Australian Dollar Slips as RBA Governor Lowe Signals Little Appetite to Join Global Race to Raise Interest Rates

- Written by: James Skinner

AUD came under pressure on confirmation the RBA is in no rush to raise interest rates, but analysts at a leading Australian bank say the RBA will hike in 2018.

The Australian Dollar slid during morning trading in London Thursday after Reserve Bank of Australia governor Philip Lowe appeared to play down the prospect of an Australian rate hike in the near future.

“A rise in global interest rates has no automatic implications for us here in Australia,” Lowe told an audience at the American Chamber of Commerce in Perth, noting that such a global increase in rates would only filter through to the Australian economy over the medium-longer term.

“Our flexible exchange rate though gives us considerable independence regarding the timing as to when this might happen,” says Lowe.

The comments were immediately picked up on by markets who eyed implications for the timing of Australian interest rate rises.

"Lowe speech key line seems to be the line that the global rate rises view have no 'automatic implications for Australia'. AUD lower," says Chris Weston with IG.

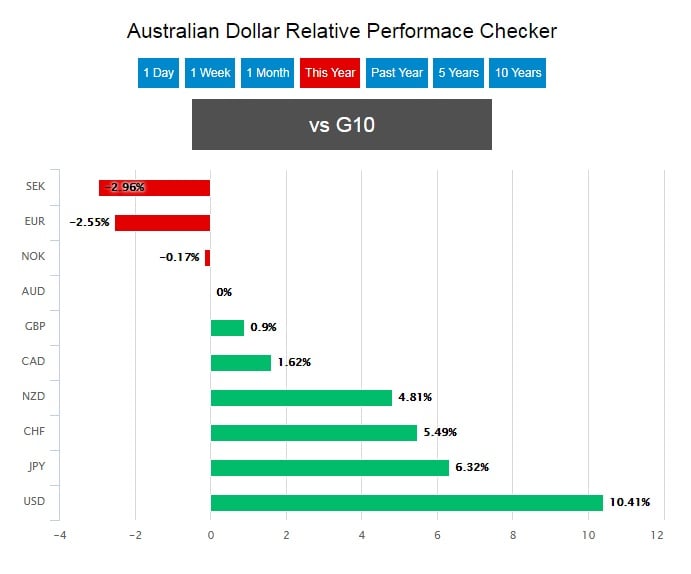

Australia has long enjoyed interest rates that are notably higher than those in other developed nations, attracting a flow of capital from global investors keen on receiving greater returns.

This in turn bids the Aussie Dollar higher. With other nations looking to raise rates, this advantage is at risk of fading, therefore signs that the RBA might raise rates in the near-future are a positive for the currency.

And the opposite is true when the RBA is looking to cut rates, or sit on existing levels as appears to be the message delivered by Lowe.

Above: The Pound-to-Australian Dollar exchange rate caught a boost following comments made by the RBA's Lowe.

Lowe emphasised that an eventual withdrawal of stimulus would be contingent on the ability of highly indebted Australian households to cope with increased borrowing costs.

“Lowe’s comments about China’s growth and that highly indebted households will be more sensitive to rate hikes, which implies a very gentle rate hiking cycle when it eventually starts, added weight to the AUD,” says Manuel Oliveri, a foreign exchange strategist at Credit Agricole.

Wednesday’s speech comes after a period of strong gains for the Aussie Dollar, itself a response to bond markets having begun pricing in a rate hike some time toward the end of June 2018.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

But One Strategist Says Rates Will Still Go Up

Depending on how the Australian Dollar behaves over coming months, ANZ say they believe the time to raise rates at the RBA will be 2018.

ANZ caution that their base forecast - that sees two interest rate rises in 2018 - is dependent on the AUD/USD exchange rate staying below 0.90.

A strengthening Australian Dollar could weigh heavily on inflation and would be enough to take a 2018 increase off the table.

“Likewise, evidence that core inflation or wages are slowing again would rule out a rate hike in 2018,” says David Plank, head of Australian economics at ANZ.

But a surprise weakening of the Australian Dollar, one that is driven by portfolio rebalancing among investors as opposed to economic weakness, would trigger an uptick in inflation and could be enough to push the RBA over the edge.

