Pound-Australian Dollar Week Ahead Forecast: Downside Risks Still Persist

- Written by: James Skinner

- GBP/AUD risking further losses in short-term

- Could slip to 1.7375 or below in week ahead

- Resistance obstrucst around 1.7554, 1.7614

- China's economic data & BoJ decision eyed

- Ahead of UK inflation figures & AU jobs data

Image © Adobe Stock

The Pound to Australian Dollar exchange rate has extended a multi-week run of losses in recent trade while painting a picture of vulnerability onto the charts and would risk further losses in the days ahead if developments in the Asia Pacific region enable the antipodean currency to further its recovery.

Australia's Dollar remained the outperformer of the fledgling year on Monday but has most recently had tough competition for the top spot in the G10 table coming from the Japanese Yen and this Wednesday's Bank of Japan (BoJ) policy decision will also help to make or break the trend in GBP/AUD.

But the Aussie, Sterling and other currencies will first have to navigate a raft of economic figures from China on Tuesday including final quarter GDP, retail sales for December and the latest numbers covering fixed asset investment and industrial production.

"We expect the market to ignore any downside surprise to the Chinese economic data released tonight. But an upside surprise to the Chinese data will support commodity prices and AUD," says Carol Kong, an economist and currency strategist at Commonwealth Bank of Australia.

China's data is widely expected to confirm a sharp slowdown in GDP growth and a steep -9.5% decline in retail spending connected with recent coronavirus-related restrictions though Kong and colleagues said on Monday that any upside surprise could lift AUD/USD to five-month highs around 0.71.

Above: Pound to Australian Dollar rate shown at daily intervals with Fibonacci retracements of late September rally indicating possible areas of technical support while selected moving averages offer prospective technical resistance.

Above: Pound to Australian Dollar rate shown at daily intervals with Fibonacci retracements of late September rally indicating possible areas of technical support while selected moving averages offer prospective technical resistance.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The Pound to Australian Dollar rate often weakens as AUD/USD strengthens so any Tuesday rally by the latter would be a downside risk for Sterling.

"To confirm potential for further immediate upside, spot now needs to close and post a clear session above that [0.7009] high level. Any retrace we expect should be contained ahead of 0.6900-0.6920," says Patrick Bennett, Asia head of FX strategy at CIBC Capital Markets, in reference to AUD/USD.

"Though a possible prompt for that type of pullback is not obvious. A large miss on employment data out Thursday is not anticipated, while medium-term support continues to build around the outlook for bolstered Chinese demand through coming months," he adds in Monday market commentary.

There might be downside risks for Sterling in the mid-week session too if the Bank of Japan gives credence to recent speculation by either abandoning its Yield Curve Control policy or by adapting the paremeters of the programme again so as to permit further increases in local government bond yields.

The Yen has benefited from this speculation to the detriment of the U.S. Dollar in what has also been a tailwind for AUD/USD and an added headwind for the Pound to Australian Dollar pair.

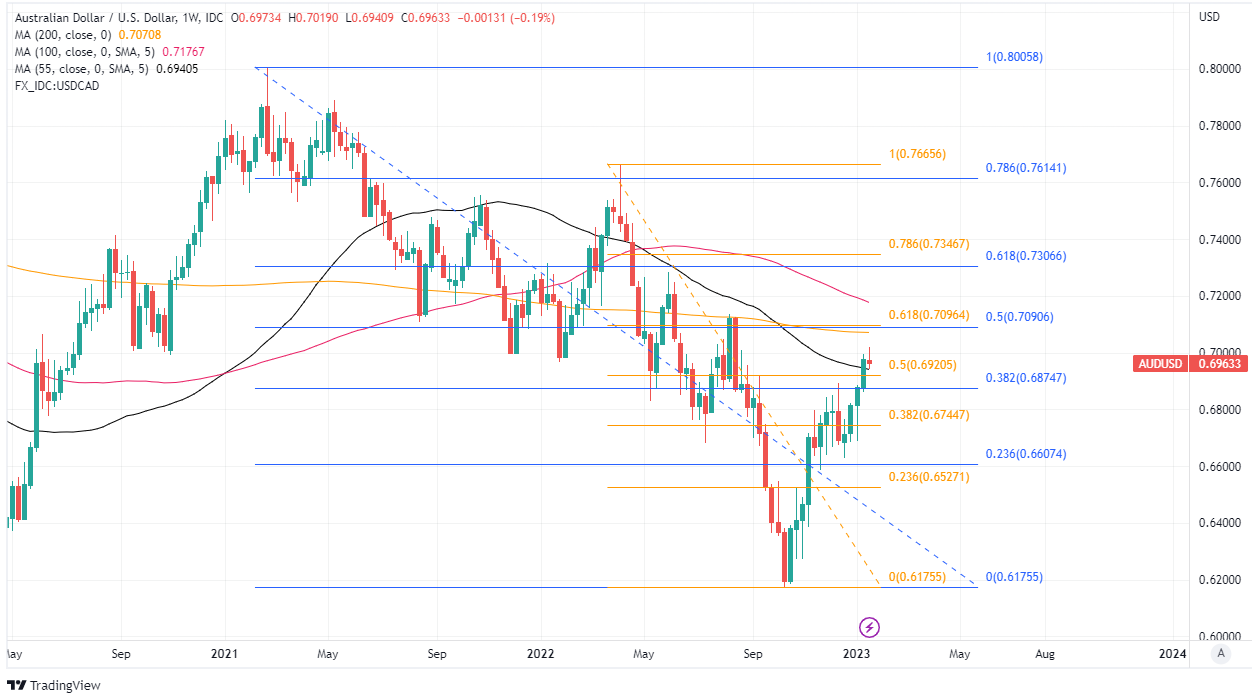

Above: AUD/USD shown at weekly intervals with Fibonacci retracements of February 2021 and February 2022 downtrends indicating possible areas of technical resistance while selected moving averages denote prospective support and resistance. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: AUD/USD shown at weekly intervals with Fibonacci retracements of February 2021 and February 2022 downtrends indicating possible areas of technical resistance while selected moving averages denote prospective support and resistance. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Any further GBP/AUD declines could be tempered from the mid-week session onward, however, if UK inflation figures emerge stronger than expected for the month of December as that could encourage further increases in Bank Rate from the Bank of England (BoE).

This is after UK GDP figures out on Friday suggested the UK economy has not deteriorated to the same extent as was envisaged by the BoE in its November forecasts, although GBP/AUD might also be responsive to Australian employment data due out on Thursday.

"Strong jobs and monthly CPI data reduce the risk of the RBA pausing in February," says Gregorius Steven, an economist at ANZ.

"We expect a 25bp hike. We’re not forecasting a recession, but if inflation surprises on the upside, this could put pressure on the RBA to hike above our current peak cash rate pick of 3.85%. This would increase the risk of a hard landing," Steven and colleagues write in a Monday research briefing.

Consensus suggests Thursday's Australian data will reveal a 21.2k increase in employment that helps to keep the unemployment rate steady at a historic low of 3.4%, while in the UK inflation is expected to fall from 10.7% to 10.5%.

Above: Pound to Australian Dollar rate shown at weekly intervals with Fibonacci retracements of late September rally indicating possible areas of technical support while selected moving averages denote possible resistance. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

Above: Pound to Australian Dollar rate shown at weekly intervals with Fibonacci retracements of late September rally indicating possible areas of technical support while selected moving averages denote possible resistance. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.