"Bubble of Belief': 2025 Could be When the Music Stops for the Equity Rally

- Written by: Gary Howes

-

Image © Adobe Images

Current market optimism, particularly concerning U.S. equities and AI investments, is unsustainable and resembles past "bubbles of belief."

This is according to a new equity strategy view from Société Générale's Albert Edwards, who is seeing warning signs that include extreme euphoria, inverted yield curves, high price-to-earnings ratios, concerns about the Chinese economy and potential negative impacts from a Trump presidency.

This leans against the near-ubiquitous consensus view that says 2025 will be characterised by U.S. economic exceptionalism. This exceptionalism extends to the equity market, where institutional strategists see the bull run continuing.

"You don't need to be a die-hard uber-bear to find talk of US equity market exceptionalism risible. I’ve heard it all before, many times, and it always ends in tears. But the most dangerous bubble of all is the bubble of belief," says Albert Edwards, Global Strategist at Société Générale.

Edwards describes himself as an 'uber bear', offering a rare contrarian stance on the bullrun underway in the U.S. markets. Critics discount his views, arguing that heeding them would have resulted in significant losses in betting against the rally, and at the very least, opportunity costs for sitting it out.

However, his time will come as all bull runs eventually run out and bubbles pop.

"In the midst (or mist) of any bubble is almost universal belief in the bullish discourse. Dare stand out from the crowd and decry the madness and you will be ridiculed and/or attacked as a charlatan," says Edwards.

Edwards acknowledges that the ride higher might be extremely profitable, but says, "the secret is to retain a healthy dose of scepticism and to time one’s exit off the dancefloor."

In a new note, he sees the following red warning lights suggesting "the party is drawing to a close and it’s time to head for the hills":

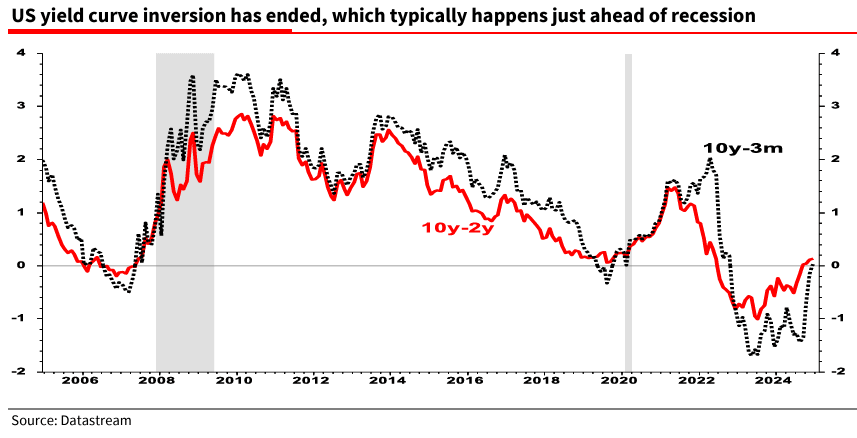

"The US 10y-2y yield curve has now resumed a positive slope as has 10y-3m. An inverted yield curve might be an early signal of an impending recession, but an un-inversion is the sound of starter gun being firing."

Image courtesy of Societe Generale.

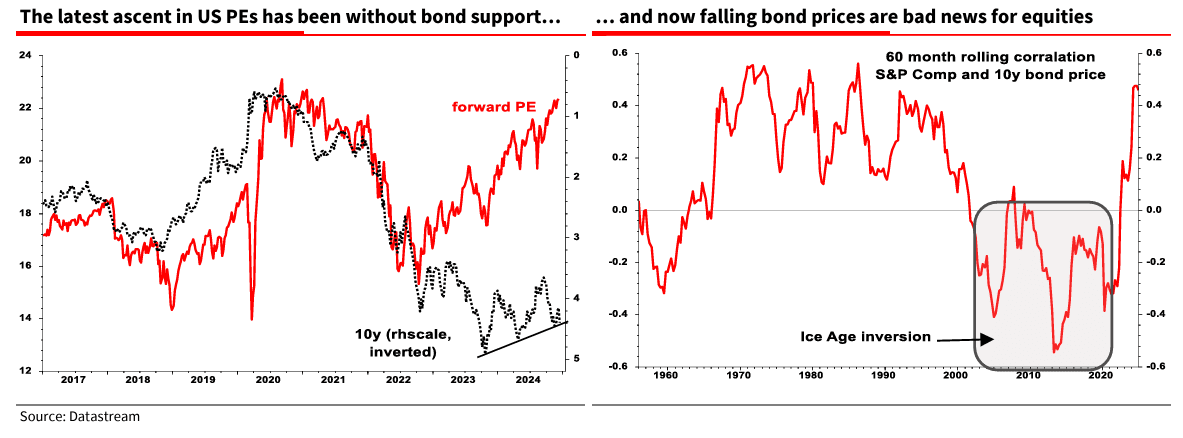

"One factor that could ‘break’ the equity bubble is any further rise in US bond yields. The last time US PEs were this high was in 2021 when the 10y yield was a supportive 1%. With Ice Age inversion of bond/equity correlations now ended, any further rise in yields would be problematic for stocks," explains Edwards.

