GBP/AUD Rate's Angels Wings in Focus

- Written by: James Skinner

"AUD/USD faces a number of important cross-currents this week. A weaker USD will support AUD/USD" - Commonwealth Bank of Australia.

Image © Adobe Stock

The Pound to Australian Dollar exchange rate entered the new week teetering at a technical inflection point on the charts with antipodean inflation figures and a Federal Reserve (Fed) decision set to determine if it rises back toward earlier highs or breaks further below ahead of the next weekend.

Australian Dollars were bought widely on Tuesday as it climbed against all G10 and G20 counterparts with the Russian Rouble and Chinese Renminbi featuring as the only exceptions while helping the antipodean currency to retain one of the top spots in the G10 rankings for the recent week.

Sterling was, meanwhile, a runner-up in the G10 currency group on Tuesday and an underperformer for the recent week with price action pulling it further down from more than one-year highs around 1.93 reached in relation to the Australian Dollar during the earlier weeks of July.

One possible driver of this may have been China's Politburo committing to boosting domestic demand through further but so far vaguely defined stimulus though Australia's inflation figures for June and the latest Fed decision are on Wednesday and will be instrumental in determining where GBP/AUD ends the week.

"A more decisive decline in inflation may lift the mood but will likely be offset by clearer signs of deteriorating economic and labour market conditions," writes Matthew Hassan, an economist at Westpac, in a Tuesday research briefing.

Above: Pound to Australian Dollar exchange rate shown at daily intervals alongside AUD/USD and with Fibonacci retracements of February rally indicating possible areas of short-term technical support.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

"Consumer sentiment shows the combination of rapid rises in the cost of living and interest rates are bearing down heavily on family finances. Households have started to draw down on the large excess reserves accumulated during the pandemic but card data suggests they are also starting to wind back on spending," he adds.

Economist surveys suggest an average expectation for Australian inflation to fall from 7% to 6.2% when data for the second quarter are released in the early hours of Wednesday while the quarter-on-quarter rate is seen declining from 1.4% to 1%.

In each case the data would suggest the Reserve Bank of Australia (RBA) was right in January when saying inflation had likely passed its peak in Australia, while data emerging from other advanced economies in recent weeks have done little to suggest anything other than a notable deceleration up ahead.

The Australian Dollar's likely reaction is uncertain, given how the data could challenge expectations for further increases in the cash rate this year and the market's tendency to buy or sell currencies in response to rising or falling inflation and interest rates.

"AUD/USD faces a number of important cross-currents this week. A weaker USD will support AUD/USD this week, though it could be a volatile week," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

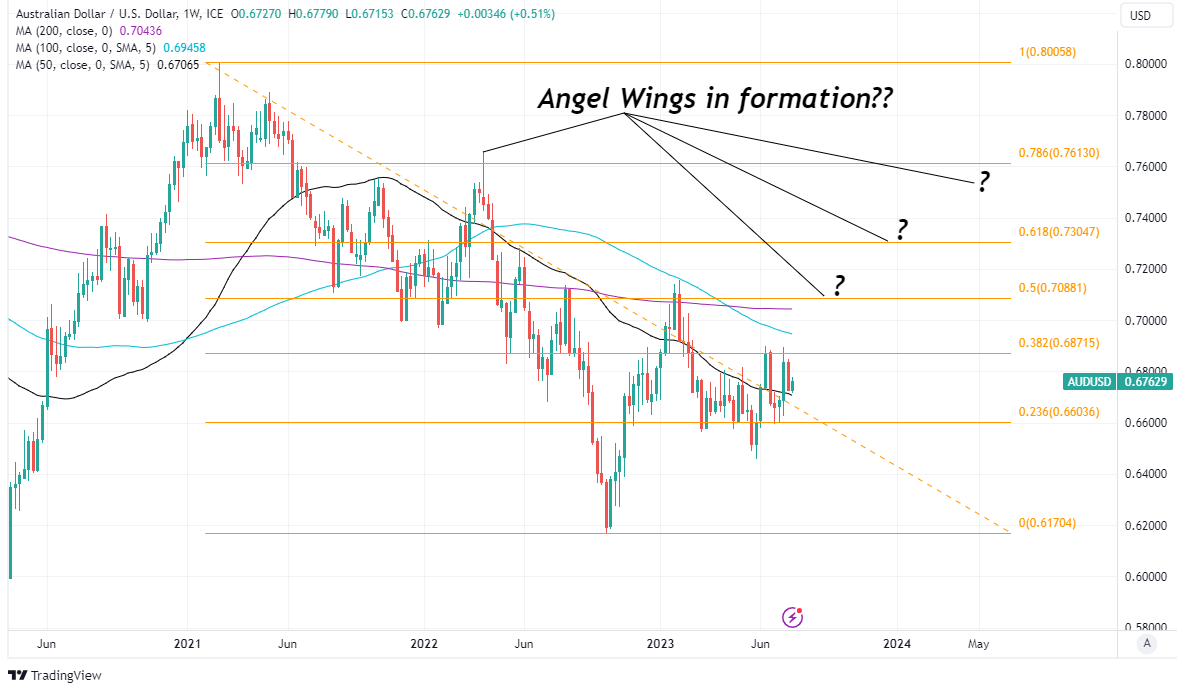

Above: AUD/USD at daily intervals with Fibonacci retracements of 2021 downtrend indicating possible areas of technical resistance. Selected moving averages denote possible support and resistances.

"The largest uncertainty for AUD this week is whether or not the Chinese government announces an economic stimulus package or not. Size and composition will matter for currencies. A large package focused on infrastructure will push AUD up significantly," Capurso and colleagues write in a Monday research briefing.

Falling inflation and moderating expectations for interest rates would potentially act as tailwinds for the Australian economy in what would typically be a negative influence for the Australian Dollar and a favourable outcome for GBP/AUD but the prospects for both are complicated by uncertainty over what the Fed will do on Wednesday and whether there will be any further details coming from China relation to its planned stimulus.

"For me, the big takeaway from the release of PMI data yday is that we can’t rule out a Fed rate hike for Sept/Nov just yet – even if the market is leaning in that direction right now. Manufacturing output expanded for the first time in months while new orders still remain in expansionary territory. On the prices front, services still leading the way while manufacturers saw a renewed increase," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

Many in and around the markets expect the Fed to raise its interest rate from 5.25% to 5.5% on Wednesday but there could be an underappreciated risk of borrowing costs being left unchanged following recent declines in U.S. inflation rates and the financial sector turbulence seen back in March when market pricing of the September interest rate decision peaked at just above 5.5% and led some small and medium-sized lenders to fail.

Financial stability concerns should mean that any further increase in interest rates would be a favourable outcome for the U.S. Dollar or a bearish one for AUD/USD and this would typically be bullish for GBP/AUD, though a decision to leave interest rates unchanged could mean this week's losses in GBP/AUD are merely the beginning of a much more protracted downtrend that could see Sterling falling back to 1.80 or below in relatively short order and the author's estimation.

Above: Pound to Australian Dollar exchange rate shown at daily intervals alongside AUD/USD.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes