Beware the October Dollar Drain: It could Hit the Australian and Canadian Dollars

Image © kasto, Adobe Stock

- Dollar liquidity set to fall in October leading to possible upside for USD

- Emerging market currency headaches could get worse

- CAD and AUD could also be hit thanks to their current account deficits

U.S. Dollar liquidity will drain in October as the US Treasury starts hoovering up more Dollars due to increased capital requirements as well as higher spending, says James Bevan CIO of CCLA Investment Management.

The usual result of falling Dollar liquidity - or 'scarcity' - is the same as it is for any asset; its value rises.

The inference is that the U.S. Dollar could start rising again in October, putting even more strain on Emerging Market (EM) countries with high Dollar-denominated debt, such as India, Indonesia, South Africa, Turkey, and Argentina.

Yet Bevan also says the contagion could spread to non-EM countries like Australia and Canada which also have high US Dollar-denominated debts as well as current account deficits they have to borrow to cover.

To date, only those EM economies with a combination of a current account deficit and a high proportion of US Dollar-denominated debt have been hit by the recent EM crisis.

(A current account deficit means a country's bank account with the rest of the world is in deficit as it imports more than it exports. This leaves the currency reliant on inflows of foreign capital to stay afloat. Should that inflow of foreign capital be squeezed, the currency will naturally fall).

Apart from Turkey, the other countries who have seen their currencies devalue the most, Argentina, India, and South Africa, as they also fall into this category.

"There are still lots of risks associated with the EM story, they still have, in lots of areas, far too much U.S. Dollar debt. If the Dollar remains strong, which is a concern I have for them, then the cost of that debt goes up," says Bevan.

Analyst Ingvild Borgen Gjerde at DNB Markets warns that Emerging Markets could even find Dollar strength starts to reinforce itself:

"The Dollar doom loop is said to be in play when the adverse impact on emerging markets from a stronger Eollar is so severe that it causes market turmoil, which leads to an overall decline in global risk appetite. This, in turn, leads to a ‘flight to safety’, including to the Dollar, and thereby an even stronger Dollar."

Yet Bevan goes further, suggesting that EM countries might not be the only 'victims' of contagion, some G10 currencies could also suffer in the future.

The two G10s which Bevan singles out are Australia and Canada, which both have deep current account deficits and high proportions of Dollar-debt.

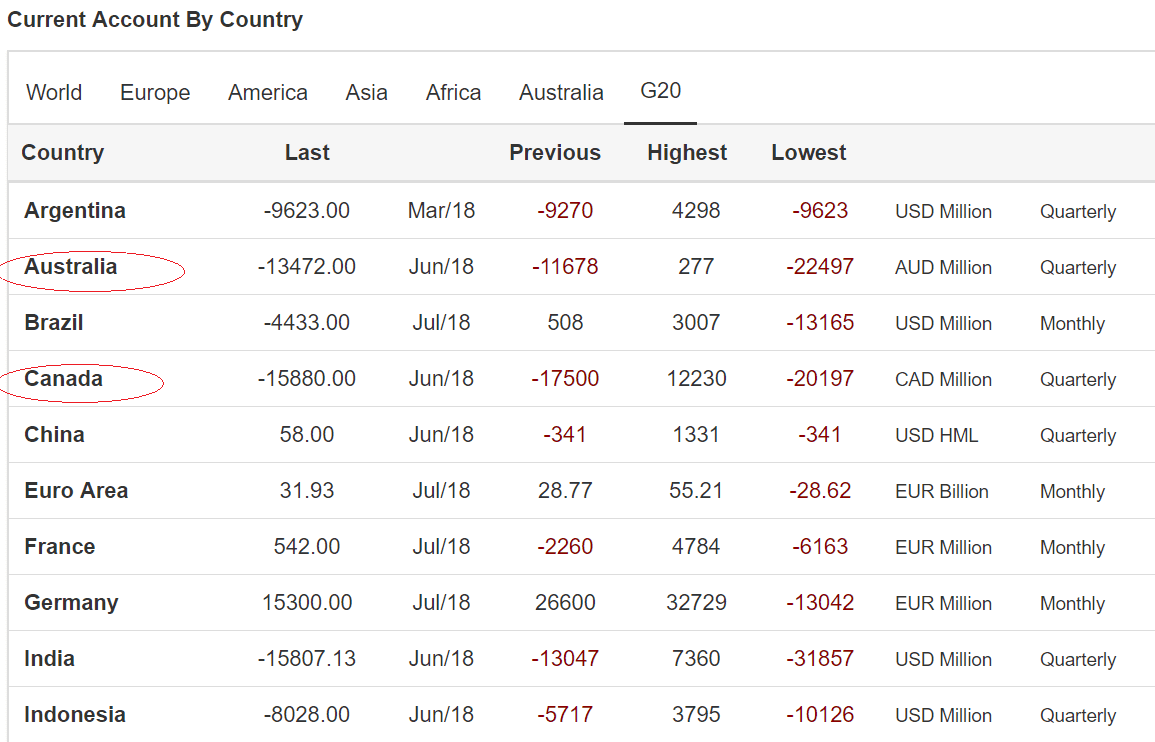

The table below shows both countries as well as a list of other EM's which have suffered particularly badly during the recent crisis.

Note how all those whose currencies have faired badly have deficits, including Argentina, India, Indonesia. Yet Australia and Canada also have deep current account deficits, making them potential targets too.

The reason why a CA deficit is so negative is that it is a sign that the country is spending more than it is making and therefore needs to reach out abroad to borrow so it can cover the shortfall.

This makes it vulnerable to overseas lenders and the exchange rate risk from their currencies - such as for example a strengthening Dollar, which pushes up the costs of the repayments.

Overseas lenders also tend to be less 'loyal' and will jump ship more quickly at the first sign of trouble. Their more risk-averse point-of-departure also tends to increase borrowing costs.

Why the Thai Baht is Doing OK

The Thai Baht is an example of an Emerging Market currency that has so far avoided the contagion spreading from its EM peers.

The Thai baht as remained relatively resilient because Thailand does not have a current account deficit or large debts owed in US Dollars.

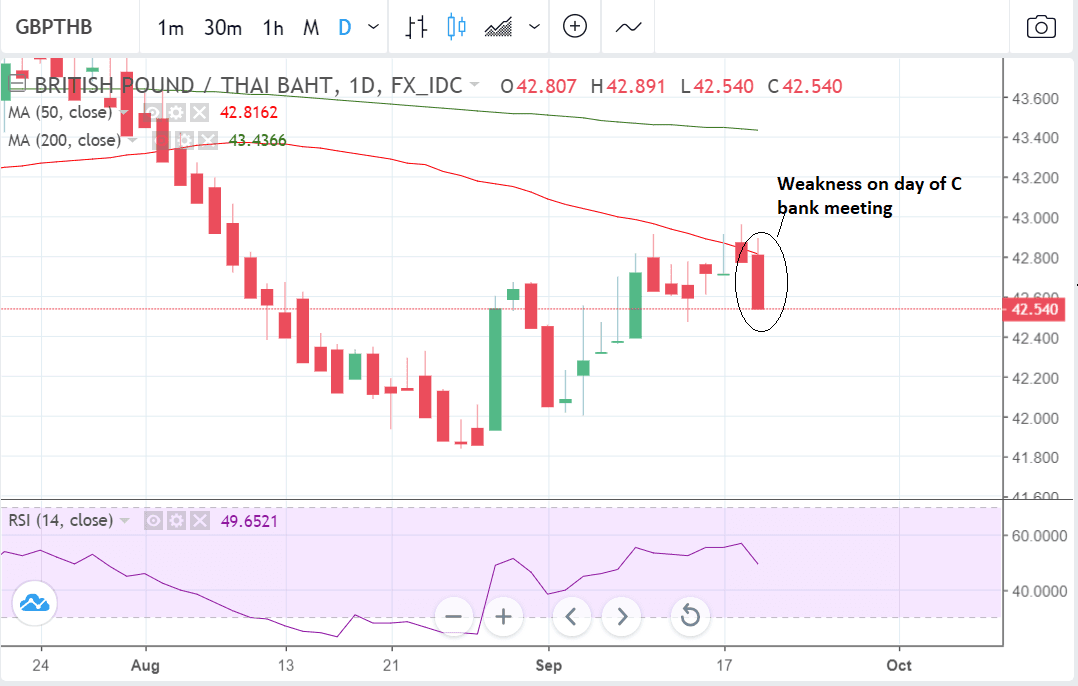

The Bank of Thailand's decision to keep its base interest rate unchanged at the ultra-low 2015 level of only 1.50% (only 0.25% above its all-time low), at its meeting on Wednesday, September 19, for example, throws into stark contrast the divide which separates some emerging market currencies from others.

The Thai Baht actually rose after the decision, going from GBP/THB 42.80 to a rate in the 42.60s.

At the same time in another EM country, India, policy-makers were furiously debating how to stop the devaluation of their currency the Rupee, which can't stop falling despite the Reserve Bank of India (RBI) raising interest rates twice this year so far, to a current base lending rate of 6.50%, and index swaps indicating two more probable hikes before the end of 2018.

The gaping divergence can be explained by the fact that the EM crisis has cherry-picked its victims.

Advertisement

Lock in Sterling's September recovery: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here