Standard Bank Back South African Rand to Overcome Hurdles and Forecast Stronger End to the Year

Image © Pound Sterling Live

- Poor data weighs on ZAR exchange rates

- First-half 2019 seen as problematic for Rand

- Election in May could be turning point into better H2

The South African Rand is being tipped to endure a tough first half to 2019 by one of South Africa's largest lenders, Standard Bank. However. The second half of the year should see the currency stage a decent comeback.

In the short-term, the Rand is vulnerable to economic weakness as economic data continues to undershoot expectations.

“In Q1:2019, both the economy-wide PMI and BER manufacturing PMI declined, indicating likely weaker growth for H1. The economy-wide PMI is a private sector survey covering a much wider sample, ranging from manufacturing, mining, services, construction and retail sectors; the BER PMI is just manufacturing,” says Thanda Sithole, an economist at Standard Bank.

The call comes following the release on Thursday of lower-than-expected mining and manufacturing data, which suggest the economy is on course for a bumpy ride in H1.

Data out on Thursday showed that mining production fell a wapping -7.5% in February, way more than the -3.2% forecast and -3.3% previously. It suggests a step decline in production.

Manufacturing also contracted more than forecast, falling -1.8% compared to -1.4% expected and -2.0% previously.

Gold production in February declined -20.6% from the year before, only marginally slower than the -22.8% previously.

All these metrics support Standard’s pessimistic view of activity in H1 although as the year goes on the economy and currency are expected to rebound based on the imposition of reforms by the Ramaphosa-led ANC government, says Standard Bank.

The travails of national utility Eskom is also expected to continue to weigh, says the economist. Black-outs happen on a weekly basis. They are caused by the companies financial problems because energy is a capital intensive business. The outages will weigh on growth as workers have to down tools during power cuts, affecting productivity and growth.

Recent data has also shown a deeper-than-expected fall in the SACCI (South African Chamber of Commerce Index) to 91.8 from 93.4 previously; the SACCI measures business sentiment.

Growth in Q2 is also expected to be constrained by protests during the election and higher fuel prices. Things are forecast to pick up in H2 but conditional on reforms.

“We’d expect a modest increase in H2:2019, but premised on reforms,” says Sithole.

Comfortable ANC Victory Would Favour a Stronger ZAR into Year-End

The main hurdle on the Rand's domestic horizon is the general election on May 8. Analystys expect ZAR to underperform into the vote, as currency's typically tend to struggle when political uncertainty is on the rise.

Yet, the Rand is expected to rise after the result, provided the ruling party secure a strong mandate for reform.

The current governing ANC party is forecast to win a majority at the election and this should lead to a rebound in the Rand in H2, according to Standard Bank.

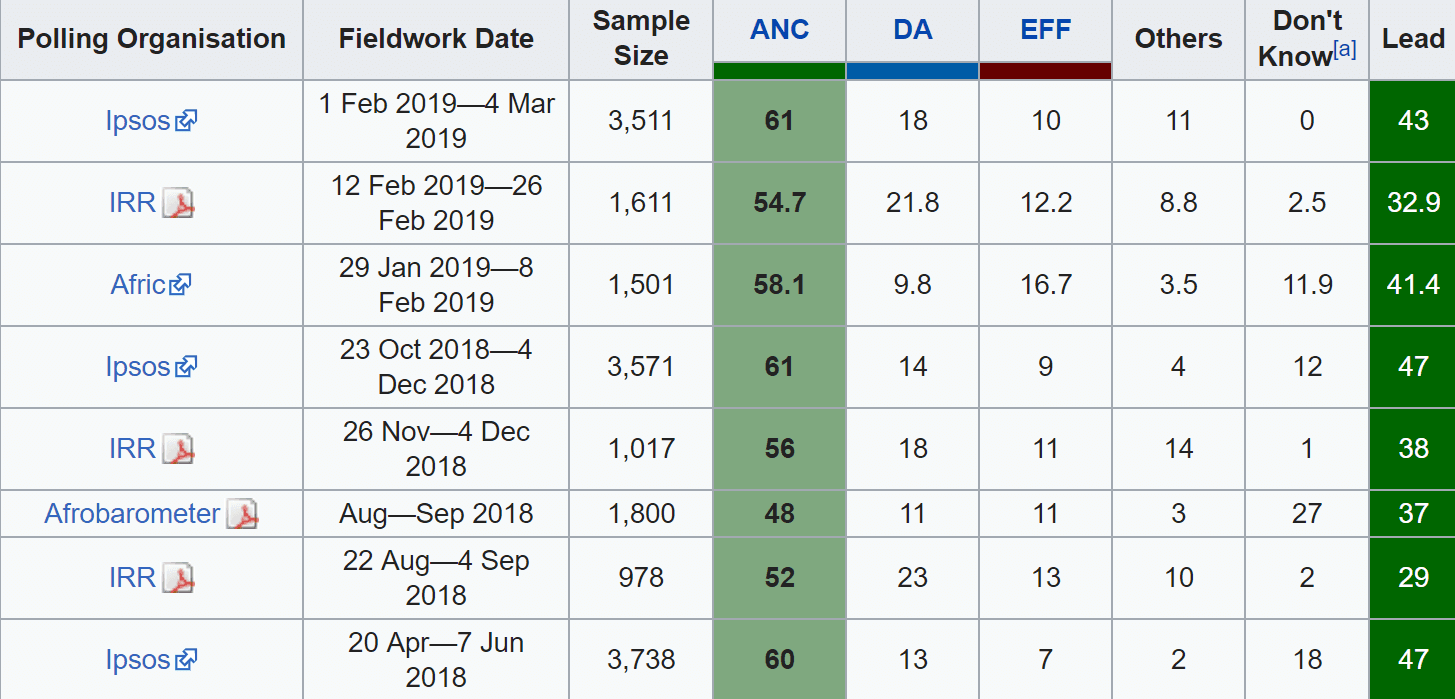

The most recent Ipsos poll showed the ANC party way ahead in the lead with 61 seats and the next largest party the DA (Democratic Alliance) only gaining 18 seats. Even taken as a whole the opposition only won 39 seats.

This shows the ruling party will probably be returned, giving President Ramaphosa the mandate to push through reforms which are seen as a positive for the economy and the currency.

“We expect the Rand to trend sideways until the 8 May 2019 elections, bar any unforeseen shocks. Our political analyst Simon Freemantle foresees the ANC retaining a sufficient majority in elections, enabling President Ramaphosa to drive economic reforms - which should be Rand-supportive,” says Shireen Darmalingam, an economist at Standard Bank.

Standard Bank forecast to the USD/ZAR exchange rate to reach 13.40 by end of 2019.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement