Pound vs. South African Rand Week Ahead: Could Fall into the 17s

Image © Comugnero Silvana, Adobe Stock

- GBP/ZAR has fallen all through September from highs in the 20s

- Studies suggest likely to fall further

- Break below the 50-day MA last week a key bearish rubicon

The Pound has started the week marginally higher versus the Rand but the broader short-term downtrend attaches a bearish bias to the forecast for GBP/ZAR and overall we think the probabilities favour further weakness rather than strength.

The trend during September was almost exclusively 'down', falling from a peak of 20.13 at the start of the month, to this morning's 18.36 lows.

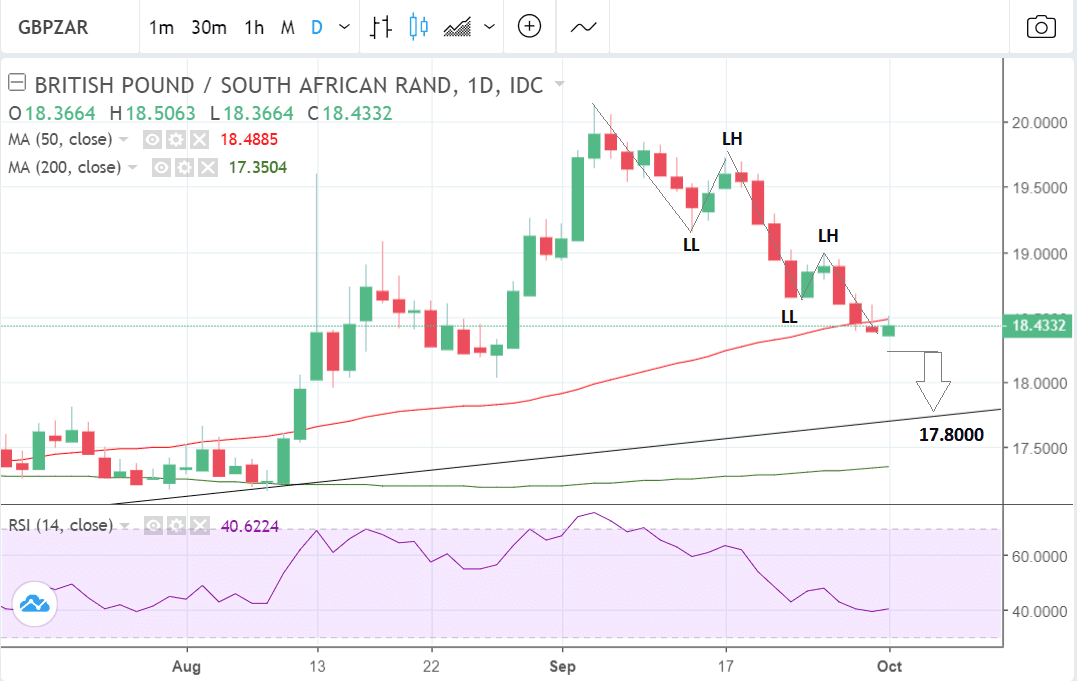

GBP/ZAR is showing a key marker that the trend has flipped. It is showing a new sequence of descending peaks and troughs on the daily chart with two sets of 'lower lows' and 'lower highs', which is one important confirming indicator that the short-term trend has changed.

The exchange rate has broken below the 50-day moving average (MA) at 18.51 on a closing basis and this is another key indicator that the trend is now bearish. Institutional investors often make broad buying and selling decisions based on whether an assets prices are above or below the MA.

The 50-day is now also likely to act as a ceiling blocking any gains at 18.50 and we see this as a key level in the week ahead, which should set a limit on gains for the exchange rate.

