Pound Recovers against the Dollar on U.S. Jobs Data Which Showed the Unemployment Rate Actually Rose in June

- Written by: Gary Howes

The British Pound recovered some lost ground against its U.S. Dollar ahead of the weekend following the release of the monthly U.S. jobs report which delivered just enough contradictions to calm Federal Reserve rate hike expectations.

The Pound-to-Dollar exchange rate (GBP/USD) rose to 1.3775 in the wake of the release that showed that while the economy created more jobs the unemployment rate actually increased.

The market's reaction was largely muted on longer-term timeframes, but a shorter-term timeframe does show the Dollar was certainly sold, allowing GBP/USD to overturn earlier losses:

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

According to the BLS, 850k non-farm jobs were created in June against the 700k that the market had expected and up on the 559k created in May.

This beat was however somewhat overshadowed by the unemployment rate rising to 5.9%, a disappointment for a market that was expecting a fall to 5.7% from May's 5.8%.

"Muted reaction in FX markets suggests this NFP beat was priced. Think the unemployment rate higher will mask the positive job gains," says Viraj Patel, Global Macro Strategist at Vanda Research.

"But broadly we may get some profit-taking on long USD positions," he adds.

The largest contributor to the increase in jobs came from those sectors that continue to open up thanks to a retreat of the coronavirus, the leisure and hospitality sector added 343K jobs while retail added 67K.

"At face value, the upwards surprise to June’s net employment data and the revision higher in May’s employment data are positive for the US labour market. Given these developments, one would expect the dollar to firm as the US economy adds jobs at a faster rate," says Simon Harvey, Senior FX Market Analyst at Monex Europe. "However, the higher net employment data didn’t translate into a faster recovery in the labour market - which is essential under the Fed’s criteria for normalising policys."

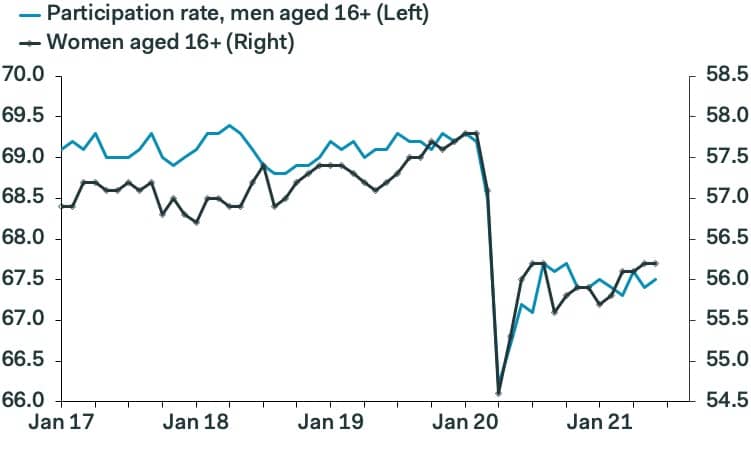

Image courtesy of Pantheon Macroeconomics.

"Overall, this report signals incremental progress in the pace of job growth, but there’s no sign yet of a shift back into the labor force. The missing millions are still missing," says Ian Shepherdson, Chief Economist at Pantheon Macroeconomics.

Traders will be digesting the jobs report in the context of what it means for Federal Reserve (Fed) policy; does it bring forward the timing of the first rate rise, or does it push it back?

The general rule of thumb is when that pricing is coming forward thanks to strong data the Dollar appreciates, and the opposite is true on weaker data.

James Bentley, Director of Financial Markets Online, explains that the rising unemployment rate, that comes despite more jobs being created, could in fact be a positive development.

"A notching up of the unemployment rate that reveals lots of people are returning to the labour market, giving employers more scope to keep hiring in coming months," he explains.

The July non-farm payroll release is ultimately consistent with the market's current pricing for a 2023 lift-off, therefore it is not necessarily consistent with any major shift in Dollar performance.

Patel says the Fed is still on target to normalise policy ahead of other central banks and it is therefore "hard to be short USD ahead of this".

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"In short, these data shouldn’t change anyone’s mind. The key question for the Fed and markets - how many people will come back into the labor force, easing the acute labor supply constraints - cannot be answered until well into the fall," says Shepherdson.

Wage data is another element of the report likely to keep the Fed patient as average hourly earnings rose 3.6% year-on-year to June, which is a shade below the 3.7% the market was looking for.

Bentley says even though U.S. consumer inflation has hit 5%, "the lack of wage pressure will muzzle the Fed’s hawks and punt the prospect of an interest rate hike into the long grass."

Hinesh Patel, portfolio manager at Quilter Investors has taken a closer look at the data and uncovers some concerning elements of the report, which might explain some of the Dollar's declines.

“Dig a little deeper and cause for concern remains. After two months the headline number is finally trending in the right direction, but the unemployment rate has climbed higher to 5.9%. Hours worked is also down and this is bad news for the recovery as it means incomes are being hit at the exact time the government wants people out spending," says Hinesh Patel.

He adds that the data is currently just too noisy to interpret and as such he believes the Fed will continue resisting calls to speed up its policy tightening.

Such an outcome, if correct, could be reflected in some softening in the Dollar moving forward.