Canadian Dollar Bolstered amid U.S. Dollar Bounce and Job Surprise though Recovery Seen Slowing

- Written by: James Skinner

Image © Adobe Stock

- GBP/CAD spot rate at time of writing: 1.7150

- Bank transfer rate (indicative guide): 1.6501-1.6620

- FX specialist providers (indicative guide): 1.6843-1.6945

- More information on FX specialist rates here

Canadian Dollar exchange rates were choppy on Friday as economists looked beyond Statistics Canada's bettter-than-expected October jobs report, preferring instead to focus on the challenges ahead, while unrelated volatility was seen in U.S. stock markets and the bigger Dollar.

The Canadian economy saw created or recovered from the coronavirus 83.6k jobs in October, less than the blowout of 378.2k seen in September but still ahead of the consensus expectation among economists and analysts that had looked for only a 59.0k increase.

Faster job growth was enough to knock the Canadian unemployment rate down to 8.9% when it had been expected to remain at 9%, and with most of it in full-time work. There were 69,000 full time hires included in the results while the number of people working part time was "virtually unchanged."

But some economists were quick to remind of how new coronavirus-related restrictions, which already disrupted some sectors last month, could go on to constrain if-not reverse a part of the broader recovery up ahead.

"The re-imposition of Covid-19 containment measures - targeting largely indoor restaurants, bars, and recreational facilities - pushed employment in accommodation & food services down sharply again (-48k). Most of that decline came from Quebec, which was among the earliest to re-impose restrictions in some regions. Further declines are likely to follow with similar restrictions also imposed elsewhere (including in Toronto and Ottawa) since then," says Nathan Janzen, a senior economist at RBC Capital Markets. "There were still more than 400k people working less than half their usual hours in October."

Source: Statistics Canada.

Janzen says the big question now is how much of the already slowing pace of job growth can be sustained amid increases in the numbers of new coronavirus infections, which have spurred provinces to close hospitality and liesure facilities again. Fears are that redundancies in those sectors could spread to others alongside any further attempts to contain the infection.

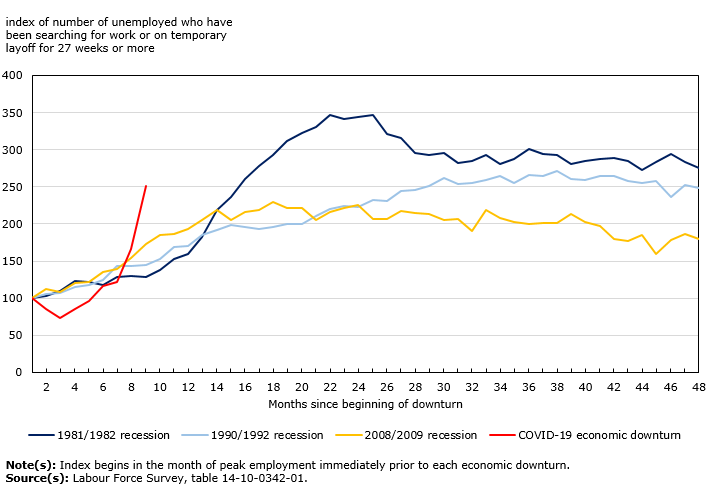

Friday's data came alongside the U.S. non-farm payrolls report for October, which showed unemployment rate falling to 6.9% after having reversed more than half its earlier rise to 14.7%. Canada's unemployment rate did not rise as far as that seen in the U.S., having topped out at 13.7% in May, but it's also been slower to fall and the risk is now of another upturn before year-end if restrictions are tightened further or prolonged through the winter months.

This relative pace of recovery could become a more important determinant of exchange rate performance in the months ahead, especially if trends become divergent, because it will directly impact upon the rate of increase in government debt levels as well as the extent of new money creation that's neccisitated by central bank commitments to buy more government bonds under their quantitative easing programmes.

"For now, USD-CAD is taking its cue more from USD sentiment and risk appetite than from domestic Canadian drivers. But if we are correct in arguing that the outlook for relative economic performance is set to become more of a focus for the FX market, then releases like today’s employment report are likely to get increasing traction," says Daragh Maher, U.S. head of FX strategy at HSBC. "The USD is struggling to capitalise on the overnight weakness in equity markets, with the JPY arguably best placed to capitalise on a “risk off” mood. The drop in European equities and US equity futures seems to be little more than profit-taking after big moves recently."

The Bank of Canada said last month that it will buy "at least C$4 billion" government bonds per week without specifying an end date, but had bought "at least C$5 billion" previously and since March as it seeks to encourage a Caandian economic recovery.

Above: Pound-to-Canadian Dollar rate (black line, right axis) at hourly intervals and USD/CAD (yellow, left).

The Federal Reserve meanwhile, has been buying around $80bn (C$104 bn) per month and committed on Thursday to continue "at least at the current pace to sustain smooth market functioning and help foster accommodative financial conditions, thereby supporting the flow of credit to households and businesses." The Fed has created more than five times the new Dollars than the BoC has, although the U.S. economy is close to 10 times the size of Canada's, which means the BoC has actually been even more expansionary than its U.S. counterpart. This might partly explain why the Loonie remains the third worst performing major currency of 2020.

Friday's data briefly weighed on USD/CAD and GBP/CAD but the Loonie was scuttled at the open of U.S. stock markets that promptly followed some of their European counterparts lower. This was as ballot counting continued in the U.S. where the challenger Joe Biden was reported to have taken the lead in Pennsylvania and Georgia, both key swing states where the race for the White House will be decided.

Financial markets had already presumed him the winner, while President Donald Trump doubled down behind allegations of fraud and confirmed an intention to take legal action in a number of states where his earlier lead was washed away by a last minute surge in postal votes.

"There are a few reasons to remain cautious. The first is the fact that the threat of a contested vote in the US is still very real and next few days could be crucial in this respect. There is also some risk the Democrats could still take control of the Senate, although we will not know until potentially as late as January and the Georgia run-off elections. The rebuilding of a ‘blue-wave’ risk would temper equity markets," says David Forrester, a strategist at Credit Agricole CIB.

Above: Pound-to-Canadian Dollar rate (black line, right axis) at daily intervals and USD/CAD (yellow, left).

A contested election scenario potentially entailing lower stock markets and a stronger U.S. Dollar during months of wrangling in the courts, would become a certainty if Joe Biden is declared the winner as appeared likely on Friday. A U.S. Dollar rebound could see USD/CAD lifted back above 1.35, according to TD Securities, although what this would mean for other exchange rates like GBP/CAD grew more uncertain on Friday.

GBP/CAD and USD/CAD have followed each other throughout much of this week, which isn't always the case, but diverged from each other on Friday as Sterling proved unable to keep up with a bolstered Canadian Dollar.

"It’s more likely that the CAD trades in line with the USD sentiment throughout the day and with the mood set by the US’s jobs print," says Shaun Osborne, chief FX strategist at Scotiabank. The 1.31 level now looks set to act as solid resistance to upside momentum (after acting as support over the past two or so months) as it did earlier this morning at 1.3097. On the flipside, the mid 1.30s area stands as the only clear support marker ahead of strong support at/around the big figure mark (and Sep 1 low of 1.2994)."