GBP/CAD: Forecast for the Next Five Days

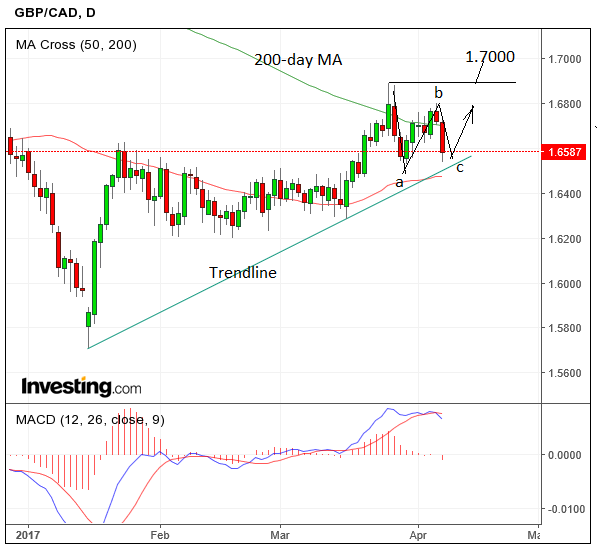

GBP/CAD had been rising quite strongly at the end of March after a long period of sideways consolidation, however, it recently pulled back after peaking at 1.6893 at the end of March.

The pair is now trading at 1.6587 but the correction is only minor and the short-term up-trend remains intact and likely to reassert itself.

The trendline for the move remains intact and if the exchange rate can rally above the March peak it will get a massive boost and probably continue rising to an initial target at 1.7000.

There is even cause to believe the pull-back may have finished as it has formed three distinct waves in an ABC correction and therefore may be ready for a resumption higher.

A bolder forecast would be for the pair to go from its current level to the 1.6890 highs, confirmed by a move above 1.6700, however, this is not a conviction call.

Data, Events Ahead for the Canadian Dollar

CAD gained support from sturdy employment data, which showed a rise in the payrolls of 18.6k in March, last Friday, which was above the negative figure forecast.

The participation rate also rose and the Ivey PMI – a general business survey barometer jumped to 61.1 in March, which was well above the 56.3 consensus estimate and 55.0 previous.

The week ahead kicks off with Housing Starts on Monday at 13.15 GMT, which is expected to show a rise of 210k.

This is followed by Bank of Canada Monetary Policy meeting on Wednesday at 15.00.

Analysts at TD Securities expect a balanced view with continuing downside risks balanced with a dose of optimism from recent positive data.

“Despite the impressive trend of positive surprises in Canadian data, we look for the BoC to retain a dose of caution to reflect the persistence of downside risks while also acknowledging that the outlook is gradually improving and excess slack is shrinking, perhaps earlier than expected. We expect the BoC to revise potential output higher, which would impact the timing of when the output gap closes and rates rise,” say TD Securities in a note to clients.

No change to Canadian interest rates are expected to be announced by the BoC.

But, which way will the Bank lean?

"For now, the odds are that the Bank will continue to wax dovish to lean against potential CAD strength," says Rai Bipan, an analyst with CIBC Markets.

Bipan warns that this can be a slippery slope to follow (just look at the experiences of the RBA and RBNZ over the past few years), but the Bank can point to the following to maintain its dovish bias:

- Uncertainty with US and implications from upcoming tax reform

- The need for further improvement in capital spending and exports

- Despite improvement in the labour market, there’s still evidence of slack

- Elevated home prices (particularly in Toronto) and the risks of a slowdown in residential investment

"While the Bank will likely sound dovish, potential comments regarding the strength of the CAD have slightly less bite than they did in January given that the loonie has lost ground versus EM currencies and others that the CAD competes against in important export markets," says Bipan.

The week rounds off with Manufacturing Sales (for February) on Thursday, April 13 at 13.30, which are forecast to show a -0.7% drop and the New House Price Index, which is expected to rise by an accelerated 0.2% in Feb.

Big Data releases Ahead for the Pound

“In the run up to Easter, we suspect we will see a relatively quiet period for political news, with few top tier political events,” says Victoria Clarke at Investec in London.

“With the Easter holidays approaching and with UK Parliament in recess, there is likely to be little by the way of major developments in Brexit talks over the coming week.”

Luckily, for those looking for the Pound to move we have some big data events ahead.

“With fewer political happenings, data will likely move to the fore next week,” says Clarke. “In the UK, data is likely to take centre stage too.”

CPI inflation figures for March are due out Tuesday morning; markets expect to see inflation at 2.3%, unchanged on the previous month’s reading.

Should inflation beat expectations we would anticipate the Pound to move higher.

But we think the core CPI reading will be more important as this presents a better reflection of the underlying strength of UK economic activity and is therefore the figure that would most likely interest decision-makers at the Bank of England.

Markets are forecasting core CPI to read at 1.9%, a little softer than the 2.0% reading seen in the previous month.

Again, should this number beat expectations then look for the Pound to jump.

Labour market data is the next big data event foreign exchange traders will be keeping an eye on and is due for release at 09:30 on Wednesday, April 12.

The claimant count is expected to fall by 3K while the unemployment rate is forecast to remain static at 4.7%.

But watch average earnings data as this is what gives a really good gauge as to the health of the economy and the potential spending power of the UK consumer.

Average earnings with bonuses included is forecast to publish at 2.2%, unchanged on the previous month’s reading.

If the figure comes in higher we would imagine the Pound will move accordingly and we would watch for the GBP/CAD exchange rate to edge up towards the 1.70 target mentioned in our technical studies above.

Disappointment will likely be punished and we would anticipate GBP/CAD falling back towards and testing the trendline.