Lira Collapse Could Trigger EM Contagion

- Written by: Gary Howes

Image sourced Flickr, credit: Astro medya Org. Ltd. ŞTİ. Licensing: CC 2.0.

A record low in the Lira could spell weakness in other Emerging Market currencies.

The Turkish Lira plunged to a record low following the arrest of Turkey's most prominent opposition politician.

Police have detained Istanbul mayor Ekrem İmamoğlu, who is likely to be the main political challenger to President Recep Tayyip Erdoğan in the next election in 2028.

The arrest comes under the guise of an investigation into alleged terrorism links and corruption.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The opposition Republican People's Party was set to name İmamoğlu as its presidential candidate on Sunday ahead of elections due in 2028.

For investors, the arrest signifies a significant step toward authoritarianism by Turkey. "The opposition crackdown comes at a time where autocrats around the world feel empowered by the current makeover in Washington," says a market note from KBC Bank.

For foreign exchange markets in particular, the Lira's fall could have profound implications, with analysts seeing potential contagion risks.

"The Turkish Lira sell-off could be a catalyst for major contagion to the rest of EM. In 2018, as the U.S. - China tariff fight was escalating, idiosyncratic blow-ups in Argentina and Turkey combined to pull the rest of EM into a nasty sell-off by mid-2018," says Robin Brooks, Senior Fellow at The Brookings Institute.

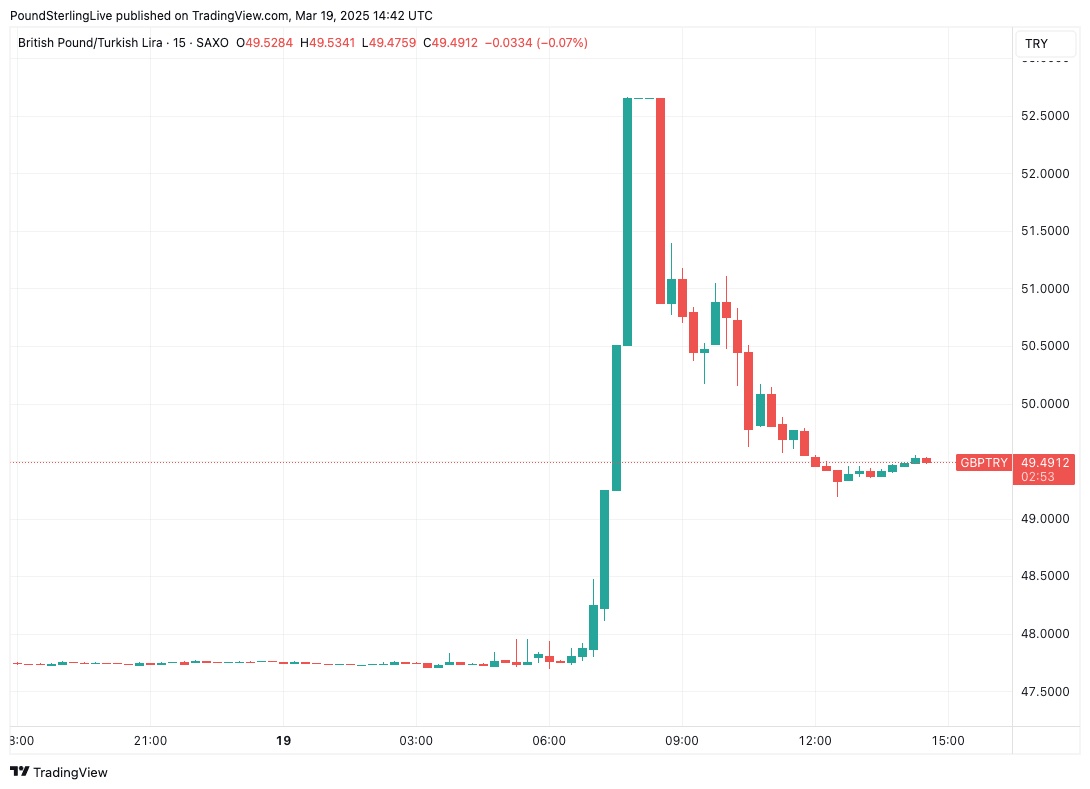

The Pound-to-Lira surged by as much as 10% earlier in the day to 52.67, but has since retraced about half of that gain to quote at 45.50. The Dollar-to-Lira went to as high as 40 before paring the gain to 36.68.

Above: The Lira collapses.

"USD/TRY reached highs of 41.2972 after President Erdogan’s main rival, Ekrem Imamoglu, was detained, sparking political instability concerns. Price action was partially pulled back after the government intervened," says Sarah Ying, an analyst at CIBC.

Authorities are said to have sold about $8BN worth of foreign currencies to support the lira, with the Treasury and Finance Minister also attempting to reassure investors.

Analysts at HSBC warn that the TRY will struggle to recoup losses and will likely trend lower from here.

"The recent developments have made the TRY’s outlook much more uncertain, with the risk of more depreciation in the upcoming period," says Murat Toprak, CEEMEA FX Strategist at HSBC.

He explains that there are two main risks for the TRY in the medium term:

1) Turkish businesses and households start to 'dollarise', i.e. store foreign currencies, which sets off a cycle of TRY weakness

2) The sustainability of the current FX policy of supporting real FX appreciation is compromised.