South African Rand Rally Helped by Inflation-fearing Money Flows

- Written by: James Skinner

- USD/ZAR, GBP/ZAR at lowest since Fed’s taper decision

- As inflation containment stokes demand for ZAR assets

- Leaves GBP/ZAR & USD/ZAR testing key support levels

Image © Adobe Images

The Rand rallied further this week to reach its strongest levels against the Dollar and Pound since before the Federal Reserve (Fed) announced plans to end its quantitative easing programme and some say this is the result of strong commodity prices and South Africa’s subdued levels of inflation.

South Africa’s Rand pushed USD/ZAR beneath the 15.00 handle on Thursday for the first time since early November, weighing heavily on the Pound to Rand exchange rate in the process, which fell tentatively below an important level of technical support located around 20.3712 on the charts.

Thursday’s advance came alongside strong gains for gold and other precious metals prices as well as amid a further rally in government bonds, which may be growing more attractive to international investors due to subdued inflation rates in South Africa and surging prices elsewhere in the world.

“South Africa continues to see investor appetite, particularly on the domestic side for government debt, while the rand is performing well compared to other emerging market currencies,” says Annabel Bishop, chief economist at Investec.

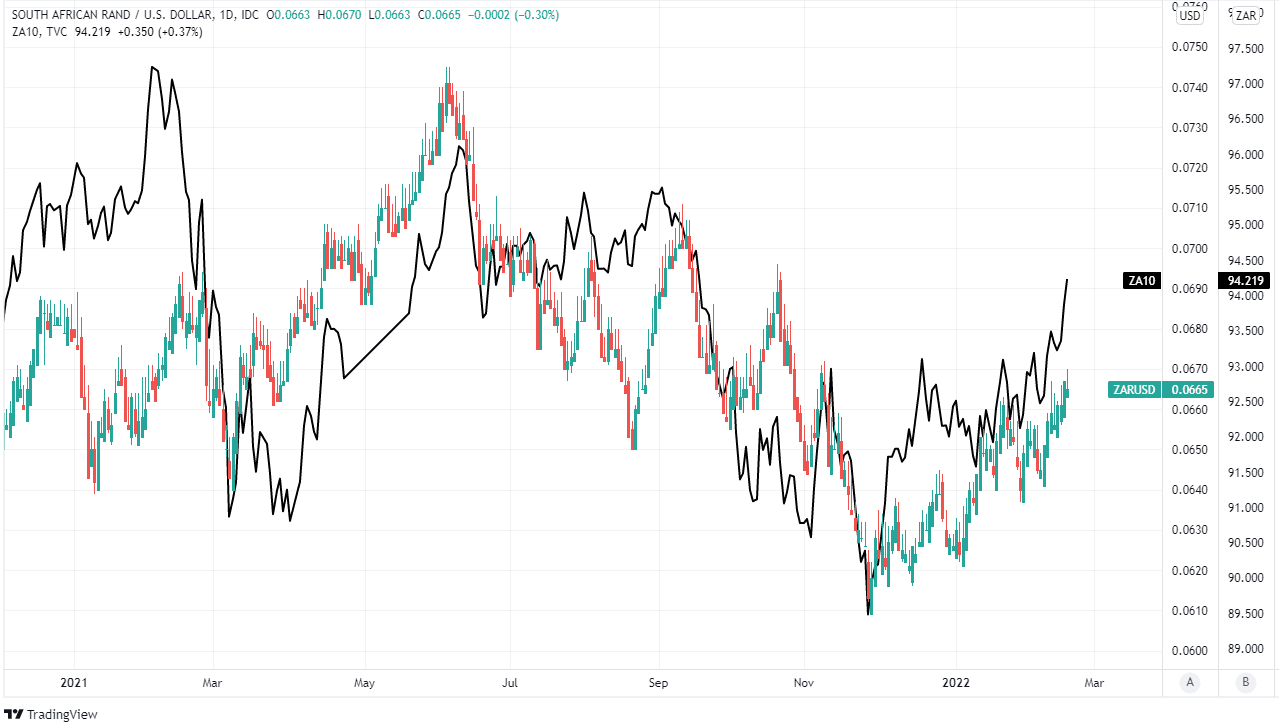

Above: ZAR/USD shown at daily intervals alongside 10-year South African Government bond price.

- GBP/ZAR reference rates at publication:

Spot: 20.36 - High street bank rates (indicative): 19.65-19.79

- Payment specialist rates (indicative): 20.18-20.26

- Find out about specialist rates, here

- Set up an exchange rate alert, here

South Africa’s annual inflation rate has remained beneath the upper limit of the South African Reserve Bank’s (SARB) three-to-six percent target band over the last year while core inflation rate has remained close to the bottom of the three-to-six percent target band.