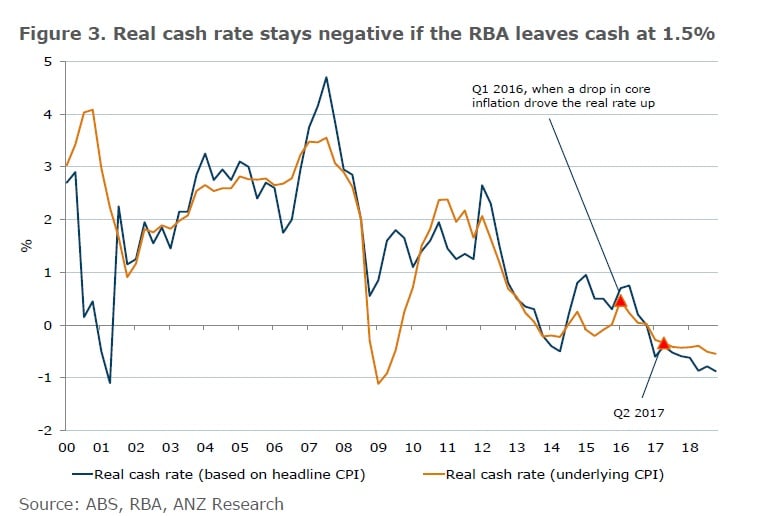

“We see the RBA tightening by 50bp in 2018. This would reverse the rate cuts of 2016 and take the real cash back to zero,” says Plank. “After these hikes we see the Bank sitting pat in 2019 as highly indebted households digest the impact of higher rates.”

Faster Growth Renders RBA Stimulus Unnecessary

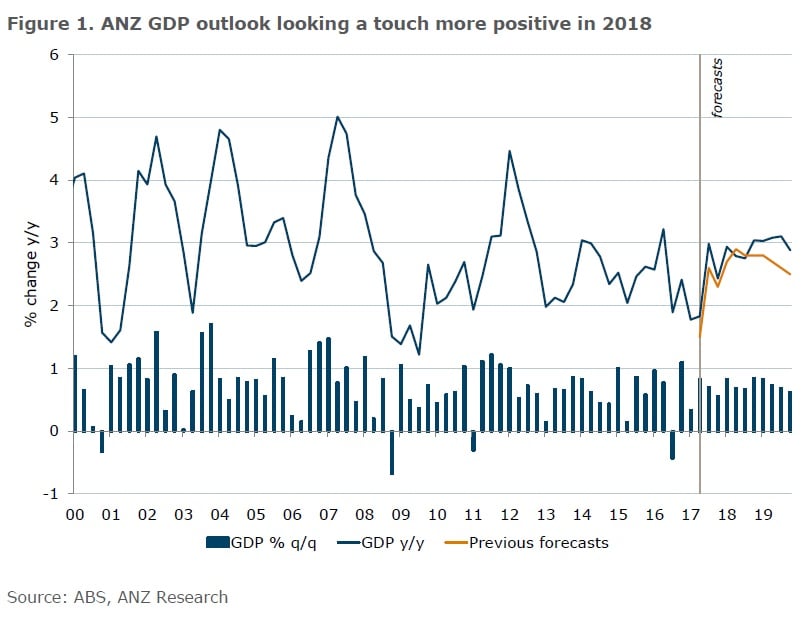

Driving ANZ’s expectations for an interest rate rise is a further pickup of growth and inflation over the coming year.

“We have updated our growth forecasts for Australia. In sum our outlook for 2018 is a touch more positive than before, reflecting a stronger outlook for non-mining business investment, the strength in public sector spending (not only in the infrastructure space) and a shallower dip in residential construction than previously expected,” says Plank.

“Importantly, we think the downside risks to the growth outlook have eased. This is despite our expectation that household consumption will remain relatively subdued in the period ahead, even as household income growth picks up,” Plank adds.

The RBA left the cash rate unchanged, at 1.5%, for the 13th month in a row in September while Lowe told a separate audience, in another speech, that the long run equilibrium interest rate for Australia will be lower than before, likely around 3.5%.

Much the same as with other developed economies, Australian real interest rates are still negative, something which is unnecessary in ANZ’s view.

“We think in large part the RBA’s 2016 rate cuts were in reaction to a surprisingly low inflation outcome that pushed the real cash rate above zero,” says Plank. “The combination of these cuts and the lift in underlying inflation has seen the real cash rate fall into negative territory. Such a policy stance looks increasingly unnecessary, even if the rally in the AUD over the past 12 months or so has acted as at least a partial offset.”