South African Rand Seen Pushing GBP/ZAR to 19.00 in Months Ahead

- Written by: James Skinner

- GBP/ZAR under pressure & could slide further

- As ZAR climbs with commodities, GBP softens

- Seen at 19.00 by June as USD/ZAR hits 14.50

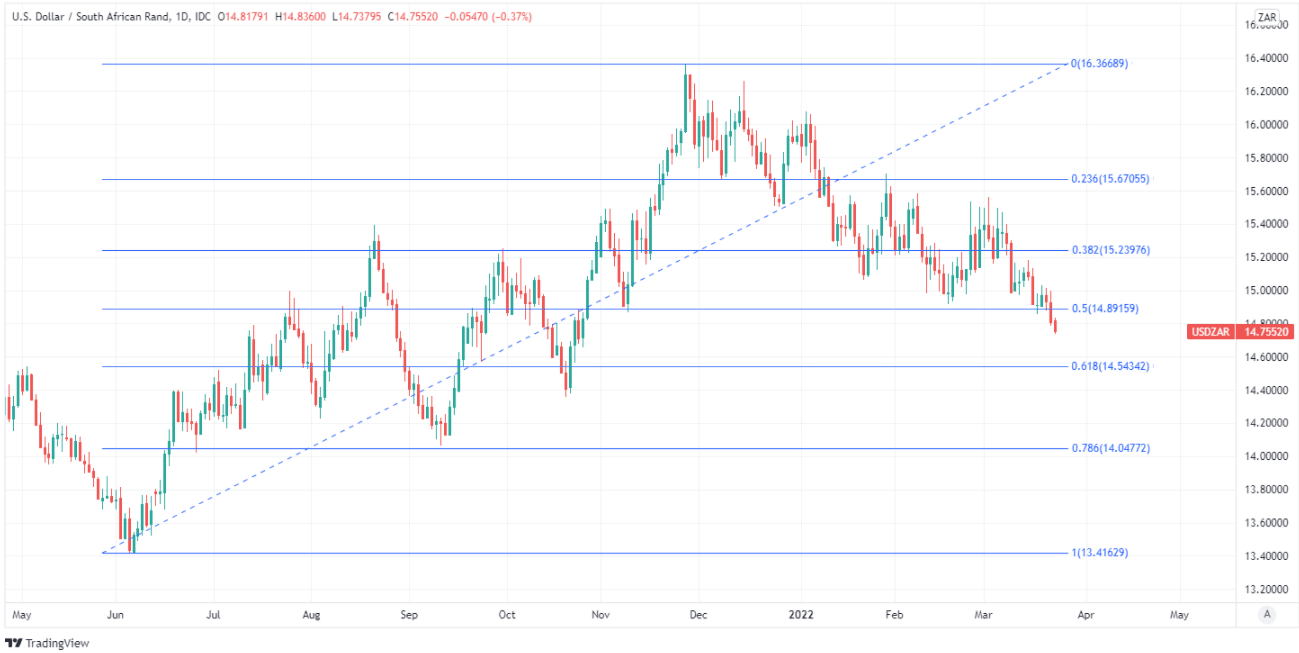

- USD/ZAR breaks 15.0 as SARB decision eyed

Image © Adobe Images

The South African Rand has this week pushed Sterling to a six-month low in the process and some forecasters suggest the GBP/ZAR exchange rate is likely to fall further in the weeks and months ahead.

South Africa’s Rand added further to recent gains over most major developed and emerging market counterparts on Wednesday when it was outdone by only the Russian Rouble and Brazilian Real.

The Rand strengthened against a vast majority of currencies within the G20 contingent during the week to Wednesday with only the other commodity-linked currencies having managed to rise further.

“This unprecedented resilience reflects the support flowing from higher gold and metal prices on fears of supply shortages due to sanctions on Russia’s metal exports. The rand also benefited from renewed foreign interest in the local equity market,” says Nicky Weimar, chief economist at Nedbank.