That is in contrast to the situation elsewhere in the world including in the most advanced economies where central banks have either lifted interest rates already or are increasingly notifying businesses, households and markets that crisis-related monetary support will soon be withdrawn

“The ZAR does not suffer from a high inflation to the same degree as many other high-yielding EM currencies. Inflation is trending upward but the move is moderate, with annual CPI staying in the SARB’s target range of 3-6%,” says Murat Toprak, head of CEEMEA FX strategy at HSBC.

“The SARB is not completely hands-off as it started a gradual policy tightening. We believe the combination of relatively contained inflation and prudent tightening is ZAR-supportive,” HSBC’s Toprak and colleagues said when setting out their “neutral outlook” for the Rand in February.

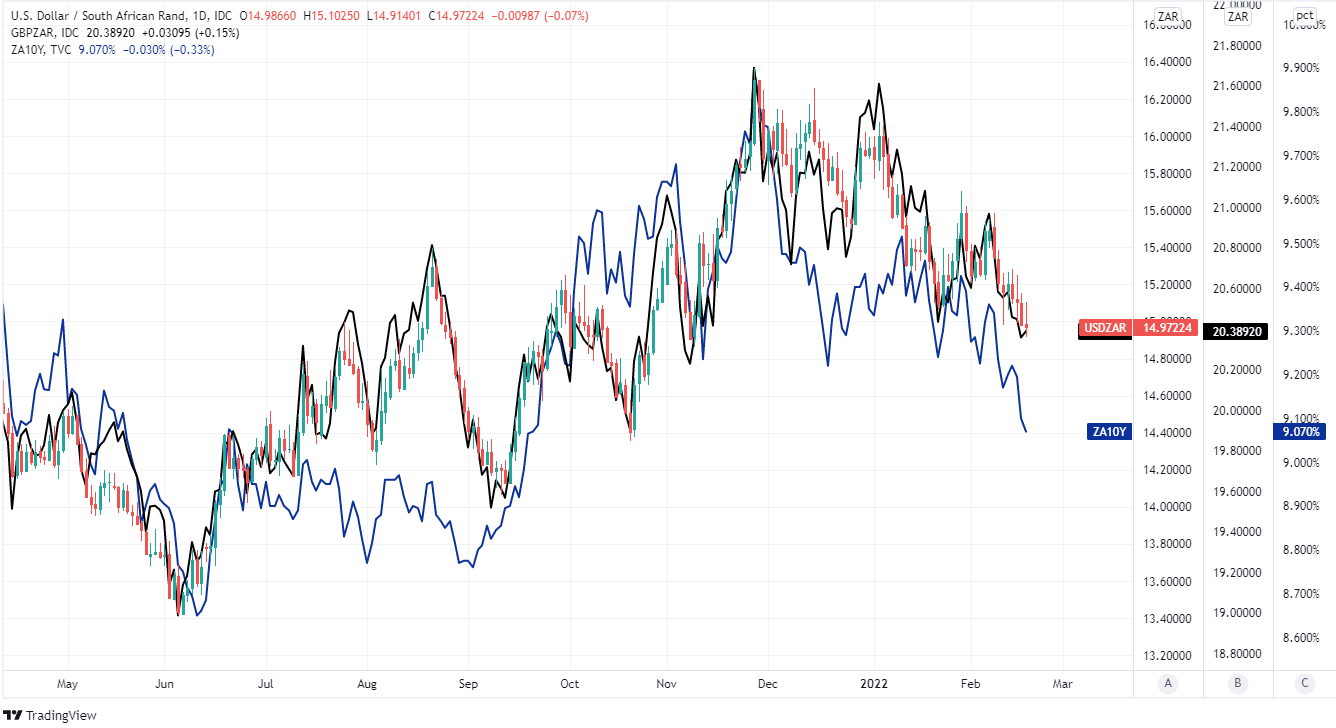

Above: USD/ZAR shown at daily intervals alongside GBP/ZAR (black) and 10-year South African Government bond yield (blue).

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

In other parts of the world where inflation rates are high and rising, it’s often the case that government bond investments offer negative returns to investors after inflation has been taken into account, and increasingly so in recent times.

However, the reverse is true when it comes to South African government bonds.

“Offshore investors continue to see value in our bond market, especially as our local inflation “problem” would appear less severe than the rest of the world, particularly amongst the emerging market peers competing for these flows,” says Deon Kohlmeyer, a trader at Rand Merchant Bank, writing in a market commentary on Wednesday.

Demand for South African government bonds has been helpful to the Rand in recent times alongside strong commodity prices, which have a favourable impact on the country's export income, its trade balance and Treasury’s tax receipts.

“This has counterbalanced quite a bit of the negative drag from the rapid US monetary policy normalisation process under way,” Investec's Bishop wrote in a note to clients this week.

