Pound-Franc Finds Support Level and Bounces, Sideways Trend Evolving

Image © Adobe Images

- GBP/CHF finds floor after downtrend

- Could eventually will break lower after sideways period

- Global risk appetite main driver of Franc

The Pound-to-Franc exchange rate is trading at 1.2475 on the interbank currency market at the time of writing, a cent higher than a week ago, with studies of the charts showing the pair has reached a major support floor and could potentially go sideways over the next few days.

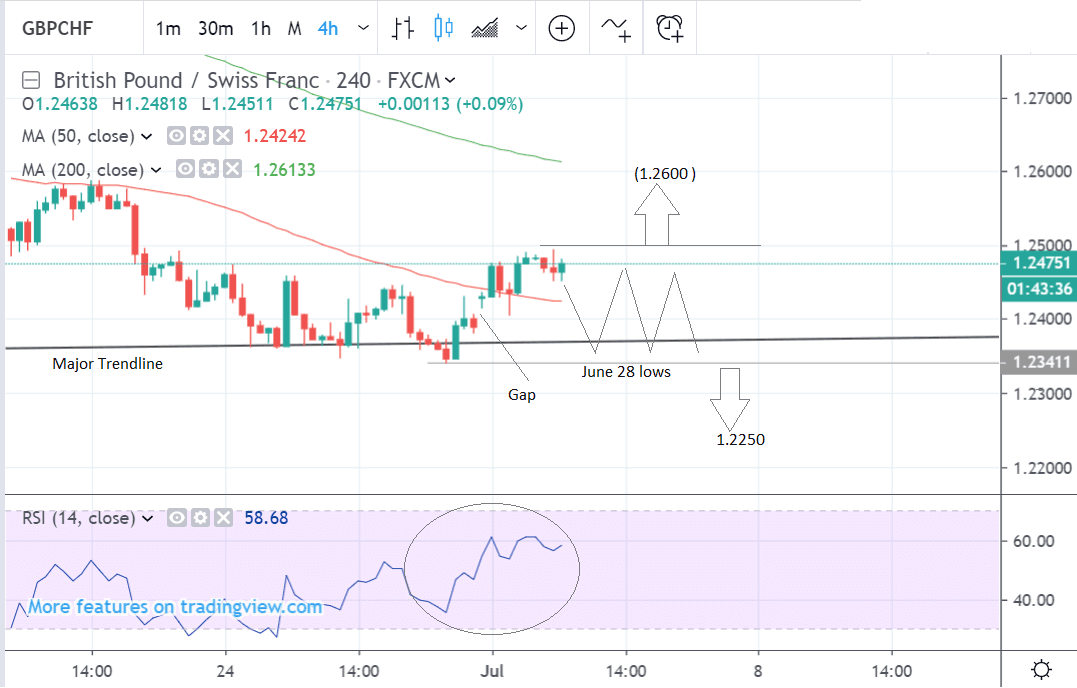

The 4-hour chart shows the pair having found a floor at the level of a major trendline stretching back since 2017.

This is likely to provide a hard floor for the exchange rate, and it is not surprising that it bounced and gapped higher on Monday morning.

The pair will probably meander along the trendline for a while before eventually breaking lower in the direction of the broader downtrend.

A break below the June 28 lows at 1.2340 could provide confirmation of a continuation down to a target at 1.2250, the January 3 lows.

At the same time, there is a risk the pair could continue rising. The strength of the bounce and the simultaneous steep rise in the RSI momentum study in the bottom pane (circled) suggests the possibility, at least, of a reversal of the trend.

Confirmation of a possible reversal higher would come from a break above the significant 1.2500 level, and would lead to a continuation up to a target at 1.2600.

The downtrend is strong, however, and our preference is for a sideways move to evolve - with the possibility of a break lower after a time.

The 4-hour chart is used to analyse the short-term trend, which is defined as that encompassing the next 5 trading days.

The daily chart shows the pair in a clearly established downtrend which is expected to continue.

It has reached support at a multi-year trendline and has bounced. It will probably go sideways for a while before the downtrend reasserts itself.

GBP/CHF is likely to fall to a target at 1.2200 conditional on a break below the 1.2340, June 28 lows.

The daily chart gives us an indication of the medium-term outlook which includes the next couple of weeks to a month.

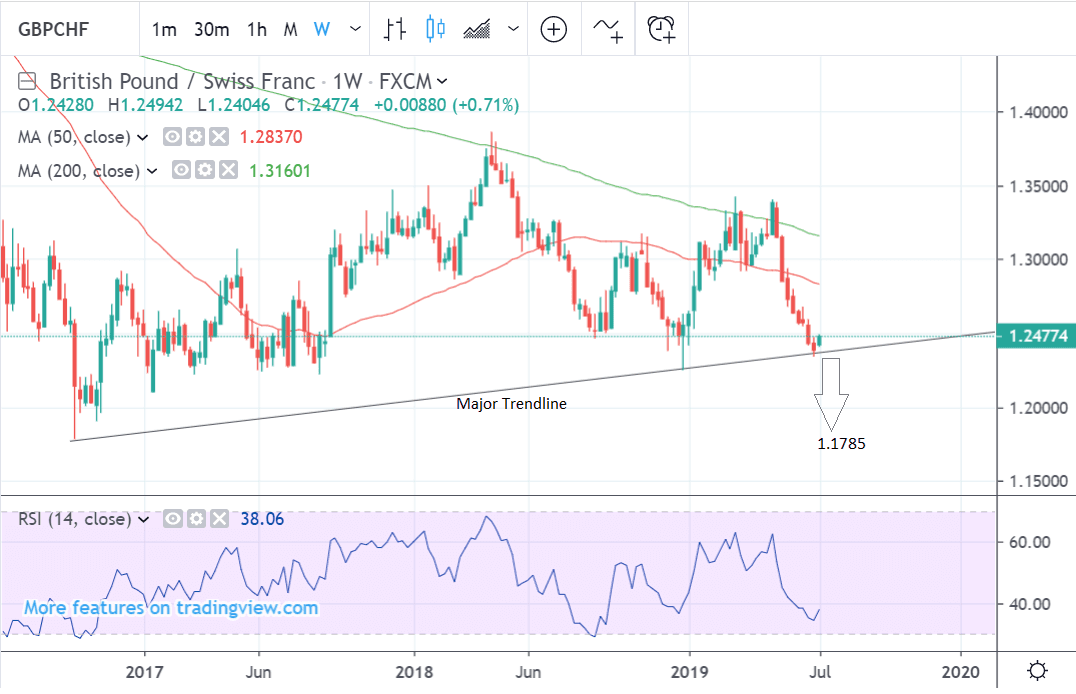

The weekly chart shows the long-term trendline more clearly and how the pair has found a floor at the trendline and bounced.

The downtrend over the last 8 weeks still remains intact despite the bounce and it could resume. There is saying that “the trend is your friend” in technical analysis - meaning it is more likely to extend in the same direction than not.

The potential remains for a continuation down to the key 1.1785 October 2016 lows.

We use the weekly chart to analyse the long-term trend, defined as the next several months.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

Franc Losing Support on Improved Investor Risk Sentiment

The main driver of the Swiss Franc is global investor risk appetite due to its safe-haven credentials.

The compromise achieved between the U.S. and China at the G20 meeting helped support risk appetite which drove up stocks, the Dollar and riskier currencies on Monday - this probably explains GBP/CHF’s gap higher.

The U.S. agreed to lift their ban on U.S companies selling components to Huawei, and China reciprocated by increasing imports of U.S. agricultural products to China.

The two superpowers also agreed not to increase tariffs, however, no official, cast-iron guarantees were made and there remains the risk a trade war could still flare up at any time.

President Trump agreed a détente with President Jinping, bringing some respite from the ongoing trade war. It should provide some short-term relief to markets," says Sebastian Burnside, Chief Economist at RBS, adding:

"The trade war has been impacting economic activity in recent quarters, clouding the global outlook. Meanwhile the threat of a further dose of tariffs on the remaining $300bn or so of Chinese exports to the U.S. was looming. So markets were hoping for signs of progress between Presidents Jinping and Trump at the past weekend’s G20. They got their wish."

The strong lift to sentiment from the trade talks at the G20 was marginally offset by negative PMI survey data from China, and most other countries as well.

PMI’s are a leading indicator of growth so the data suggests lower global growth, which would be expected to weigh on sentiment and support the Franc.

Both China’s official and Caixin manufacturing PMI surveys undershot expectations and the latter fell unexpectedly into contraction territory. Caixin covers smaller and medium-sized companies.

The People’s Bank Of China responded to the poor data by saying they were planning to lower interest rates to facilitate lending and help businesses through the rough patch.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement