South African Rand Boosted by Broadening Commodity Recovery

- Written by: James Skinner

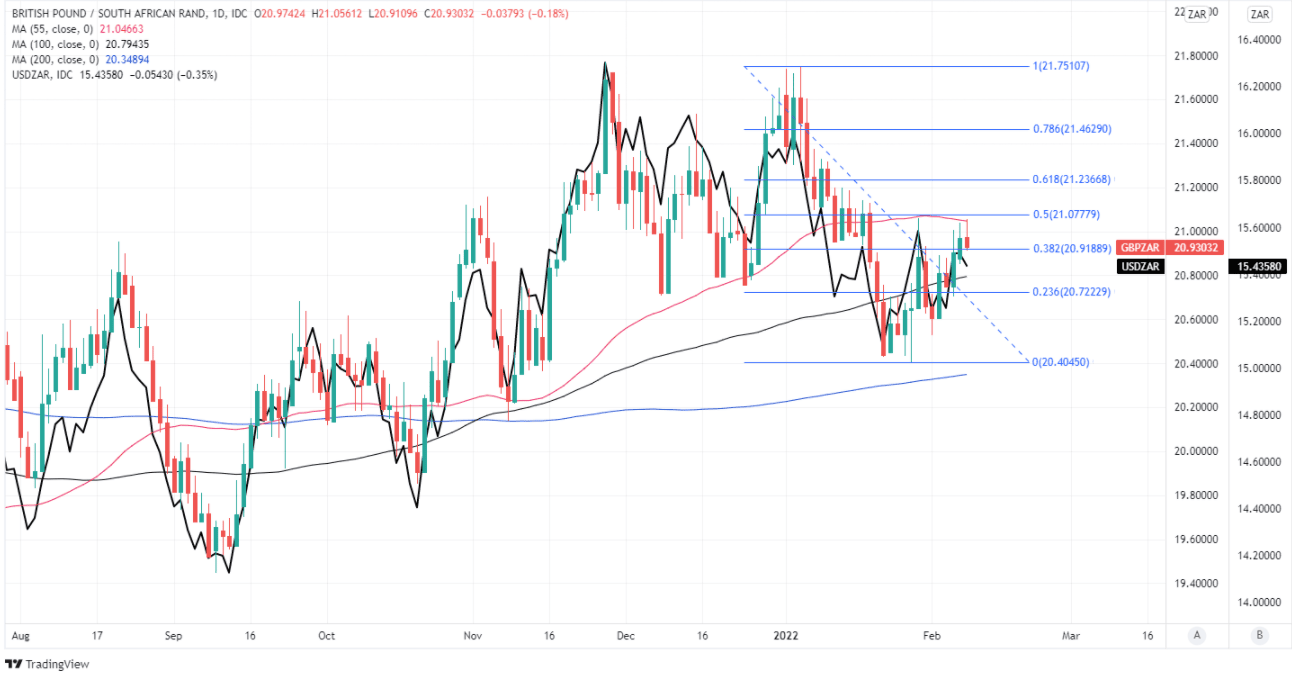

- GBP/ZAR in retreat following probe above 21.00

- Chart resistance obstructs between 21.04, 21.07

- With USD/ZAR slippage weighing ahead of SONA

- Commodities support ZAR as U.S. CPI poses risk

Image © Adobe Stock

The Pound to Rand exchange rate’s attempted recovery of the 21.0 handle was frustrated early in the new week and could be followed by a modest setback over the coming days if recent gains in commodity prices continue to push the USD/ZAR exchange rate lower.

Sterling’s Monday foray above 21.0 stalled around GBP/ZAR’s 55-day moving-average at 21.0466, which is reinforced as a technical resistance level by the nearby 50% Fibonacci retracement of Sterling’s January decline around 21.0777.

