South African Rand: SARB to Cut Interest Rates Twice say Standard Bank

- SARB tipped to cut rates twice in 2020

- Could undermine support for ZAR

- However SARB say won't be rushed into a decision

Above: File image of Lesetja Kganyago. Image © GovernmentZA.

- GBP/ZAR spot: 19.75, +0.55%

- Bank transfer rates (indicative): 19.06-19.20

- FX specialist transfer rates (indicative): 19.30-19.60 >> More information

One of the world's worst performing currency of the past month has been the South African Rand, and a potential series of interest rate cuts at the South African Reserve Bank could ensure that downside pressure remains a feature going forward.

Economists at South African lender Standard Bank have told clients they are now forecasting two interest rate cuts at the SARB in 2020, as part of a global response by central bankers to the coronavirus outbreak.

"The Fed’s prompt policy response should mitigate the adverse growth impact through supporting asset prices and stimulating credit; global central banks will likely follow suit, as will the SARB," says Thanda Sithole at Standard Bank:

When central banks cut interest rates, the currency they issue tends to decline in value. South Africa's high interest rates are a mainstay of support for the currency as global investors send billions of dollars worth of capital into South Africa each year to take advantage of the high yield on offer.

Remove this advantage - via interest rate cuts - and a further pillar of support for the currency is removed. South Africa's main REPO rate currently stands at 6.25%, which offers a substantial yield to investors when we consider the ECB has rates set at -0.5%, the Bank of England at 0.75% and the U.S. Federal Reserve now targets a band of 1.00-1.25% following Tuesday's emergency interest rate cut.

The Pound-to-Rand exchange rate is currently trading at 19.70, but had spiked above 20.00 last week and the trend does appear to favour further gains by Sterling. The Dollar-to-Rand exchange rate meanwhile quotes at 15.30, the pair had gone to 15.89 on March 02 before settling lower amidst a broad-based ZAR recovery.

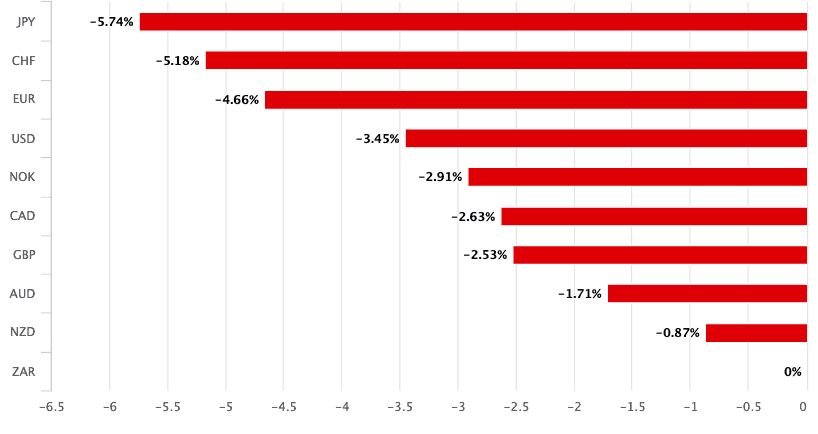

Above: ZAR has lost ground against all the world's major currencies over the course of the past month.

Driving the recent improvement in ZAR performance was the decision by the U.S. Federal Reserve to cut interest rates by a sizeable 50 basis points on Tuesday, joining other global central banks in an effort to increase the supply of money into the global economy as economic activity slows in response to the coronavirus outbreak.

Standard Bank's G10 strategist Steve Barrow foresees another interest rate cut at the Fed in April.

"The viral spread further threatens SA growth due to disruptions to both supply chain and trade links with China and other global economies. Indeed, SA’s already protracted economic weakness in goods-producing sectors is now spilling over to the private services sectors," says Sithole.

Caixin said on Monday that China's manufacturing purchasing managers index (PMI) sank to 40.3 in February, down from January's 51.1 and the lowest reading since the survey began in 2004.

It was also well below the 45.7 that analysts polled by Reuters expected.

"This naturally calls for the SARB to cut rates, and we now foresee two cuts this year, from one before, after the Moody’s rating review in March when a downgrade to junk on 27 March seems likely," says Sithole.

However, Nema Ramkhelawan-Bhana, Economist at Rand Merchant Bank, says "the SARB is not to be swayed that easily."

"The Governor is adamant that there is no need for an emergency meeting and that any changes to the policy rate, prompted by its assessment of risks to the economy, will be communicated at its gathering in two weeks’ time," says Ramkhelawan-Bhana.

SARB Governor Lesetja Kganyago said there is no need for an emergency meeting on interest rates and they will instead wait for its regular gathering on March 19 to announce a policy decision.

“One policy tool that we don’t have is panic... We have a Monetary Policy Committee meeting scheduled for later this month and we will then assess all the information and make a decision based on that data,” said Kganyago.

Calls for the SARB to cut rates have increased this week after data on March 3 showing the economy slumped into a recession in the fourth quarter. The economy shrank -0.5% last quarter when markets were looking for only a 0.1% decline, which made for an annualised contraction of -1.4%.

"Following Tuesday’s dismal fourth quarter 2019 GDP print, there is rising consensus that a cut is in order on 19 March, though the magnitude remains uncertain," says Ramkhelawan-Bhana.

Money markets show investors are pricing in two cuts to have been delivered in eight months’ time, though the SARB is largely unphased by market estimates and remains true to its mandate.

"While we believe that a cut is in the offing this month, we remain firm that monetary policy cannot be held solely accountable for resuscitating the economy," says Ramkhelawan-Bhana.

Calls for thorough policy reform in South African continue to grow with the finance minister Tito Mboweni and Kganyago arguing only reform can resuscitated the domestic economy.

Tuesday's GDP has come close to eliminating any remaining hope of South Africa being able to retain its 'investment grade' credit rating given that a shrinking economy will automatically increase the already-too-high debt-to-GDP ratio and could put upward pressure on the budget deficit.

Both the deficit and debt ratio are already at levels that rating agencies find objectionable and the economic contraction may not be over yet.

Moody's, the last agency to still have South Africa as an 'investment grade' borrower, is expected to announce its next decision on March 27 and if the rating is cut to 'junk' then it could trigger outflows from the Rand because some fund managers who already hold South African bonds would automatically be prevented from owning them. In other words, some fund managers could be forced to sell their bonds.

"EM currencies benefited significantly from the Fed's rate cut and the G7 signal for a common fight against the Covid-19 virus. But before that, disappointing data on South Africa's gross domestic product (GDP) caused ZAR losses," says Elisabeth Andreae, an analyst at Commerzbank. "The South African economy shrank surprisingly sharply in the final quarter of 2019, sliding into recession. The outlook is far from rosy, especially with regard to Moody's rating review at the end of March. With global risk-off sentiment the rand is at least temporarily at risk of more pronounced losses than we have outlined so far."