Rand strength saw the USD/ZAR exchange rate slip further below the landmark level of 15.0 this week, although the Pound to Rand exchange rate had fallen further by Wednesday and broke below an important level of technical support around 19.57 during the mid-week session.

Above: Pound to Rand exchange rate shown at daily intervals with Fibonacci retracements of June 2021 rally indicating possible areas of medium-term technical support for Sterling. Shown alongside USD/ZAR.

- GBP/ZAR reference rates at publication:

Spot: 19.47 - High street bank rates (indicative): 18.79-18.93

- Payment specialist rates (indicative): 19.30-19.33

- Find out about specialist rates, here

- Set up an exchange rate alert, here

While the decline in GBP/ZAR has also been encouraged by recent and ongoing weakness in Sterling exchange rates, the Rand has been lifted broadly by high and rising commodity prices as well as expectations for South African Reserve Bank (SARB) interest rate policy.

“The prospect of further SARB rate hikes is likely to support the rand just like its status as a commodity currency. It was able to appreciate significantly against the EUR as a result of the Ukraine conflict and USD-ZAR too was traded below the 15 mark again recently,” says Elisabeth Andreae, an FX and emerging market analyst at Commerzbank.

The South African Reserve Bank is widely expected to lift its interest rate from 4% to 4.25% on Thursday as part of an effort to keep a lid on inflation, which held steady at an annualised 5.7% during February, according to data released by Statistics South Africa on Wednesday.

“The FRA curve is pointing to a larger hike; however, we don’t anticipate this, owing to the downside risks to domestic GDP growth. Specifically, we now anticipate SA’s 2022 GDP growth at 1.6% y/y as global growth weakens, along with SA specific factors including load shedding and sluggish reform implementation,” says Lara Hodes, an economist at Investec.

February’s statement from the SARB said that further increases in the cash rate and a “gradual normalisation” of its overall monetary policy will be necessary over the next two years or so if inflation is to be kept within the three-to-six percent target band over the medium-term.

“South African 5 and 10 year paper implies a yield of in excess of 7 and 8% respectively. On top of that the SARB looks set to deliver sequential rate hikes at meetings later this year, attracting investors to the once again high yielding currency. Therein lies the initial bullish case for the Rand, however, much of this is already priced-in,” says Charles Porter, an analyst at SGM Foreign Exchange.

The SARB’s concerns about inflation have led financial markets to price-in multiple further increases in the cash rate for the months ahead, which has been supportive of the Rand during recent weeks but could eventually act as a restraint on the currency if market expectations go unmet later this year.

“The SARB is likely to under-deliver on market expectations in the second part of the year, amid weak growth and turning inflation. Consequently, ZAR policy rates will likely remain below those of Poland and Hungary, making the ZAR less attractive,” says Marek Raczko, an FX strategist at Barclays.

Above: USD/ZAR shown at daily intervals with Fibonacci retracements of June 2021 rally indicating possible areas of medium-term technical support.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Many analysts have worried that meeting market expectations for South African interest rates would undermine the domestic economic recovery, leading some to anticipate the SARB could be likely to disappoint the market later in the year.

“The SARB is expected to tighten monetary policy, but at a measured pace to safeguard a fragile economic recovery,” Nedbank’s Weimar and colleagues said in a Monday research briefing.

This is all a part of the reason why many forecasters remain cautious in their outlook for the Rand, with some including the Nedbank team doubtful that it could cling onto recent gains for much longer, although Barclays’ forecasts do envisage further declines in GBP/ZAR and USD/ZAR in the short-term.

Barclays looks for GBP/ZAR to fall to 19.00 by the end of June, with Rand strength driving much of the loss for Sterling as well as an anticipated USD/ZAR decline to 14.50, although each of these moves is tipped to reverse over the second half.

“In the near term, the ZAR should benefit from higher commodity prices and global risk sentiment stabilisation,” Barclays’ Raczko says. “In the long term, however, we expect weak economic growth to weigh on the ZAR.”