Canadian Dollar Crumbles, GBP/CAD Surges after Bank of Canada Takes Aim at Longer Term Bond Yields

- Written by: James Skinner

- CAD slides after BoC tweaks and tapers QE programme without upset.

- Tapers scale of bond buying while turning all firepower on longer yields.

- Bold move & delicate communications exercise takes CAD by surprise.

- CAD losses aided by risk aversion as Brexit chatter also aids GBP/CAD.

The Bank of Canada, Ottawa. Image reproduced under CC licensing conditions

- GBP/CAD spot rate at time of writing: 1.7303

- Bank transfer rate (indicative guide): 1.6604-1.6724

- FX specialist providers (indicative guide): 1.7050-1.7154

- More information on FX specialist rates here

The Canadian Dollar crumbled on Wednesday, extending or otherwise cultivating losses against most major currencies including Pound Sterling after the Bank of Canada (BoC) said it will now target longer-term Canadian government bond yields with its quantitative easing (QE) programme.

Canadian policymakers surprised nobody when they told markets on Wednesday that they're holding cash rate "at the effective lower bound" of 0.25% "until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved," echoing the BoC's previous statement in September.

But what may have taken the market by surprise was the BoC's decision to recalibrate its quantitative easing programme, and in a way that turns all of its firepower onto longer-term government yields, which are among the highest in the developed world and a source of support for the Loonie.

"The Bank is recalibrating the QE program to shift purchases towards longer-term bonds, which have more direct influence on the borrowing rates that are most important for households and businesses. At the same time, total purchases will be gradually reduced to at least $4 billion a week. The Governing Council judges that, with these combined adjustments, the QE program is providing at least as much monetary stimulus as before," the BoC says.

That decision and guidance on the outlook for the cash rate, given by the BoC in its monetary policy report, upset the Canadian Dollar with a downgraded forecast for the 2021 economic recovery adding insult to injury. Canada's economy is now expected to contract by -5.7% in 2020, less than the -7.8% suggested back in July, but the recovery in 2021 is now expected to be slower at just 4.2% when previously the BoC had tipped a 5.2% rebound.

Above: USD/CAD shown at 15-minute intervals alongside Pound-to-Canadian Dollar rate.

The BoC's reduction of purchases "to at least $4 billion" is a surprise that might've strengthened the Canadian Dollar if not for the simultaneous announcement that it will now subject 5-year, 10-year and 30-year yields to treatment that has so-far been meted out only to 2-year counterparts.

"While we expected the overall size of the program to be pared back next year, the Bank went ahead and announced that today," says Avery Shenfeld, chief economist at CIBC Capital Markets. "With the Bank pledging to eschew rate hikes until inflation is sustainably at 2%, its forecast that inflation will average below that mark through 2022 implies no hikes until at least 2023, and the Bank went as far as to mention that expectation."

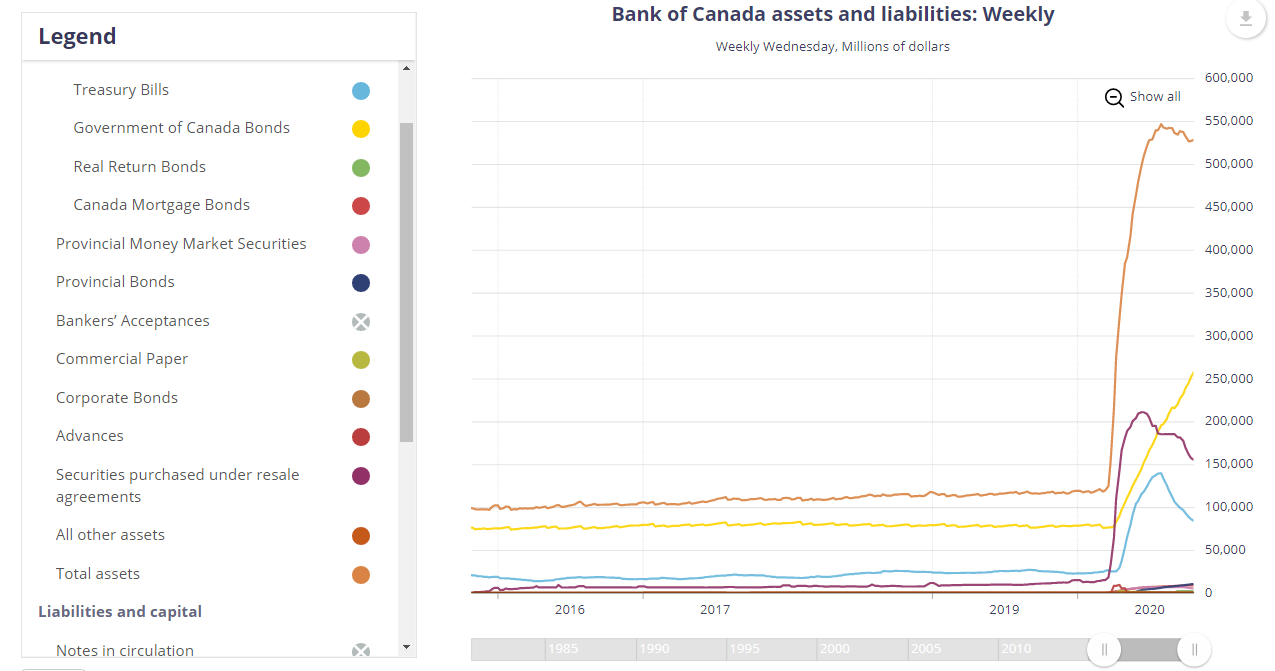

The bank has been buying C$5 bn of federal and local government bonds per week since March and under its first ever QE programme. But the bank has since acquired so large a share of the market that a recalibration was inevitable, although there was no consensus on when this would come.

While some economists had anticipated the bank might recalibrate its QE programme this week, and most accepted that it would eventually have to move further out along the maturity spectrum, almost all said either that it would only move out along the maturity spectrum or make no changes at all in October.

Above: BoC balance sheet size (orange line) with breakdown of securities acquired under various programmes.

"Tapering now would send the exact wrong message. The economy remains under significant pressure and with COVID infections on the rise once again with localized restrictions expanding, there's clear downside risk to Q4 GDP growth. Beyond the near-term issues, we're still years away from the output gap closing," says Benjamin Reitzes, a director, rates and macro strategist at BMO Capital Markets, in a Monday note. "Any pullback on stimulus measures at this time is not the message Governor Macklem should be sending."

What the BoC actually did was move out along the maturity spectrum in what was always going to require a delicate exercise in communication, while simultaneously promising lower long-term yields along the way and also "tapering" the overall size of its QE programme.

"The knee-jerk price action suggests market participants are assuming the long-end is where the purchases will be directed towards, though we vehemently disagree," says Ian Pollick, global head of FICC strategy at CIBC Capital Markets. "On page 24/25 of the MPR, the Bank describes, in detail, what they mean in regards to these maturities, specifically noting that “In particular, fixed-rate households and corporate borrowing tends to be most closely linked to 3- to 15yr GoC bond yields”. From our lens, that means the calibration the Bank is discussing means purchasing more 5yrs and 10yrs, not 30yrs."

Above: 30-year Gov bond yield with 10-year (blue line, left axis), 05-year (yellowline, left axis) & 02-year (red line, left axis).

Wednesday's decision merely built on earlier Canadian Dollar losses however, given that risk currencies were already under pressure and safe-havens like the Japanese Yen and U.S. Dollar in demand, as Europe appeared to lurch again toward another ‘lockdown.’

"USDCAD has finally broken above the 1.3280s resistance level, but we think this is being more driven by the continued selling in the S&Ps and Dec WTI," says Eric Bregar, head of FX strategy at Exchange Bank of Canada.

Germany is said to be contemplating the closure of bars from November 04, French officials are reported to be advocating that the government impose another all out shutdown. Meanwhile, the UK government’s advisers were reported to be using new analysis - that the second wave could be more deadly than the first - to lobby for another shutdown in England.

"GBPCAD has made some progress this week but it looks to be a case of two steps forward and one back for the pound at the moment and the cross still looks range-bound," says Juan Manuel Herrera, a strategist at Scotiabank in a Monday note. "We note that daily and weekly DMI oscillators are stuck firmly in neutral which militates against a strong directional move either way at the point, leaving the GBP adrift in the middle of the broader trading range and still in search of a stronger sense of direction."

Britain’s second wave has been far larger than its first so the suggestion that it could be more deadly might seem like a statement of the obvious if not for the reality that deaths have so-far been much lower than in the initial outbreak.

The ‘lockdown’ threat and other factors sank stock markets and risk currencies alike on Wednesday, although Sterling received its own afternoon bid amid reports claiming progress in the Brexit trade negotiations, further boosting the Pound-to-Canadian Dollar rate.

Above: Pound-to-Canadian Dollar rate at daily intervals alongside Canadian Dollar Index (blue line, left axis).