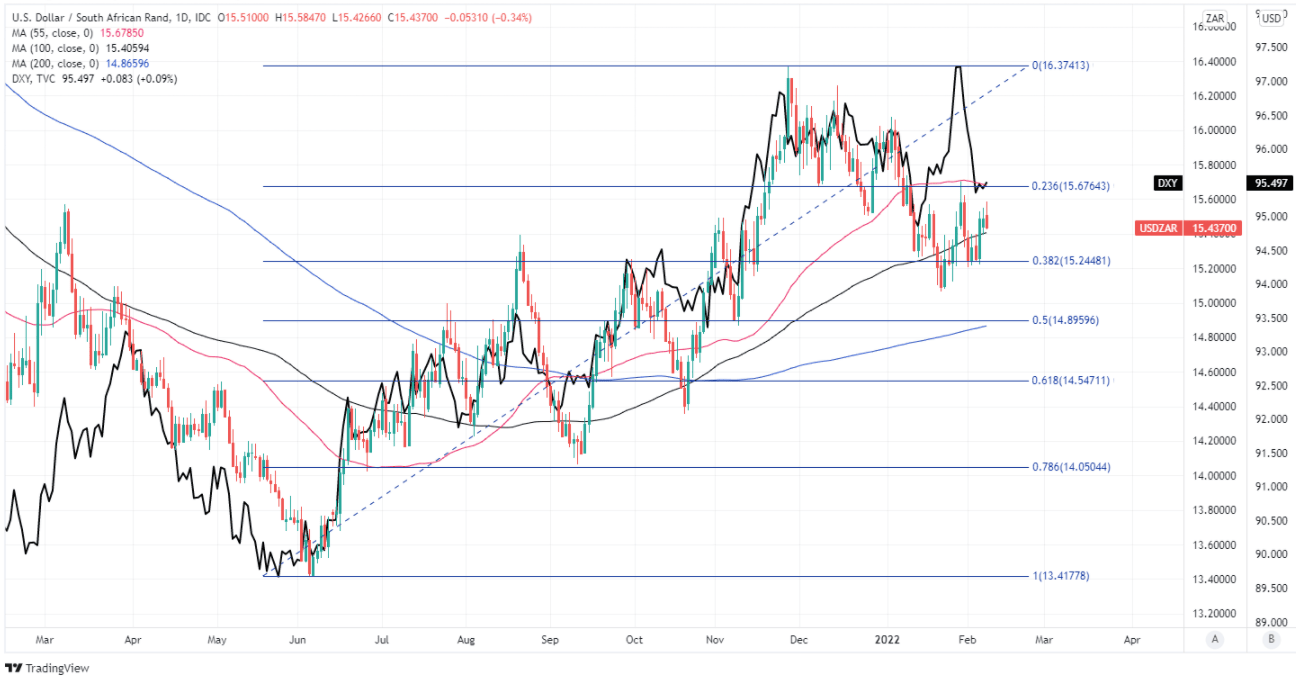

GBP/ZAR topped out before beating a retreat around the same time as the all-important and highly influential USD/ZAR exchange rate, which resumed its 2022 decline on Tuesday following a short-lived rally late last week.

“ZAR's recent good performance is very well linked to the recovery in its commodity ToT [terms of trade]. We were initially inclined to dismiss the ToT recovery as narrowly based in iron ore and coal, but the commodity strength has now broadened. Without a strong view on SA’s ToT from current levels and no clear misvaluation signal or positioning signal, we close our UW [underweight] in ZAR,” says Meera Chandan, an FX strategist at J.P. Morgan.

Above: GBP/ZAR shown at daily intervals alongside USD/ZAR. Fibonacci retracements of January decline indicate likely areas of technical resistance to a GBP/ZAR recovery. Major moving-averages indicate possible support and resistances for GBP/ZAR.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“We have in the past had very good success fading the extremes in our EM FX risk appetite index via USDZAR, but this measure is currently neutral. ZAR is also broadly fair in our BEER FV [fair value] framework. Hence for now, we prefer to stay on the sidelines,” Chandan also said this Monday.

Tuesday’s declines in USD/ZAR and GBP/ZAR continue a new year trend that many analysts attribute to recent gains in commodity prices, and which has recently prompted the strategy team at J.P. Morgan to abandon wagers against the Rand.

“South Africa is a key commodity exporter, particularly of metals such as iron and other ores, platinum, gold and also of ferro alloys and coal and agricultural prices have also seen substantial increases, and so SA’s exports have been boosted by these price rises,” says Annabel Bishop, chief economist at Investec.

Precious metals like Platinum and Palladium and industrial metals like iron ore opened the year with strong gains during January in price action that likely had a favourable impact on South Africa’s trade and current account balances while also contributing increased tax revenue to national treasury.

- GBP/ZAR reference rates at publication:

Spot: 20.94 - High street bank rates (indicative): 20.17-20.31

- Payment specialist rates (indicative): 20.71-20.79

- Find out about specialist rates, here

- Set up an exchange rate alert, here

These are all typically supportive influences for the Rand, which has risen strongly against the Dollar thus far in 2022 despite the greenback itself posting gains over many other major currencies along the way.

“The recent gain in commodity prices has provided some support for the domestic currency but global PMIs have softened in SA’s key trading partners’ while supply chain disruptions and shortages persist, with the rand expected to be limited for substantial strength in H1.22,” Investec’s Bishop wrote in a Monday note to clients.

The resulting fall in USD/ZAR has weighed heavily on the Pound to Rand exchange rate, which tends to closely reflect the combined performance of USD/ZAR and GBP/USD, despite Sterling also advancing against many major currencies in response to the Bank of England (BoE) interest rate outlook.

This week’s rebound by the Rand comes ahead of Thursday’s State of the Nation Address from President Cyril Ramaphosa, which will be watched closely by domestic and international investors.

Above: USD/ZAR shown at daily intervals alongside U.S. Dollar Index. Fibonacci retracements of June 2021 rally indicate likely areas of technical support for USD/ZAR. Major moving-averages indicate possible support and resistances for USD/ZAR.

“This will be an important message to the South African population and local and offshore investors who will want to gauge how the president and his government plan to tackle an increasingly difficult policy environment in which the fiscus is under pressure, unemployment is at a record high and growth is returning to a pattern of stagnation as the effects of the pandemic fade,” says Siobhan Redford, a macroeconomist at Rand Merchant Bank.

GBP/ZAR often demonstrates a positive correlation with USD/ZAR and so for this reason would likely be at risk of a further modest setback this week if USD/ZAR continues to beat a retreat from last week’s highs.

However, much depends on Wednesday’s U.S. inflation figures for January and the market’s response to them as the data could potentially fuel increases in American government bond yields as well as the rally in the U.S. Dollar.

“The US inflation report this week could lead to more market volatility. A reading north of 7%, the highest since the early 1980s, is expected,” says Walter de Wet, a fixed income and currency strategist at Nedbank CIB.

“The rand appears vulnerable to further depreciation against the current global backdrop; the short-term objective is around the 15,7000 level,” de Wet warned in a Tuesday market commentary.