JP Morgan Constructive on the Rand, But Says it's a Tad Expensive Right Now

- Written by: Gary Howes

Image © Government of South Africa, reproduced under CC licensing

One of the world's biggest investment banks says it is constructive on the South African Rand's prospects, even if it screens as expensive short-term.

In a further boost for the South African currency, JP Morgan says it has now returned to its pre-election constructive bias on ZAR.

"We see a potential for an inflection point in SA’s fundamentals," says JP Morgan in a recent mid-year update. "Specifically, improvements in energy availability and prospects for lower logistical bottlenecks should lift SA’s potential growth while we also expect stronger efforts at fiscal consolidation and potentially lower SARB inflation target."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

ZAR rallied 3.0% in June after the elections resulted in the formation of a multi-party Government of National Unity (GNU), that investors think will deliver better policy outcomes than under an alternative scenario of 1) another ANC majority and 2) a coalition between the ANC and radical left-wing parties.

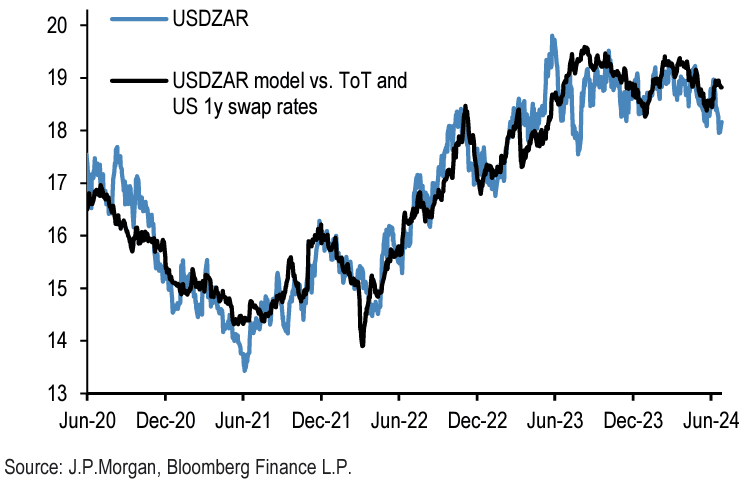

From a tactical standpoint, JP Morgan thinks better entry levels ahead will allow exposure to the broader rise in value. In fact, JP Morgan's models think the Rand is looking a tad expensive at current values.

Above: "ZAR is about 3.5% expensive in our short-term model" - JP Morgan.

JP Morgan's Emerging Market analysts think the GNU arrangement can increase the confidence that South Africa will improve its fiscal position. A risk to bear in mind is that the GNU could prove unstable and "unity remains uncertain."

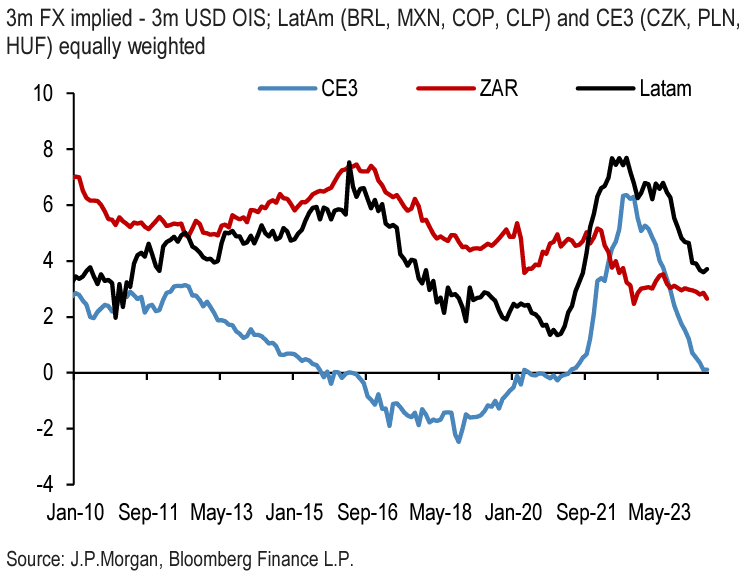

Besides fundamentals, JP Morgan says there are other factors that are in ZAR’s favor: "ZAR has gained in carry rankings and it is an under-owned currency compared to other carry plays while locals have likely reached peak foreign asset allocations."

Above: "ZAR carry has improved versus LatAm and CEE" - JP Morgan.

Carry refers to the trade that sees investors borrow where interest rates are low and invest where they are higher. For instance, one might borrow in Yen (the Bank of Japan's official rate is 0.1%) and buy South African ten-year bonds, which are yielding 9.6% at the time of writing).

This creates a flow of currency that is supportive of ZAR value, particularly if investors think volatility will remain low and South African assets are a safe bet.