South African Rand Vulnerable to Portfolio Outflows and Slowing Global Backdrop

Image © Adobe Images

- Despite recent recovering in risk appetite risks remain

- ZAR one of the most at risk from capital outflows

- Rand at risk from being overvalued

Analysts at Nordea Markets - the capital markets division of Scandinavian lender Nordea Bank - have warned the South African Rand appears to be overvalued and is increasingly at risk of a turn lower.

A growing vulnerability to a sovereign bond ratings downgrade and the economy's anaemic growth both combine to leave the Rand sensitive to the outflow of foreign investor capital say analysts.

Emerging Market (EM) currencies have made a recovery recently on an improving outlook for global growth due to strengthening relations between U.S. and China, but risks remain, and Nordea are maintaining a “defensive” stance in relation to the EM FX space, which includes the Rand.

"Although EM currencies have generally withstood these uncertainties fairly well lately, the risk of external shocks is currently high. This risk could in turn spill over to capital outflows, lower growth and EM FX volatility,” says Morten Lund, an analyst at Nordea Markets.

Despite the improved mood music over trade, Lund sees 5 main factors likely to drive the Rand and other EM FX lower in November.

These include slower global trade, tightening financial conditions, geopolitical uncertainty, a slowing Chinese economy and lower oil prices.

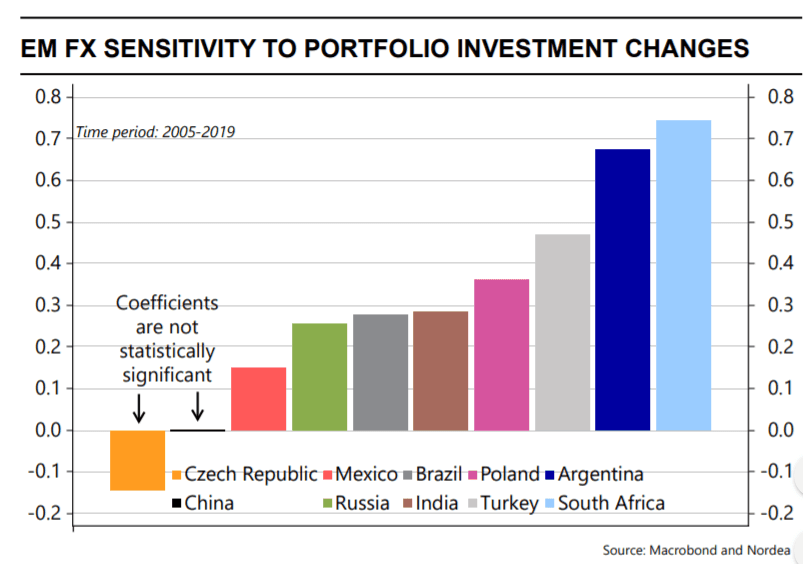

The main reason EM FX but the Rand in particular, is so sensitive to short-term changes in investors sentiment, is because they are hyper sensitive to portfolio flows, and so when the global growth outlook worsens investors tend to pull more rapidly out of stocks and shares.

The Rand has the highest correlation coefficient of any EM currency to portfolio flows.

“As indicated above, the most exposed currencies to capital outflows are the ZAR, ARS and TRY. Generally, economies with dollar dependency and current account deficits are the most vulnerable. For South Africa, for example, the above beta-coefficient (0.74) indicates that if portfolio investments into South Africa increase by USD 1bn, the ZAR will appreciate by 0.74% (all other factors being held constant),” says Lund.

The outlook for portfolio flows is not conducive to a more aggressive stance on the Rand or other EM FX.

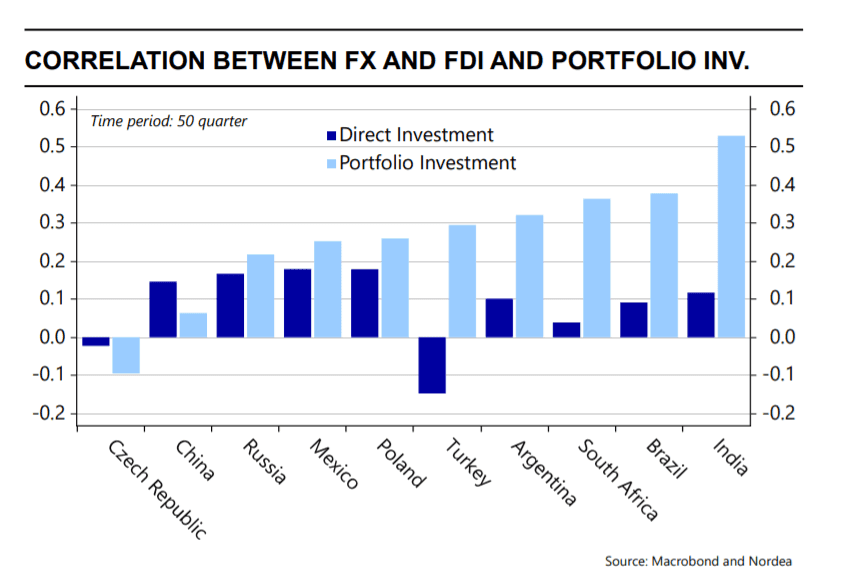

“Looking at the latest trends, portfolio inflows have considerably declined across most EM countries since the end of last year. FDI has also declined somewhat, but so far, it has mostly been concentrated in China – likely due to the trade war,” says Nordea.

Previously it had been thought that there was a higher correlation with foreign direct investment (FDI) but Nordea’s research shows this is not the case and the main driver is portfolio flows.

FDI includes larger investments (defined as more than 10% stake in a company) which normally places investors in long-term relationships with beneficiaries making them less sensitive to the yo-yoing of daily risk dynamics.

“FDI is not statistically significant for 9 out of 10 selected EM currencies. In contrast, portfolio investment variables are significant for 8 out of 10 currencies.”

Further slowing global growth and weakening risk sentiment suggest a defensive stance in the future.

“Overall, we think that the capital flow pattern in the EM space witnessed in 2019 supports our view of a defensive EM stance. Furthermore, the prospects of weakening risk sentiment and slowing growth suggest more monetary and fiscal easing,” says the analyst.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement