Pound vs. Swiss Franc Outlook Rests with Key Support at 50-Day Moving Average

- GBP/CHF corrects back to 50-day MA

- This could provide the base for a recovery

- Franc eyes inflation data this week

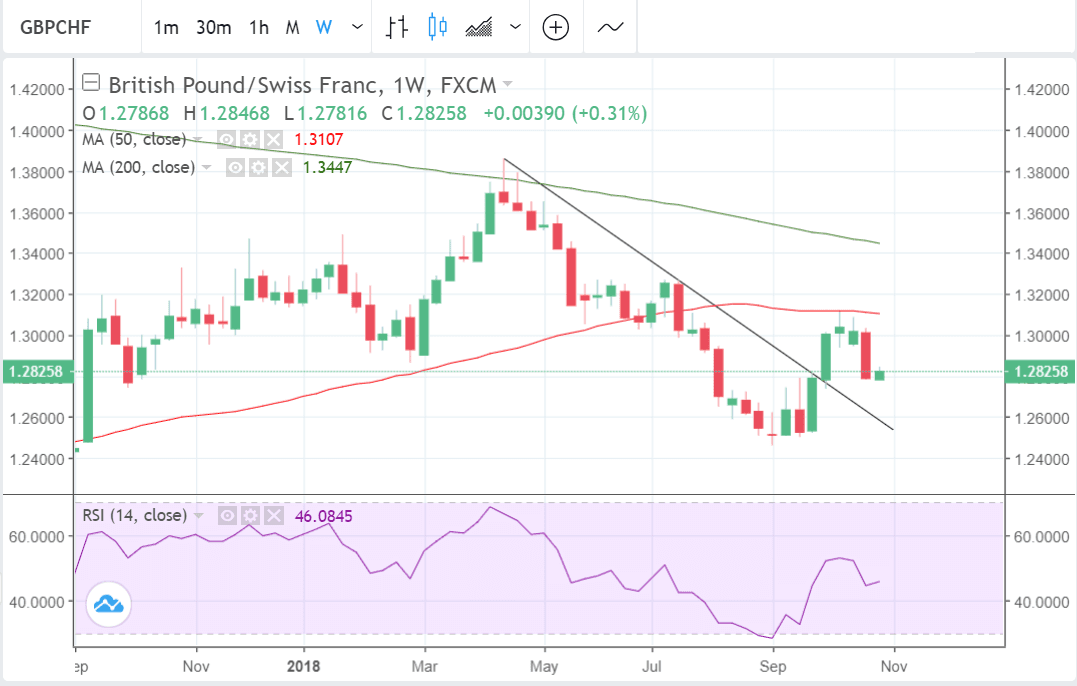

The Pound-Franc exchange rate has corrected back to the 50-day moving average (MA) at 1.2763 where there is a high chance it could base before resuming a previous uptrend.

At the time of writing the exchange rate is at 1.2786.

The pair has risen strongly in recent weeks from off its September lows. It broke through a major trendline (A) in the process and rose up to the 200-day MA at 1.31 in mid-October before rolling over and moving back down.

Now it is the turn of the 50-day MA to provide a floor of support for the exchange rate which could provide the underpinning support for a recovery.

The analysis is complicated, however, by the fact that the pair has met some of the qualifications for starting a new downtrend since the October 12 highs - such as completing two 'lower lows' and 'lower highs' on the daily chart.

The 4hr chart below also shows a clear short-term downtrend in play, albeit with converging momentum (a bullish sign). The 4hr is the first timeframe used by analysts to assess changes in the primary trend.

Yet on balance we actually expect the pair to start a new short-term trend higher from off of the 50-day MA. But we also remain cautious as there remains insufficient evidence to indicate such a resumption has started yet, nevertheless, we see risks skewed for it to begin this week.

Such a development would herald a probable deleveraging of risk as the Franc tends to weaken when risk appetite increases because of its safe-haven credentials.

This could come about either as the outlook improves for Brexit negotiations or due to a general improvement in market sentiment globally - as already appears possible given the potential for China-US relations to improve.

Franc Eyes Inflation Data this Week

The main economic release for the Franc this week is probably inflation data, which is expected to show a rise to 1.1% in October from 1.0% previously, when it is released at 9.15 GMT on Thursday, November 1.

A higher-than-forecast rise would support the Franc as it would suggest the possibility the Swiss National Bank (SNB) might increase interest rates from their perpetual sub-zero level.

Yet, likewise, it is unlikely the SNB will increase rates before the European Central Bank (ECB) does, which the SNB tends to track quite closely. The ECB does not expect to raise rates till earliest September 2019. It is unlikely, therefore, the SNB will act before then. The reason for this is that the SNB prefers a cheaper Franc and keeping interest rates low ensures this.

Another key release for the Swiss Franc in the coming week is retail sales data out at 9.15 on Friday. Retail sales are forecast to show a -0.3% fall compared to a year ago from the 0.4% recorded in August, on an annualised basis.

Consumer Confidence is out on Thursday at 7.45 and is forecast to show a slight fall to a balance of -8 from -7 previously as pessimism marginally deepens.

The Manufacturing PMI is out at 9.30 on Thursday as is forecast to show a slowdown in activity to 58.5 in October from 59.7 in the previous month.

Chairman of the SNB Charles Jordan is scheduled to give a speech on Wednesday at 6.15, where he might mention monetary policy which could result in movement for CHF.

The Pound, meanwhile, remains under pressure from Brexit uncertainty. This is likely to continue until a deal is done, which will probably not be the case in the week ahead.

The main event for Sterling is the Bank of England (BOE) rate meeting and inflation report on Thursday.

The BOE is constrained by Brexit uncertainty and until a Brexit deal materialises - if it materialises - it is unlikely to make any major changes to monetary policy.

Nevertheless, a marked rise in inflation expectations, if revealed in Thursday's quarterly report, could boost the Pound as it would sow the seeds of future rate hikes.

The current view is that the next increase will not be until May 2019, and the BOE will raise rates on average twice a year for the foreseeable future.

Advertisement

Bank-beating GBP/CHF exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here