Image courtesy of Societe Generale.

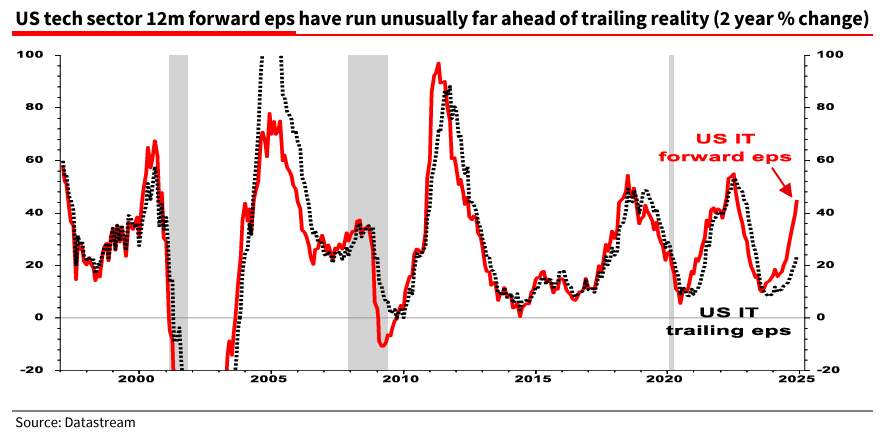

The US Tech sector is heavy with the burden of optimism with forward earnings expectations running way ahead of trailing reality. US Tech now must deliver on that optimism.

Image courtesy of Societe Generale.

"Crucially, the AI investment really must pay off in higher profits or prove to be a wasted investment," says Edwards.

A counterpoint comes from Barclays, where strategists say 2025 will see a shift in the AI investment narrative as investors move away from semiconductors and towards software. In short, the AI investment thesis will broaden, and we will see companies deploying AI start to benefit.

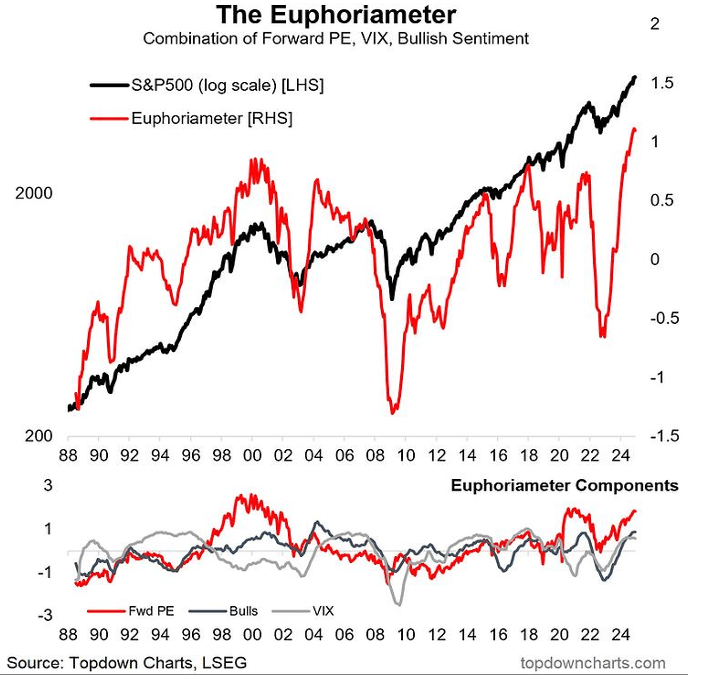

Image courtesy of Societe Generale.

One feature of a bubble of belief is euphoria, says Edwards, noting current euphoria is extreme. "The warning bells are ringing."

Donald Trump's second term in office has been a driver of the equity rally of late, with investors seeing his laissez-faire approach to running government and the economy as being supportive.

However, economist Paul Mortimer-Lee at the NIESR says there are reasons to anticipate a "Trump slump."

China is another concern. Ongoing attempts to stimulate the economy have thus far failed to ignite.

"I have no idea why most investors seem so sanguine about the Chinese economic conjuncture. Perhaps they believe the problems are ‘contained’ in China, just like Ben Bernanke claiming the 2018 CDO crisis was ‘contained’. I remember my erstwhile college James Montier quipping that it was indeed ‘contained’ – on Earth! The China crisis matters – ignore it at your peril," he says.