Australian Dollar Now "Expensive" says Westpac Economist, Eyeing Coal Prices

- Fair value for AUD at 19 year low

- But AUD continues strong run higher

- Price of coal down 22% in April

Image © Adobe Images

- GBP/AUD spot rate at time of writing: 1.9076

- Bank transfer rates (indicative range): 1.8408-1.8542

- FX specialist transfer rates (indicative range): 1.8638-1.8904 >> more information

The Australian Dollar's ongoing bout of appreciation against the likes of the Pound, Dollar and Euro comes amidst broadly improving market sentiment concerning the coronacrisis, but the rally now risks leaving the currency overvalued.

According to Australian lender Westpac, the gains in the Australian Dollar come at a time that the currency's 'fair value' estimate continues to fall, suggesting that the sustainability of the gains becomes increasingly questionable.

Analyst Robert Rennie at Westpac in Sydney says research shows the 'fair value' midpoint for the Australian Dollar against the U.S. Dollar dropped to a fresh 19 year low at 0.61.

"This means that the Australian Dollar is now seen as 'expensive' to fair value for first time since April 2018," says Rennie. The Australian Dollar has rallied by 5% against the U.S. Dollar over the course of the past month, with the Australian Dollar-to-U.S. Dollar exchange rate now quoted at 0.6451.

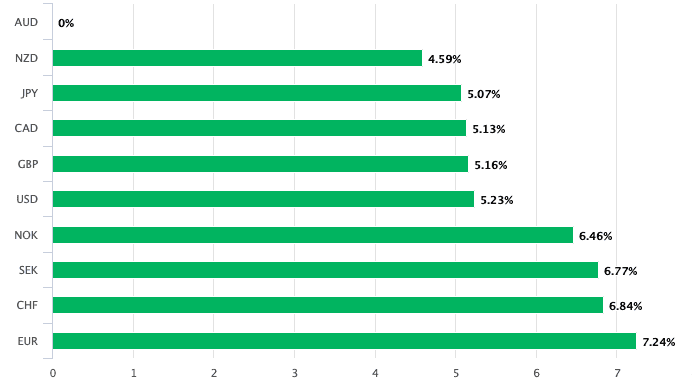

Against Sterling, the Aussie currency has also advanced 5%, with the Pound-to-Australian Dollar exchange rate now quoted at 1.9238. The Euro-to-Australian Dollar exchange rate has meanwhile risen 7.24% over the course of the past month to reach 1.6764.

Above: AUD performance over the course of the past month

The Australian Dollar's rally comes at the same time as one of Australia's primary exports looks set to suffer a significant reduction in demand, owing to the global economic slowdown sparked by the coronacrisis.

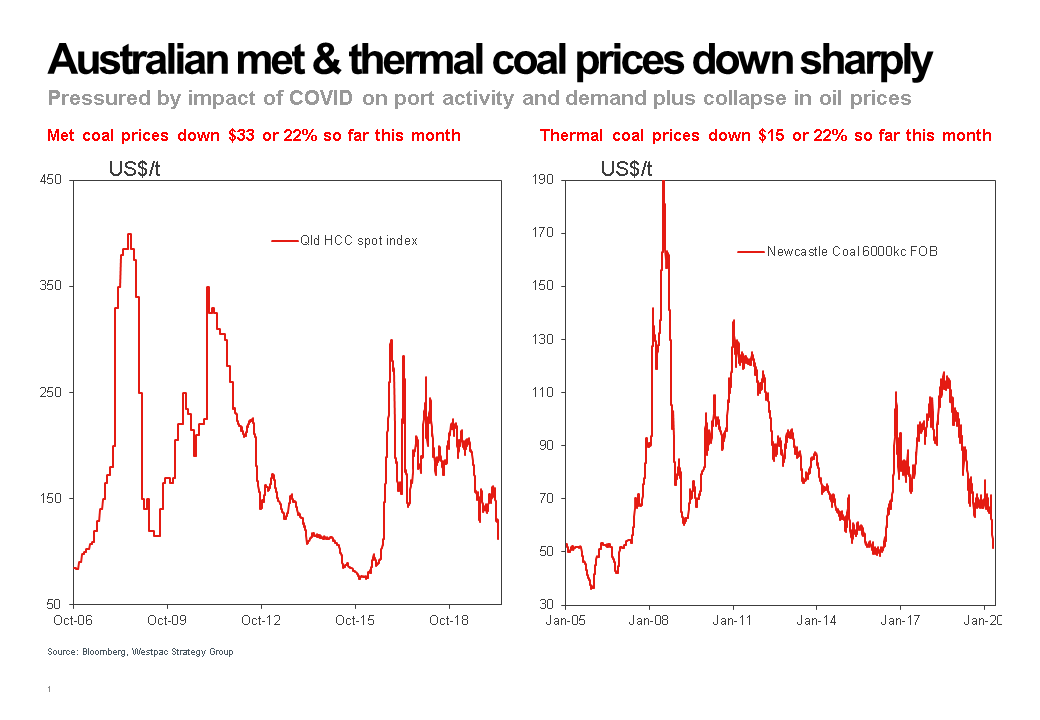

"The coal market crunch is simply being ignored," says Rennie.

Rennie says the recent drop in coal prices is indeed significant, driven by impact of COVID on port activity/ demand in Asia plus the collapse in oil prices.

The analyst notes met coal prices down $33 or 22% so far this month while thermal coal prices down $15 or 22% so far this month.

Above image courtesy of Westpac.

Coal is Australia's second most important export after iron ore and is therefore a substantial driver of Australian Dollar value; higher coal prices and higher export volumes would in turn result in higher earnings for Australia which in turn would support its currency.

According to Australian government statistics, coal exports accounted for nearly 15% of all Australian exports in 2018-2019, while iron ore accounted for 16% of export volume.

Iron ore dynamics do however appear to be more constructive with data suggesting the market remains relatively buoyant.

Data cited by Rennie shows that in the first 20 days of April, grossed up for 30 days, iron ore exports from Brazil are 23mt to reach a 4 month high. Exports from Australia are meanwhile at 72mt, which is up 6% year on year.

"Combined April exports are +10%yy and +7% 3myy. Feb marked low for Brazilian exports at -22% 3myy! In April, they are just -3% 3myy," says Rennie.

The solid dynamics in iron ore could therefore be masking the underlying stresses in coal, and allowing the Aussie Dollar's deviation away from 'fair value' to take place, we do however wonder whether the currency will defy gravity indefinitely, allowing any setback in global investor sentiment to question the rally.

Viraj Patel, Foreign Exchange and Macro Strategist at Arkera has also picked up on the Australian Dollar's potentially exaggerated valuation, and is wary of a turn lower in the even markets turn.

"Be careful chasing the Aussie Dollar higher, the rally is largely hot air. AUD is the archetypal high-beta FX - tracking global equities in lockstep. But the moment equities turn - AUD will be in freefall. If rates were driving the AUD then the pair would be closer to 0.60," says Patel.