Canadian Dollar Hits New 2017 Highs Against the Dollar, Outlook Bullish

The US Dollar to Canadian Dollar exchange rate (USD/CAD) hit new yearly lows of 1.2963 on Friday after Canadian GDP data surprised to the upside, solidifying expectations that the Canadian central bank is about to embark on an interest rate hiking cycle.

“A 0.2% gain in monthly GDP comes despite production outages at a key oil sands facility, the return of which we’ll see in May. The second quarter now seems to be easily tracking 2½% growth, building on the first quarter’s robust gains. An impressive first half more than justifies the Bank of Canada’s recent inclination to hike rates in the next few months,” says CIBC Economics’ Nick Exharos.

Then Bank of Canada’s recent hints that it is considering raising interest rates is positive for the Canadian Dollar, because interest rates are a major driver of currencies with high rates pushing up the value of a currency as they attract more foreign capital, and vice versa for low rates.

French lender Societe Generale have issued a sell recommendation for USD/CAD suggesting they now see even deeper losses.

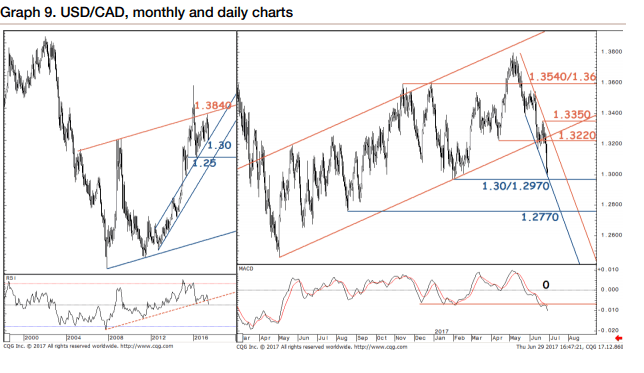

“The downtrend in USD/CAD is accelerating after breaking below a daily upward channel within which the choppy and laborious recovery since last year has evolved. The pair is now probing the crucial support at 1.30/1.2970, consisting of January lows, the 61.8% retracement from last May and, more importantly, the monthly steeper ascending channel upper limit,” says Soc Gen’s Olivier Korber.

Soc Gen’s trade recommendation has been activated now as the rate has already pushed below 1.30 following the release of Canadian GDP data.

“A close below 1.30,” says Korber, “will confirm the next leg of the decline towards the May 2016 lows of 1.25 with intermittent support at 1.2770.”

On our own charts we note even more weakness as possible, perhaps even to as low as 1.2000.

The current breakdown appears to be signalling the end to the trend up from the May 2016 1.2400 lows.

Seen as part of a larger pattern down from the January 2016 highs the pair looks like it is probably beginning a fresh ‘C’ or third leg lower.

This could mean the whole formation since the January 2016 highs is in fact a large 3-wave ABC correction, with the 'C' leg just starting.

If so then the C-wave should be similar in wave length to the A wave as patterns in markets tend to conform to the principle of wave equality.

If this is true then 'C' could move as low as 1.2000.