Canadian Dollar Forecast to Maintain Recent Outperformance Near-term

- Written by: Gary Howes

- GBP/CAD eyes bottom of two-year range

- CAD strengthens on new highs for oil

- BoC tipped to taper at month-end meeting

Image © Adobe Stock

- GBP/CAD reference rates at publication:

- Spot: 1.6988

- Bank transfer rates (indicative guide): 1.6393-1.6512

- Money transfer specialist rates (indicative): 1.6835-1.6903

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Canadian Dollar is forecast by foreign exchange analysts to maintain a trend of outperformance, including against the British Pound, thanks to an ongoing surge in oil prices and a strengthening Canadian economy.

The Canadian Dollar strengthened in the previous week courtesy of fresh multi-month highs for oil as well as a strong jobs report that far exceeded analyst expectations.

Fresh highs for oil in the new week keep these themes alive.

Canadian Dollar strength is the driving force behind a dip in the Pound-to-Canadian Dollar exchange rate below the floor provided by the May-July lows, leaving it vulnerable to a test of the May 06 2021 low at 1.6871:

The above chart highlights the GBP/CAD exchange rate has tended to move within a range defined by 1.7895 towards the top and 1.6744 at the bottom since late 2019.

While this observation by no means constitutes technical analysis it does offer an insight into the levels the exchange rate is comfortable with under the current regime; hinting the odds of a mean reversion far outweigh the prospects of a decisive break in either direction. (See: Canadian Dollar: CIBC Forecasts Show Headwinds to Build into 2022)

Although the pair is pointed lower in the near-term the bigger picture suggests this weakness will ultimately fade allowing for another move back up into the range.

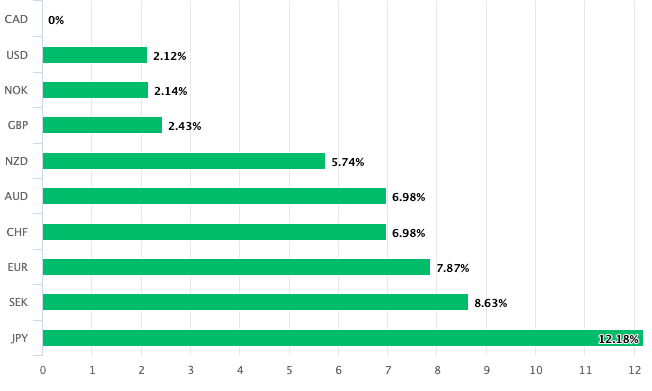

For now though the Canadian Dollar holds the advantage, holding the title of 2021's top performing currency:

Above: CAD performance in 2021.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Some analysts we follow maintain a constructive approach towards CAD over the near-term horizon, which offers confidence that GBP/CAD can still go lower before any return higher into the middle of the above-mentioned range.

Juan Prada, FX Strategist at Barclays says elevated oil prices and a supportive risk backdrop should allow the Canadian Dollar to hold on to recent gains.

"Elevated energy prices, a more supportive risk backdrop, the postponement of debt ceiling risk and less scope for further aggressive Fed pricing could continue to provide a favourable backdrop for the CAD," says Prada in a regular weekly currency strategy briefing.

Foreign exchange analysis from RBC Capital Markets meanwhile shows the Canadian Dollar has found support from surging oil prices since September and they expect this to continue in the near-term.

Prices for the benchmark U.S. oil contract (WTI) have on Monday risen to their highest level since November 2014 at $80.38/barrel, while Brent crude went to its highest level since October 2018 at $83.50/barrel.

"The current combination of inflation concerns (higher energy prices, supply bottlenecks, higher yields) and downward pressure on risky assets favours currency pairs that show a positive correlation to crude, once we’ve controlled for equity moves," says Elsa Lignos, Senior Currency Strategist at RBC Capital Markets.

The Canadian economic recovery meanwhile looks set to continue, allowing for the Bank of Canada (BoC) to continue its programme of 'normalising' monetary policy, offering another source of support to the Canadian Dollar.

Investors are already looking forwards to the October 27 interest rate at the BoC and economists at Barclays expect a further reduction to its quantitative easing programme to be announced.

Paving the way for such an outcome is the very solid September employment report, details of which were released last Friday.

The Canadian Dollar clocked up multi-month highs against a range of major counterparts when September’s employment report surpassed market expectations coming in at 157.4k, well ahead of the 59.5k expected by economists.

This means the total number of Canadians in employment is back to pre-pandemic levels.

BoC Governor Tiff Macklem recently cautioned that supply disruptions and resulting inflationary pressures could prove to be more persistent than previously expected.

But he noted them to be due to the unique nature of the pandemic and will hence recede over time.

Barclays anticipate a BoC rate hike in the third quarter of 2022, even though market pricing has become more aggressive with a hike priced in the second quarter of 2022.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The near-term prospects for the Canadian Dollar lean towards further strength, but a major Canadian lender has reiterated it sees the currency losing altitude as 2022 gets underway.

CIBC Bank have said they anticipate the currency to run into strengthening headwinds and the best part of 2021's outperformance could therefore now past.

In a regular monthly exchange rate forecast update CIBC finds that the BoC will need to take its foot off the accelerator in its race to tighten monetary policy, thereby denying the currency a crucial avenue of support.

"The BoC will have to proceed with more caution," says Katherine Judge, Senior Economist at CIBC Capital Markets, "given the increased sensitivity of highly indebted households to interest rate increases".

CIBC finds that although the Canadian Dollar is considered a 'commodity currency' by virtue of Canada's oil exports, the global energy crisis is unlikely to have a material impact.

"The loonie hasn’t gained any traction of late, despite the momentum seen in the price of oil and natural gas. Instead, a growing consensus for a sharper Federal Reserve QE tapering and subsequent rate hikes have provided an offset to the commodity price enthusiasm for the CAD," says Judge.

Judge says oil supply setbacks related to hurricane Ida and OPEC+ are to prove temporary.

Instead, "the driving force for CAD in 2022 will be the greater degree to which the market raises its assumptions about Fed tightening relative to that for the Bank of Canada," says Judge.

On this count the Bank of Canada is likely to disappoint while the Fed is expected to prove more hawkish.

"While the BoC is likely to further taper its QE program in October, it will use that same meeting to push back its forecast for achieving a zero output gap into Q4 of 2022, and markets will begin to price in a lighter path for its policy rate as a result," says Judge.