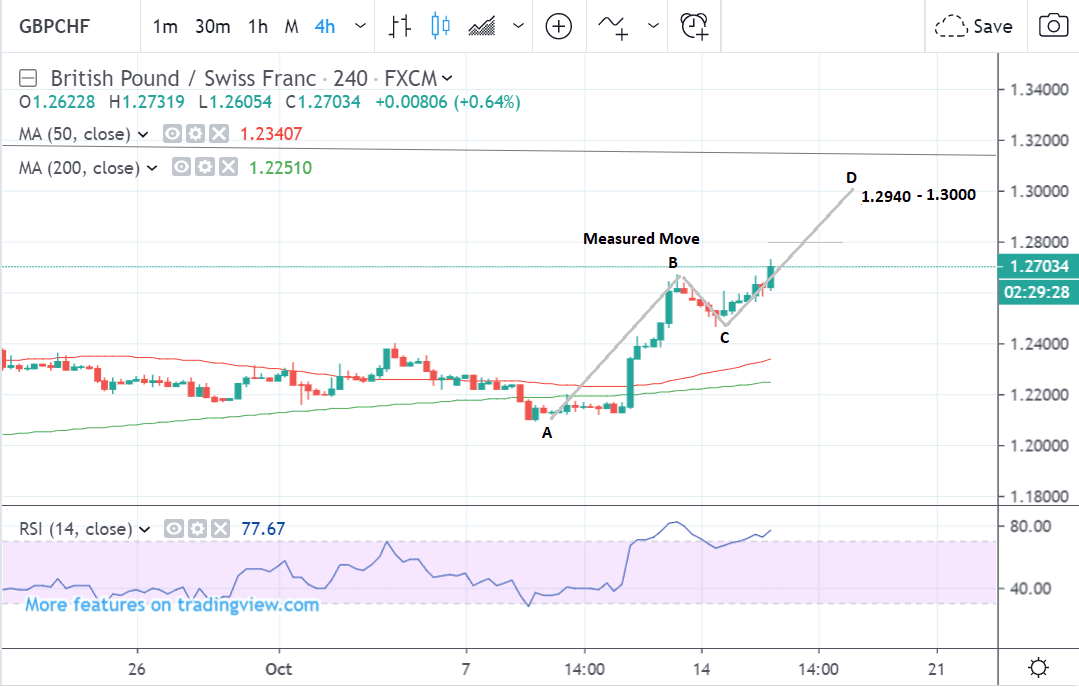

The Pound-to-Franc exchange rate is trading at around 1.2703 at the time of writing after showing a 2.68% rise in the previous week and a 0.9% increase so far this week. Studies of the charts suggest the pair is biased to extend its new uptrend even higher.

The 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows how the pair stopped declining and reversed sharply higher at the October 10 lows.

This new up move is still surging higher despite a temporary pull-back and it will probably continue to the next target at 1.2940 eventually.

A break above the 1.2800 level would provide added confidence to the bullish call.

The pair is probably forming an ABCD pattern or ‘measured move’ which further supports the bullish forecast.

Measured moves are composed of three waves - the first and third of which are usually of a similar length.

This means the first wave, or A-B, can be used to calculate the end of C-D.

In this case, it gives a target of 1.2940-1.3000 level.

The daily chart provides more evidence supporting the bullish outlook in the shape of a 3-bar continuation pattern (circled) which is currently forming.

These patterns a reliable indicator of further upside and suggest a move higher to around the same target as the measured move in the latter 1.29s.

At that point there is a risk the pair will pull-back and consolidate in a sideways trend for the rest of the forecast period.

The daily chart is used to give an indication of the outlook for the medium-term, defined as the next week to a month ahead.

