South African Rand Dives after October Budget Tips Huge Rise in Debt Up Ahead

- Written by: James Skinner

Image © Government of South Africa. reproduced under CC licensing

- ZAR slides after budget figures shock nervous market.

- Deficit rises above 6% of GDP on more Eskom bailouts.

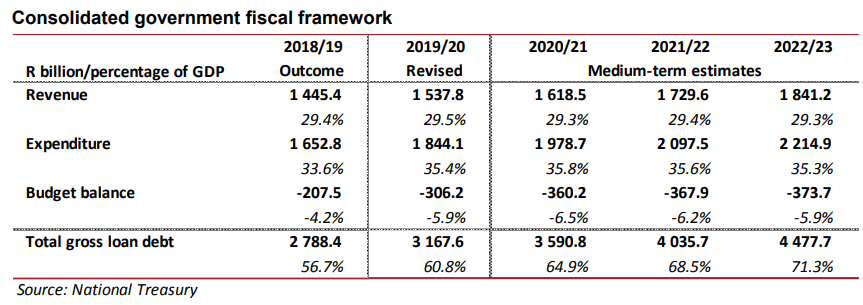

- Debt-to-GDP through 60%, seen at 70% before 2022/2023.

- And Mboweni offers no answers or clues on turnaround.

- Just days ahead of latest Moody's credit rating decision.

The Rand slumped Wednesday after Finance Minister Tito Mboweni shocked the market with a mid-year budget update that showed South Africa's deficit rising sharply this year, which is set to fuel a meteoric rise in the national debt over coming years, just days ahead of Moody's next credit rating review.

Finance Minister Mboweni slashed forecasts for South Africa's economy Wednesday, raised projections for government spending and lifted estimates of national debt as a percentage of GDP over the coming years, which was almost the polar opposite of what markets would have liked to see. The update has put Moody's, the last agency to still rate South Africa an 'investment grade' prospect, in a difficult position ahead of its next decision on Friday afternoon.

South Africa's budget deficit is now expected to hit 5.9% of GDP this year, up sharply from the 4.5% envisaged back in February, and is forecast to hit 6.5% in 2020. Meanwhile, debt-to-GDP is seen rising above 60% this year and hitting 70% before the end of 2022, as a result of additional spending that is partly down to a weak economy, but largely due to bailouts of the failing utility Eskom as well as other state-owned firms.

Above: Selected South African government budget statistics.

Mboweni says the higher expenditure projections that contributed to the increased deficit and debt projections were the result of R26 bn in new financial support for Eskom, some R11 bn for other state-owned companies and R430 mn for infrastructure spending. The finance minister also floated the prospect of "debt relief" for Eskom but said the size of any package is yet to be determined.

Taxpayers are on the hook for around R350 bn of Eskom's R450 bn debt, which the company is unable to service due to the sheer scale of the liability as well as years of underinvesment that are now hampering its ability to generate sufficient revenue. Moody's has criticised the government for repeated failures to stem the increase in the deficit and has said many times that fixing the cash-burning stable of state-owned companies is crucial to South Africa's credit worthiness.

"With Moody’s worst case scenario including a debt-to-GDP level of 70% including Eskom debt, this announcement marked a significant increase in the likelihood of a profile change by the credit agency on Friday – although we still believe a downgrade to junk is a tail risk. The inevitability of an outlook downgrade was priced into both the rand and bond yields upon announcement, however, with the rand falling nearly 2% against both the US dollar and euro," says Simon Harvey, an analyst at Monex Europe.

Above: USD/ZAR rate shown a 4-hour intervals, alngside Pound-to-Rand rate (orange line, left axis).

"Savings from the compensation measures announced in the Budget have not materialised as expected. Thus, in total, non-interest spending rises by R23 billion this year, relative to the February estimate. If we exclude Eskom, non-interest spending would have been R2.9 billion less than projected. The consolidated budget deficit is now projected at 5.9 per cent of GDP in the current year. This year, the national debt exceeded R3 trillion. It is expected to rise to R4.5 trillion in the next three years. Clearly, we need to do things differently," Mboweni told the South African parliament.

The government said in February the deficit would likely be around 4.5% of GDP this year and 4.3% the following year, which was already bad enough for the ratings agencies, but since then the economy has struggled more than was previously envisaged and the national electricity monopoly that is Eskom, perenially close to death's door, has required further cash bailouts that are expected to total around Rs59 bn over two years.

Plans for fiixing Eskom, which were unveiled by Public Enterprises Minister Pravin Gordhan on Tuesday, left the market disappointed. And Mboweni, although reiterating familiar aspirations of structural economic reforms, gave few details on Wednesday of any that might be expected to improve the public finances and economic outlook in the years ahead. The absence of a detailed and credible plan for improvement could now be testing Moody's patience.

"A horrible revision to fiscal targets has led to a sharp ZAR sell-off. The debt trajectory now peaks at over 80% of GDP from 60.2% previously. Crucially, it does not achieve convergence over the forecast horizon. This puts South Africa's debt sustainability in grave peril," says Cristian Maggio, head of emerging markets strategy at TD Securities. "USDZAR will continue to adjust higher. If Moody's delivers a negative rating action (even not a downgrade), the rand could weaken to 16.50. The curve will also be subject to upside adjustments and any residual expectations of rate cuts should be priced out."

Above: USD/ZAR rate shown a daily intervals, alngside Pound-to-Rand rate (orange line, left axis).

"The Treasury projected the economy won’t expand more than 2% in the coming two-years, further increasing scepticism over the sustainability of elevated gross debt levels," says Monex's Harvey. "A viable solution to the Eskom debacle is needed alongside fiscal reforms and economic stimulus. Without which, expect South African assets to remain under pressure. Upcoming bond sales in November will likely see reduced foreign demand, increasing the likelihood of USDZAR making a sustained break above 15.00."

Moody's still has a positive outlook on the rating, which staff say would likely change before any downgrade to rating is made, but the budget statement could mean at least one of those things changes on Friday.

If the rating is cut then investors who benchmark to the Citi World Government Bond index will no longer be able to hold South African government debt in their portfolios, meaning they will have to sell their existing investments.

That could mean large outflows of foreign capital from South Africa and downward pressure on the Rand because just less than half of the national debt, or around $70 bn, is held by overseas investors.

"I think a detailed plan – in which, for example, the state absorbs a large part of Eskom's ZAR440 bn debt – is what markets will demand in order to move on. While this would be ideal, locals have highlighted the ideological differences between Public Enterprises Minister Pravin Gordhan and South African Finance Minister Tito Mboweni in how to fix the problem," says Chrissie Loedolff, a multi-asset class salesperson at UBS.

UBS' Loedolff had tipped the Rand as a sell late last week in anticipation of an adverse reaction from the market to Wednesday's budget. The Swiss bank had said investors were unprepared for the level of fiscal deterioration that was likely, and duly, revealed. UBS strategists also have a bearish outlook for the Rand, although they're by no means alone.

"The 15.50 mark is not a high bar from here, given the circumstances. But if the outlook is changed to negative, we see the rand weakening to around 16.50. This equates to approximately 10% down from current levels. SAGBs and rates are also likely to suffer. Here, long-dated bonds should take the brunt of the correction given the projected increase in government debt. Any monetary easing expectation will also have to be priced out of the curve. This includes our own," says TD's Maggio, in a post-budget briefing to clients.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement