Canadian Dollar: Fed-watching Bank of Canada Will Delay Rate Cut Until July

- Written by: Gary Howes

The Bank of Canada, Ottawa. Image reproduced under CC licensing conditions

An under-pressure Canadian Dollar could recover if market expectations for a June interest rate cut at the Bank of Canada fade in favour of the first cut falling in July.

A new analysis from HSBC shows the Bank of Canada will forgo a June rate cut simply because it doesn't want to diverge from the Federal Reserve, where rate cuts are expected later in the year.

"Though many central banks take their cue from the Fed, the policy rate path of the Bank of Canada is especially linked," says Ryan Wang, US Economist at HSBC. "Uncertainty around the Fed may drive the Governing Council to exercise more caution around cutting."

When Canada is considered in isolation, the case for a June rate cut is strong: underlying disinflation has continued to progress, growth has been sluggish, and productivity remains relatively poor.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

This week saw the Canadian Dollar slump after Statistics Canada said the country's inflation rate fell to 2.7% year-on-year in April, down from 2.9% in March and undershooting estimates for 2.8%. The details of the print were also supportive of a rate cut as the Bank of Canada's favoured measures of core inflation all undershot expectations.

"It's high time for the Bank of Canada to give the economy some oxygen, because by maintaining such a restrictive monetary policy, it risks inflicting unnecessary damage on the economy," says Matthieu Arseneau, an economist at National Bank of Canada.

HSBC says a June rate cut is still a close call, but fears of falling out of kilter with the Federal Reserve will prompt the Bank of Canada to delay.

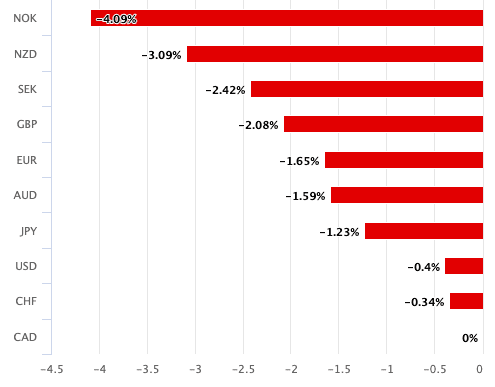

Above: CAD has lost value against all its G10 rivals during the course of the past month.

Wang explains the Canadian and U.S. economies are closely interrelated through trade and investment, and excessive divergence between the paths of Fed and BoC can have bigger implications for the Canadian economy than elsewhere.

This sentiment has been echoed by BoC Governor Tiff Macklem in recent speeches. It also explains why the CAD had tracked the USD's fortunes for much of 2023 and early 2024.

"There has been a shift in Fed expectations recently. With little movement in the annual core PCE inflation rate over the past four months, Federal Reserve Chair Jerome Powell noted at the May FOMC press conference that confidence on US inflation has not improved. For the Fed we now expect a first cut in September," says Wang.

"Consequently, given the shift in expectations, our previous forecast of a first cut in June, and 200bp total by end-2025 now stands out against the outlook for the Fed. Given the domestic progress on inflation, we still see reason for Bank of Canada rate cuts to start before the Fed, and to proceed at a slightly faster pace. We now see a first cut of 25bp in July, an additional 25bp rate cut in Q4 2024, and 75bp of cumulative rate cuts in 2025," he adds.

The CAD can potentially arrest its ongoing decline and stage a recovery if the market senses the Bank of Canada is set to delay.