Canadian Dollar Recovery to be Underpinned by Rising Oil Prices: Crédit Agricole

- Written by: Gary Howes

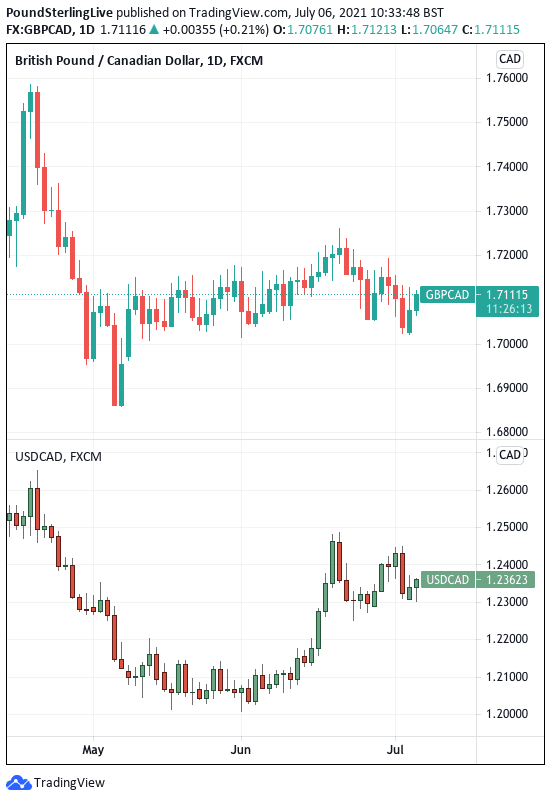

- GBP/CAD deadlocked at 1.71

- But CAD showing strength against USD

- CAD supported by rising oil prices

- BoC likely to raise rates in H1 2022

Image © Adobe Stock

- GBP/CAD reference rates at publication:

- Spot: 1.7108

- Bank transfer rates (indicative guide): 1.6509-1.6629

- Money transfer specialist rates (indicative): 1.6954-1.6988

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

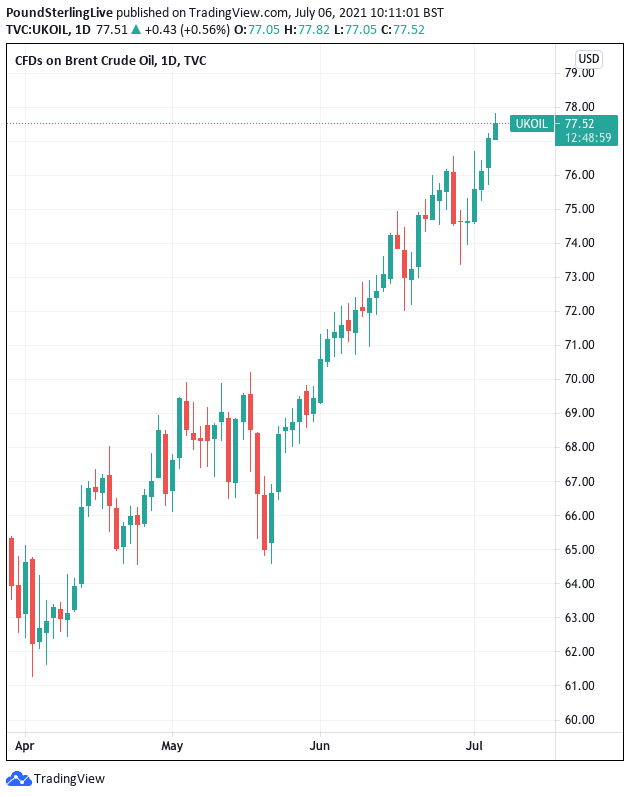

The failure of the world's major oil producing countries to reach new supply agreements has resulted in further gains for global oil prices, which are in turn proving supportive of the Canadian Dollar.

Foreign exchange analysts at Crédit Agricole have said they hold a "growing confidence" that the Canadian Dollar can maintain its outperformer status, thanks in part to the ongoing rally in global energy prices.