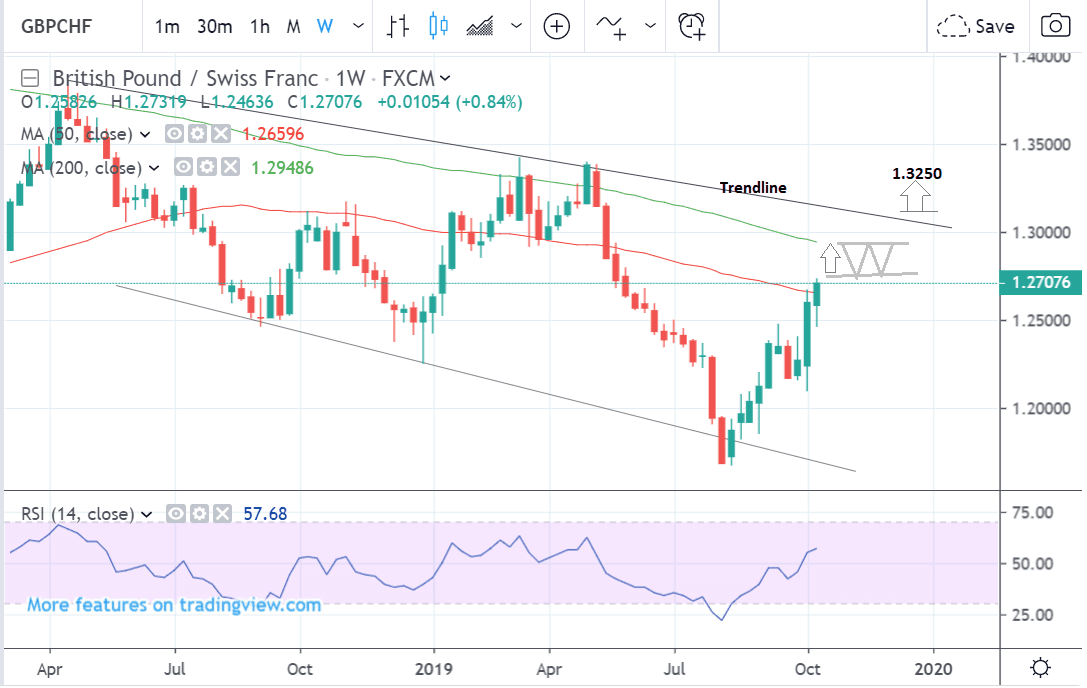

The weekly chart shows the pair rising up within a falling wedge-shaped pattern.

It has just reached the 50-week MA but is expected to continue rising up in line with the forecasts on lower timeframes.

A continuation higher will probably take the pair up to the late 1.29s as already mentioned, at which point it will probably pull-back and range trade for a while.

The 200-week MA at 1.2948 is a major obstacle for the uptrend to overcome and this fits with our view that at about that level the uptrend will probably pause.

The weekly chart is used to give us an indication of the outlook for the long-term defined as the next few months.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Swiss Franc: What to Watch

The main fundamental factor driving the Swiss Franc over the short-term horizon is likely to be global risk sentiment, to which it is highly attuned since it is a safe-haven currency, which means investors tend to flock to it in times of crisis, or when global growth forecasts disappoint.

U.S.-China trade risks and the outcome of Brexit talks are the two major drivers of risk sentiment currently, whilst Chinese Q3 GDP data at the end of the week could also impact on the outlook since it provides a gauge of world growth.

At the end of last week market optimism was high following the announcement of a trade deal between China and the U.S, however, that good feeling is seeping away now as analysts start to question whether the deal will actually hold up under scrutiny.

They also say that it has yet to be written up in all its complexity and signed by both parties, a process which could take a month or longer, and this is concerning investors who see a chance of either party having a change of heart and backing out before the deal gets the final say-so.

Some economists are even arguing the numbers don’t add up and China cannot meet the terms of the deal as it stands.

Cina has promised to purchase $40-$50bn of U.S. agricultural products but in order to meet that quota they would have to withdraw certain remaining bans, which are not part of the deal - leading to potential sticking points further down the line.

Although China has already made large purchases of soya beans (20 million tonnes), cotton and wheat, analysts argue the orders could be canceled at any time, and prior to delivery, reducing their validity.

On the Brexit front, much uncertainty still exists and although negotiators are aiming to put a deal together before the deadline - working over the weekend if necessary - there is still a chance that, like on previous occasions, the divide between the two sides simply cannot be bridged.

EU chief negotiator Michel Barnier was sounding more optimistic about the possibility of a deal on Tuesday, however, saying “even if an agreement (Brexit) has been difficult, more and more difficult, it’s still possible this week.” He then added, “Reaching an agreement is still possible. Obviously, any agreement must work for all. The whole of the UK and the whole of the EU. Let me add also that it is high time to turn good intentions in a legal text.”

This helped provide an antidote for his previous negative comments on Monday when he said the UK’s proposals “were not enough”.

If a deal was struck the Swiss Franc would weaken (especially versus the Pound, seeing a massive spike in GBP/CHF) since it would mean the removal of a major risk source from the global tabletop, but likewise there is a risk everything might still fall-apart before the deadline, leading to a probable extension and more uncertainty.

Another global risk factor which could impact on CHF is Chinese Q3 GDP, which is forecast to show a slowdown in growth to 6.1% when data is released at 3.00 BST on Friday.

A deeper-than-forecast contraction would sour the outlook for global growth pushing up demand for the Swiss Franc.

Judging from trade and inflation data the outlook does not particularly favour a bullish surprise in GDP.

Recent data showed a bigger China trade surplus in September - which on the face of it is positive - if it were not for gross trade actually falling.

CPI overshot expectations and hit 3.0% which is the People’s Bank of China (Pboc) target, and this again, on the face of it was positive, however, the details showed the rise in inflation was almost entirely due to a rise in pork prices - a Chinese dietary stable - due to shortages, and not as a result of increased general demand from greater prosperity.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement