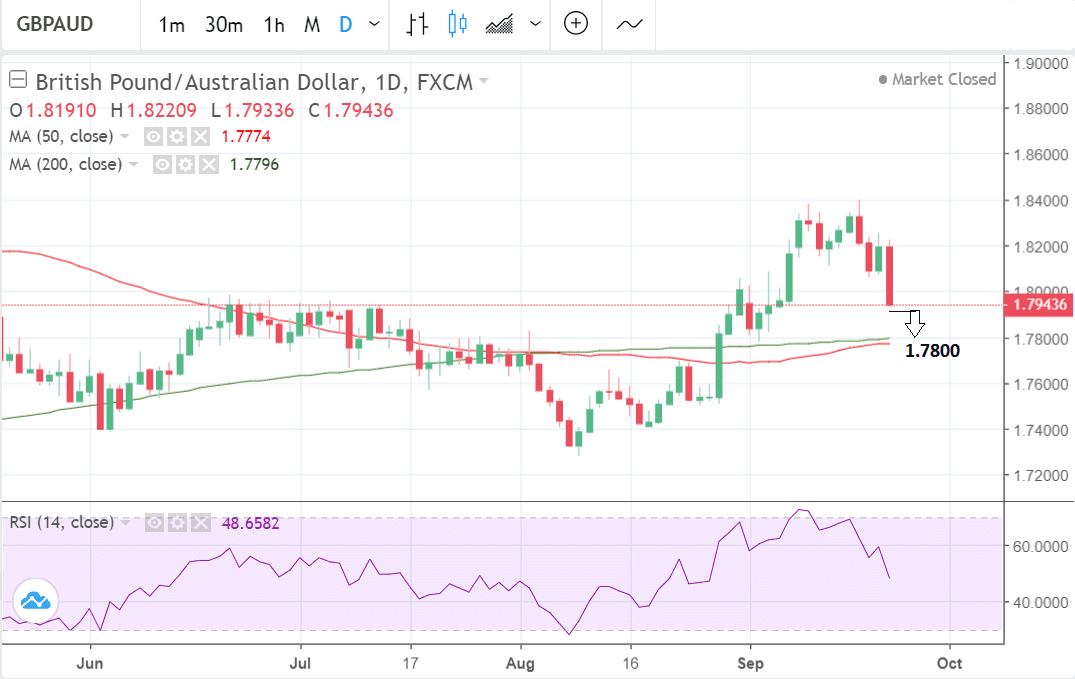

Pound-to-Australian Dollar Rate in the Week Ahead: Downside Targets in the 1.77s

Image © Adobe Stock

- GBP/AUD could extend recent losses over coming days

- Target now in 1.77s where major support area sits

- Australian Dollar to remain subject to global sentiment this week

The Pound-to-Australian Dollar rate has fallen following signs Brexit negotiations between the U.K. and E.U. have reached an impasse.

The pair fell from the week's opening spot price of 1.8191 down to a closing price for the week of 1.7943.

In the week ahead we the potential for more losses since the volatile sell-off was probably a game-changer for pair's trend - at least in the short-term - and after such a steep decline the odds now favour an extension rather than reversal back up.

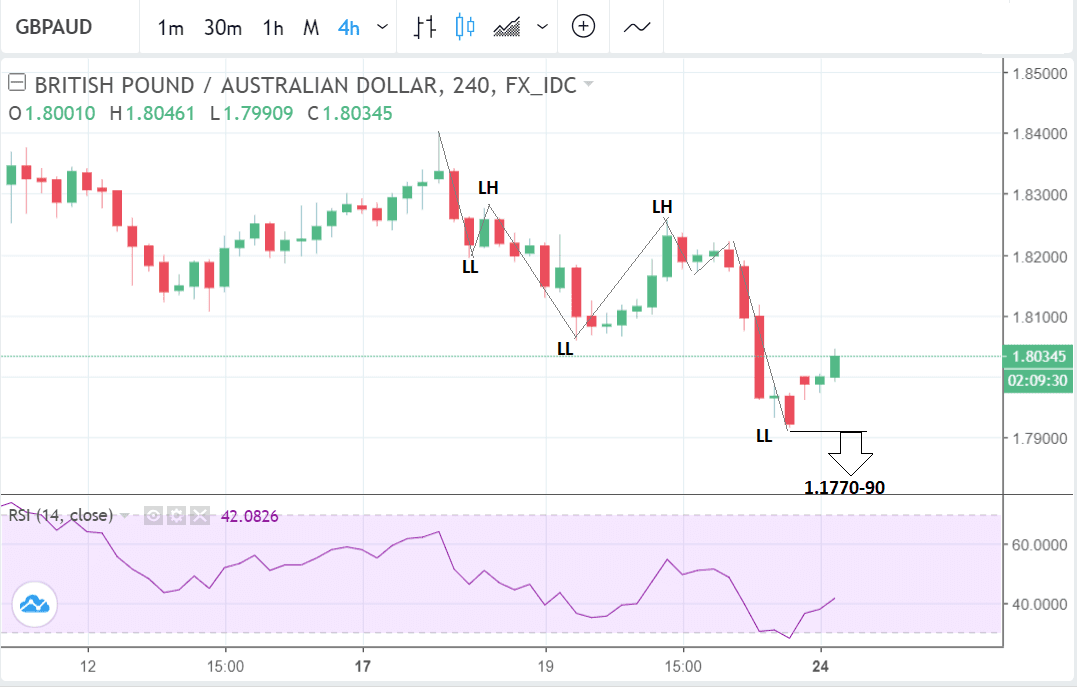

The pair has formed two lower lows (LL) and lower highs (LH) on the 4hr chart which is often a sign that the pair has reversed its short-term trend and is moving lower.

The next target to the downside is at the level of the 50 and 20 moving averages (MA) between the 1.7770s and 1.7790s. A break below the 1.7925 level will probably confirm such an extension lower.

Major moving averages such as the 50 and 200-day MA present obstacles to the trend and often lead to reversals.

Short-term technical traders exacerbate the resistant effect by entering the market at the MA and buying the pair in anticipation of a bounce, which often leads to further buying pressure.

Bearish momentum is strong as measured by RSI and further supports the bearish forecast for the pair.

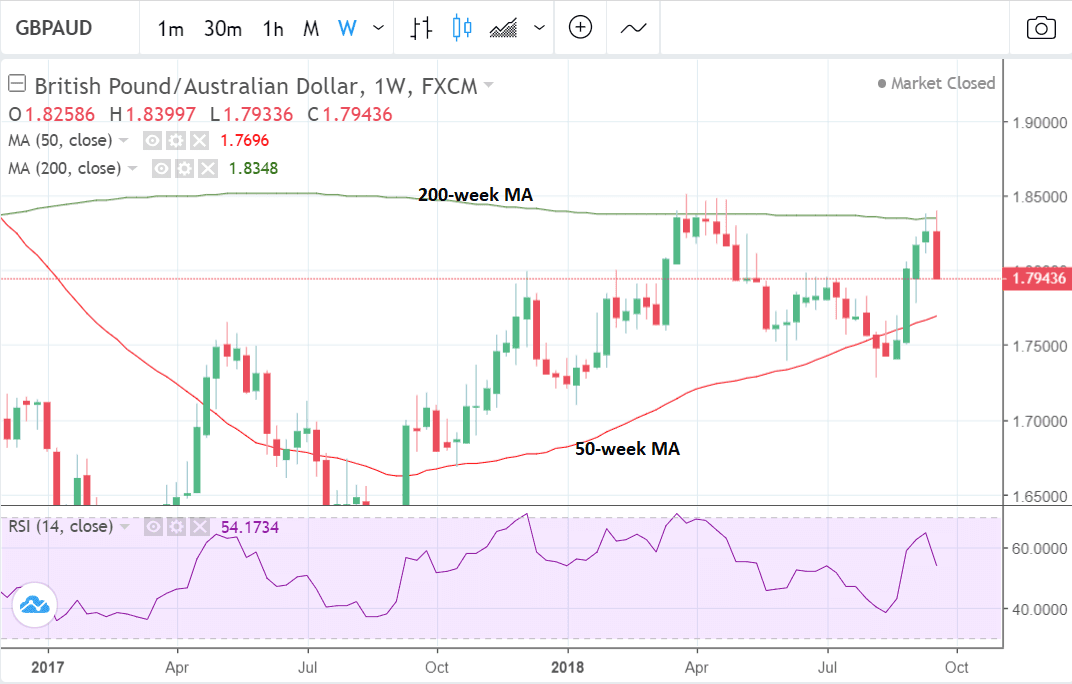

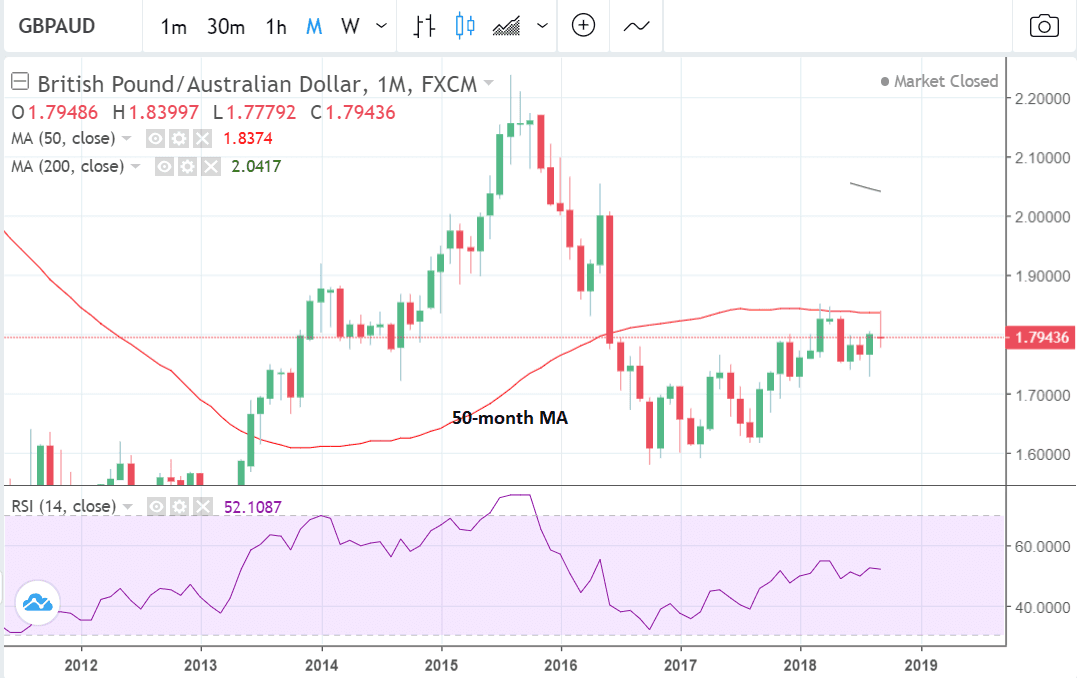

GBP/AUD rose up and touched the 50-month MA and the 200-week MA before turning sharply lower on Friday.

In this example, the large MA was the site of pull-backs and reversal down rather than up.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Australian Dollar: What to Watch

It is a quiet week for Australian domestic data and the currency is, therefore, more likely to be impacted by data from China or the evolution of trade talks.

The week starts in an Aussie-negative fashion amidst reports China has withdrawn from a proposed round of trade talks. The move is in response to the U.S. decision last week to slap 10% tariffs on a further $200bn worth of Chinese imports.

No more talks are currently scheduled and markets are concerned the trade war will be a protracted affair.

A further erosion of free trade has had a negative impact on AUD and is likely to continue to do the same in the future.

The main Chinese data to watch is Caixin Manufacturing PMI, which is forecast to show a slight decline to 50.5 from 50.6, in September, when it is released on Friday at 2.45 B.S.T.

PMI is short for 'purchasing manager index', a metric calculated using responses from surveys of purchasing managers.

A result of over 50 is indicative of expansion and of under of contraction.

If the result deviates much from the expected it could have an impact on AUD.

A higher-than-expected result would support the Aussie and vice-versa if lower. China is Australia's largest trading partner so its economic health has an impact on the latter.

The Pound: What to Watch this Week

Currency markets are likely to continue to be affected by the shockwaves from the Brexit bombshell dropped by May at the end of last week and we will be looking for any new proposals from both the U.K. and E.U. aimed at unlocking the stalled process.

This week, further matters to consider on the political front include whether or not the Labour Party will back a second referendum on Brexit; something that is likely considering polling of Labour Party members suggests well over 80% are in favour of such an outcome. Reports suggest Labour leader Jeremy Corbyn will accept the will of his party on the matter.

Also of note is a report in the Sunday Times that Theresa May might be left with little choice but to call another general election in order to both shore up her own position and to deliver her desired Brexit plan.

Reports suggest her aides are suggesting an election might be called in November: We believe if this were to happen it will inject a significant amount of downside into Sterling which detests uncertainty.

Political developments are likely to dwarf the few economic data releases on the calendar, including industrial trends data from the Consortium of British Industry (CBI) (Monday 11.00 B.S.T), the Nationwide house price index (HPI) (Friday 7.00), business investment (Friday 9.30), current account data (ditto), Q2 GDP revisions (ditto) and gross mortgage approvals (Wednesday 9.30).

None of the above are major market moving releases unless they deviate hugely from their expected results.

Possibly of more importance for the Pound could be what Bank of England (BOE) officials say in their speeches in the week ahead about the current state of Brexit negotiations and associated risks - if they decide to comment, which they probably will.

BOE Monetary Policy Committee (MPC) member Gert Vlieghe speaks on Tuesday at 9.40, MPC member and BOE chief economist Andy Haldane at 11.45 on Thursday, and MPC member Sir Dave Ramsden speaks at 14.20 on Friday.

In addition, the week ahead also sees the release of the BOE's Financial Stability Report, at 4.30 on Monday, which will contain clues of the BOE's thinking on the outlook for the economy, although their assumptions about the outcome of Brexit may already be out-of-date following Friday's shock breakdown in negotiations.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here