"The relative resilience of the CAD reflects the fact that global energy prices remain very elevated and this could continue to underpin the market’s expectation of further growth and inflation recovery in Canada," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

The call comes amidst an ongoing rise in the value of energy products, underpinned by the rise in global crude oil prices which remain in a convincing uptrend.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Recent gains in oil prices are in part a result of a failure of the 'OPEC+' group of oil producers to secure a new agreement at their July meeting.

Ministers looked to be in agreement on a 400 kb/d production increase for August but they nevertheless failed to secure any formal agreement after four days of talks.

No date for the next OPEC+ meeting has been set.

"The failure to reach a deal is because of the Saudi/Russia attempt to extend the current agreement from its Apr-22 expiry to end-22. This has catalysed the UAE into demanding a reset of its baseline sustainable capacity figure to reflect intervening field expansions," says Jon Rigby, Analyst at UBS.

For the Canadian Dollar the rise in crude oil prices is supportive as Canada is a major source of crude exports, benefiting the country's balance of payments dynamics.

Stronger earnings from oil exports will underpin the Canadian economy's strong recovery phase, which in turn will bestow confidence on the Bank of Canada (BoC) to end its extraordinary monetary policy support programme.

"The Canadian rates markets continue to expect a relatively aggressive BoC policy normalisation from here and this boosts the currency’s rate advantage across the board," says Marinov.

Foreign exchange markets are currently being driven by central bank policy expectations, with those currencies belonging to central banks that are leading the way in raising interest rates and ending quantitative easing appreciating in value.

The BoC is tipped by economists to be one of the central banks leading the pack, a supportive dynamic for the Canadian Dollar.

"This could help underpin the currency’s recovery once risk sentiment starts to stabilise and the USD rally loses some momentum," says Marinov.

In April the BoC became the first among Group of Seven central banks to reduce the scope of its pandemic support by reducing the size of its its asset purchase programme.

"We continue to expect the Bank to cut its purchases at every other meeting, meaning that it will trim them to C$2 bln per week in July and to C$1 bln per week in October," says Stephen Brown, Senior Canada Economist at Capital Economics.

Oil prices are tipped by some economists to remain bid as global demand for the product continues to recover, a dynamic that could well ensure the currencies of oil producing nations remain supported.

UBS analysts expect demand to continue to recover through the remainder of 2021 but not to fully regain 2019 levels until the second half of 2022.

However, forecasting the precise trajectory and target point for oil prices remains particularly difficult given the unpredictable nature of OPEC+ politics.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Canadian economy continues to recover according to the BoC's Business Outlook Survey, out at the start of the week.

Declining covid cases and rising vaccinations in Canada meant the Survey's composite indicator rose to 4.2 from 3.0 in the spring release.

"Expectations for hiring over the next four quarters increased, while the outlook for sales and investment remained firm," says Royce Mendes, Economist at CIBC.

Like most other nations, Canada faces higher inflation over coming months with the Survey revealing inflation expectations for the next two years up markedly.

There was a significant rise in the share of firms looking for inflation to average more than 3%, and a plunging share of those expecting it to average less than 2%.

"The surveys paint a picture of an economy that is headed in the right direction, but will be on the road to recovery for some time," says Mendes.

Should the Canadian economy continue its strong recovery, and oil prices maintain their robust levels, the BoC will likely hike rates in the first half of 2022.

"Any positive data surprises could help the CAD regain more ground mainly vs its G10 commodity peers," says Marinov.

Recent Canadian Dollar strength is most evident against the U.S. Dollar where a June rebound in the U.S. Dollar-Canadian Dollar exchange rate has been met by resistance, with the June 18 highs posted at 1.2487 giving way to lower levels at 1.2360.

The 2021 low is at 1.20.

The Pound and Canadian Dollar are meanwhile butting heads with neither really gaining the advantage, a deadlock that is in part due to the observation that both the BoC and Bank of England are likely to raise rates in 2022.

The Pound-to-Canadian Dollar exchange rate is presently quoted at 1.71, which places it at the midway point of a range that has largely been intact since May (1.70-1.7250).