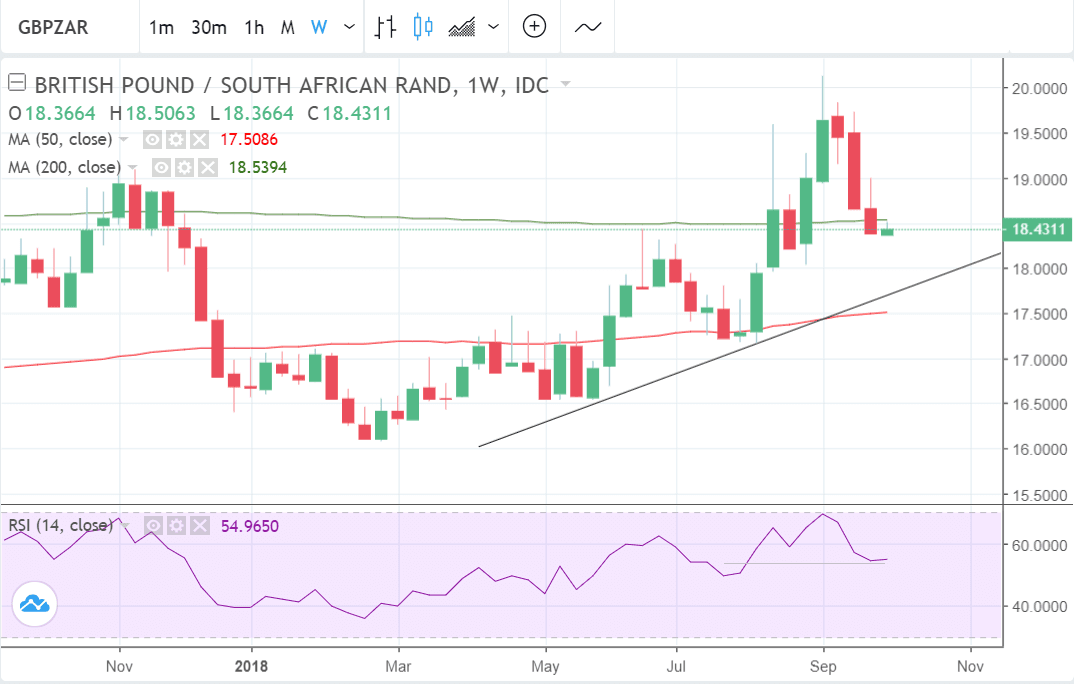

The weekly chart shows a trendline on GBP/ZAR in the late 17s which is likely to provide a floor for the pair, and we see these two levels - the MA and the trendline - as probably providing the parameters for fluctuations in the week ahead.

The short-term downtrend established in September should extend given the old adage that the "trend is your friend" and we see more downside conditional on a break below 18.35 to a target at 17.80, right on the trendline.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The South African Rand: What to Watch this Week

The South African Rand may be more subject to external drivers in the week ahead as domestic data remains sparse and low-tier.

A major focus could be global PMIs which if higher are likely to support the outlook for global growth, commodity prices, and SA as well as the Rand given its status as a leading emerging market nation.

"Global growth slowing down would leave emerging markets (EM) vulnerable to trade tensions, developed market (DM) policy normalisation, and lower commodity prices — all of which would impact on EM growth. Global growth forecasts are still rather robust though — but we will monitor downward revisions," says Zaakirah Ismail, a strategist at Standard Bank.

She adds that the welter of global PMI data for September will be a key gauge of global growth and therefore a possible determinant of the Rand.

At the same time as broad global growth is positive for SA and its currency - segmented growth in developed countries alone without coincidental growth in EM could be negative as it would lead to G10 countries lifting interest rates and therefore raising the overall cost of borrowing for the world in general, including SA.

This would be negative for the SA economy and the Rand as it would increase the debt-burden for SA companies as well as the repayment costs due to exchange rate erosion.

Later on this month the Rand could also be influenced by Moody's credit rating review and also the medium-term budget policy statement (MTBPS), both of which pose individual and interrelated risks to the outlook. Recall SA's credit rating is only one notch above junk status and therefore vulnerable.

As far as local data in the week ahead goes, however, the main releases will be PMI's for SA.

The ABSA Manufacturing PMI has already been released this morning and came out marginally lower than previously at 43.2 from 43.4 in August. A reading below 50 is indicative of contraction; above expansion.

The Standard Bank PMI for September is out on Wednesday at 8.15 B.S.T. The previous reading was 47.2.

Total new vehicle sales for August are released on Monday at 13.00. They showed a lower-than-forecast rise last month of 47.96k which analysts fear is indicative of a broader economic malaise.

"Recall that August vehicle sales contracted 2.5% y/y, below the 2.6% y/y increase in July. The unexpected decline in August’s sales figures is concerning and, in our view, reflects continued economic policy and labour market uncertainty as well as fading economic sentiment," says Ismail.

Finally, consumer confidence in Q3 is out at 9.00 on Tuesday, which previously rose to a balance of 22 in Q2, showing overall optimism.

This could be a significant metric given it will be one of the first data releases for the autumn quarter.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here