South African Rand Usually Weakens in the 3rd Quarter

- Written by: Gary Howes

- GBP/ZAR up a further 0.44%

- Q3 traditionally associated with ZAR weakness

- But some strategists back more ZAR strength ahead

President Cyril Ramaphosa addresses nation on developments in South Africa’s risk-adjusted strategy to manage the spread of Coronavirus COVID-19 [Photo: GCIS].

- GBP/ZAR reference rates at publication:

- Spot: 19.86

- Bank transfer rates (indicative guide): 19.17-19.31

- Transfer specialist rates (indicative): 19.68-19.72

- Get a specialist rate quote, here

- Set up an exchange rate alert, here

The South African Rand is entering a time of the year that is traditionally associated with weakness, however some analysts are saying that following a month of losses the prospects for a rebound are growing.

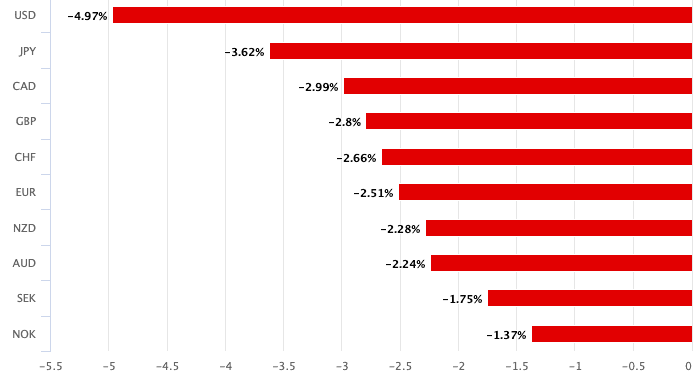

The Rand has fallen against all the world's major currencies over the course of the past month, having endured a stellar first half to 2021.

The Pound-to-Rand rate has lost a further 0.40% at the start of the new week to trade at 19.72 while the Dollar-Rand rate has risen a third of a percent to 14.24.

Losses for the South African currency come as the country faces a notable rise in Covid-19 infections which could prove a headwind to domestic activity, while developments at the U.S. Federal Reserve have provided a source of global selling pressures.

Above: Rand performance over the past month

"The Fed’s hawkish policy surprise has clearly triggered a sharp reversal of long ZAR positions," says Derek Halpenny, Head of Research, Global Markets EMEA at MUFG.

The U.S. Dollar rose as markets brought forward the moment they expected the Fed to raise interest rates into 2023, following the Fed's June policy briefing.

The shift in expectation meant the yield paid on U.S. bonds rose, simultaneously reducing the attractiveness of South Africa's high yielding bonds.

South Africa's high yielding bonds are a traditional source of support for the Rand, and therefore developments concerning Fed policy have proven detrimental to investor demand for this asset.

But, Martin Miller, a Reuters market analyst points out that another headwind must be considered when approaching the Rand over coming weeks: seasonality.

"Typical seasonal rand weakness, growing U.S. dollar demand and a constructive USD/ZAR monthly chart point to gains in the third quarter," says Miller.

Seasonal analysis of the Rand's third-quarter performance since 2000 against the Dollar shows it has fallen in 14 of the past 21 years.

"Seasonality should not be considered in isolation, but it's a useful tool combined with other factors," says Miller.

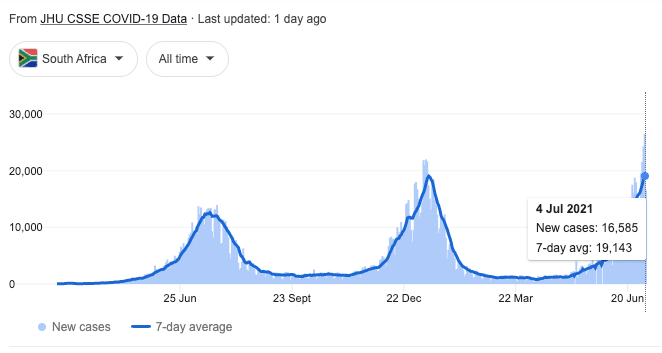

The Rand's traditional seasonal struggles in 2021 come as the country battles a third wave of coronavirus infections, a development tipped to compromise domestic economic output via restrictions as well as through diminished consumer and business confidence.

News reports say the health system in Johannesburg is being overwhelmed by a massive wave of infections driven by the Delta variant, the winter in the southern hemisphere and a faltering vaccine campaign.

In the face of rising infections President Cyril Ramaphosa last week imposed a two-week ban on all gatherings, indoors and outdoors, along with the sale of alcohol and travel to or from the worst hit areas of the country, such as Gauteng, its most populous and economically productive province.

An extended curfew was also imposed, and schools shut early for holidays.

But foreign exchange strategists at investment bank Société Générale are looking through the near-term pressures and are backing the Rand to maintain its 2021 outperformance over coming months.

"The ZAR will continue to benefit from very favourable terms of trade and improving market risk sentiment," says Phoenix Kalen, Strategist at Soc Gen.

In a mid-year foreign exchange research and strategy briefing to clients Soc Gen say more gains for the Rand lie ahead.

"South Africa’s narrative has improved considerably in the past several months and we believe the ZAR will see further gains in the near future. The ZAR will continue to benefit from the global economic recovery, elevated metals and mineral commodity prices, and favourable market risk sentiment," says Kalen.

The analyst notes South Africa's current account is set to remain in surplus despite the domestic economic recovery and higher imports.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Also backing the Rand to rediscover its sparkle are MUFG who tell clients in a weekly currency briefing there is now room for the South African Rand to rebound following the heavy sell off seen over the duration of the past month.

"After such a sharp correction lower the ZAR now appears more attractively valued," says Halpenny.

MUFG hold an assumption for U.S. rate hike expectations to begin easing following the recent period of excitement, rather than continue to escalate further.

"There has already been a marked hawkish repricing of rate hike expectations into 2022 which sets a higher bar for positive surprises going forward," says Halpenny.

Indeed, the reaction by markets to the June U.S. employment report suggests the economy must significantly accelerate from current levels to materially shift the dial on Fed expectations.

As such, a good portion of the weakness in ZAR derived from issues concerning the Fed might now already be absorbed into existing exchange rates.

"The ZAR should begin to rebound following the heavy sell off as Fed rate hike

fears begin to ease," says Halpenny.

MUFG observe the positive fundamentals that have led to Rand strength for most of this year including favourable South African interest rates, improving terms of trade and improving investor risk sentiment remain in place.

"The SARB is also moving closer to raising rates in 2H of this year," says Halpenny.