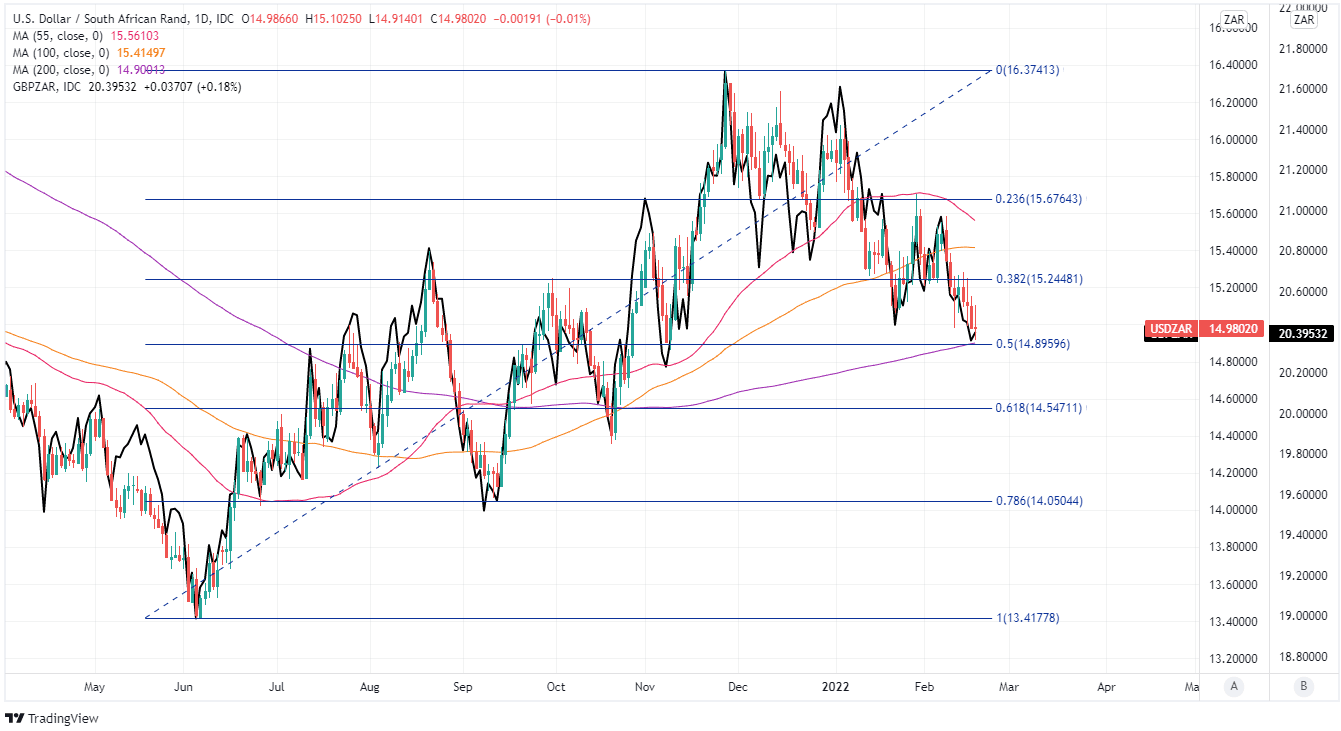

Above: USD/ZAR shown at daily intervals alongside GBP/ZAR, and with Fibonacci retracements of June 2021 rally indicating likely areas of technical support for USD/ZAR. Selected moving-averages denote possible support and resistances for USD/ZAR.

This week’s rally means both USD/ZAR and GBP/ZAR have reversed exactly half of the uptrends engineered by last June’s landmark policy decision from the Fed, which was the first signal that a now underway withdrawal of its crisis-inspired monetary stimulus had entered the pipeline.

Both GBP/ZAR and USD/ZAR were more than five percent lower for 2022 on Thursday and were testing important levels of technical support on the charts, despite a market environment where expectations for U.S. and other central bank interest rates have become ever more ‘hawkish” of late.

“We believe the ZAR’s resilience to external headwinds should persist,” says HSBC’s Toprak. “We are expecting South Africa’s external position to display some resilience thanks to supportive commodity prices. The trade surplus remains sizeable enough to avoid any significant FX depreciation.”

Market expectations for U.S. interest rates have shifted aggressively in the weeks since inflation was reported to have reached a four-decade high for January and after the latest payroll figures suggested the labour market went from strength-to-strength in January, which saw overnight-indexed-swap pricing evolve to imply a high probability that as many as six interest rate rises could now be announced by the Fed in 2022.

This is exactly the kind of market development that might typically have led to heavy losses for the Rand in the absence of this year’s strength in commodity prices and recently subdue levels of South African inflation.