GBP/JPY: Downtrend May Continue if BoJ Tighten

Image © Adobe Stock

- GBP/JPY in long-term downtrend but anything could happen as both central banks set to meet

- A break below the 143.195 lows would be key to advancing the bearish cause

- The BoJ meet early on Tuesday morning and BOE on Thursday

The Pound-to-Yen exchange rate is vulnerable to volatility in the week ahead as meetings of both the Bank of England and Bank of Japan have the potential to move markets.

Rumours about that the Bank of Japan (BoJ) is widely tipped to tweak its ultra-loose monetary policy at 04:00 B.S.T, on the basis the current policy of using negative deposit rates to boost inflation is causing unsustainable financial stability risks.

Any alterations to the Bank's complex policies add up to a de facto tightening of monetary conditions which is likely to be positive for JPY, as it moves policy further along the long road back to normalisation.

Likewise the Bank of England is expected to raise interest rates in the UK, however, concerns about Brexit politics provide a spoiler which could surprise markets with a no-vote and weigh on Sterling.

Whilst there are risks the pair could move both ways, technically the trend is bearish, which means the charts are saying the Yen is more likely to rise versus the Pound which is more likely to weaken.

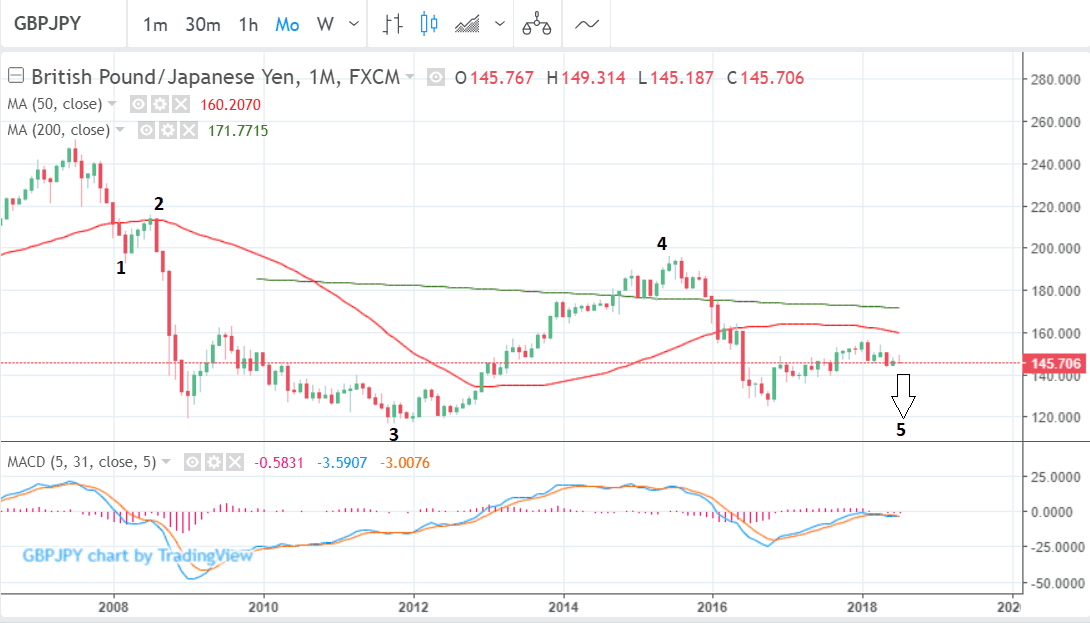

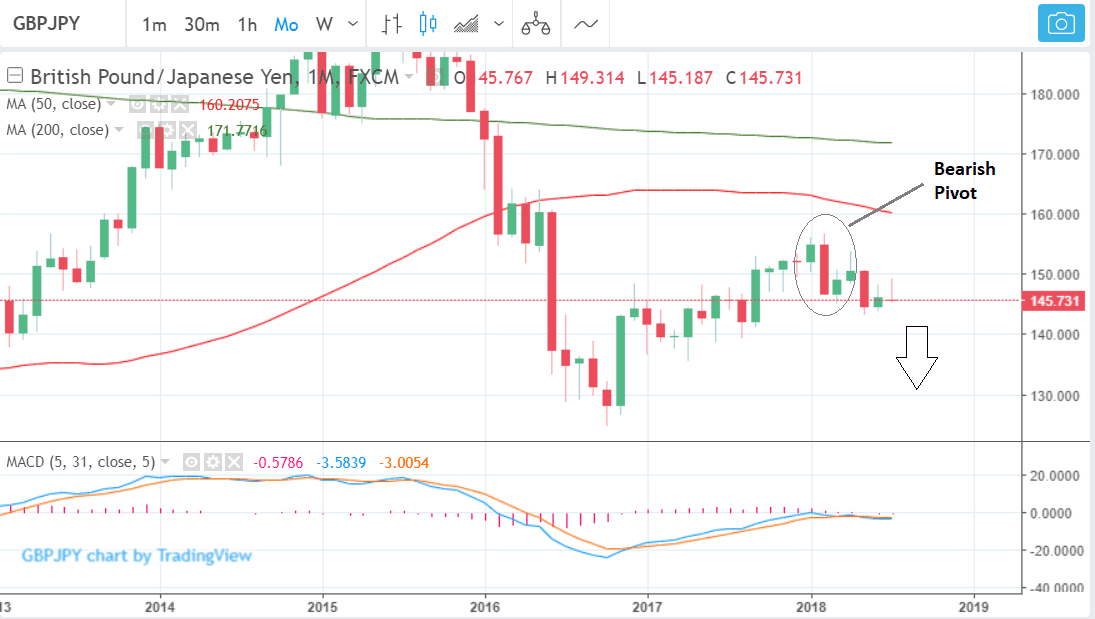

From as technical perspective the longer-term trend is down after a bearish pivot formed on the monthly chart in February (circled below); this suggests a new medium-term downtrend has begun and the overall backdrop is bearish.

Adding to the negative, long-term, outlook is the five wave Elliot wave which appears to be descending on the monthly chart since the 2007 highs.

GBP/JPY seems to be in the 5th wave of this cycle, which normally reaches to at least as low as the low of wave 3, which in this case is in the 116s, although an initial target would be the 124.78 October 2016 lows.

Once wave 5 has completed, however, the long-term trend could reverse.

Recent price action is showing a break down occurred out of a rising channel in April 2018 - a bearish short-term indication. Since then the pair has fallen to the 144s and 145s.

Pic - GBP-JPY-July30-week.png

After breaking out of the channel the pair has formed two lower lows and two lower highs, suggesting it is on the cusp of entering a new medium-term downtrend. Taken together with the breakout of the channel, it reinforces the bearish tenor of the chart.

A break below the 143.195, key, May 28, dragonfly doji, lows, it would probably confirm a continuation south to the next target at 139.30 at the same level as the June lows.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

All Eyes on the Bank of Japan

The main attraction for traders of the Yen in the week ahead is the BOJ policy meeting.

The Bank meets on Tuesday morning to discuss and decide monetary policy and is widely expected to 'tweak' its ultra- loose monetary policy, after rumours leaked from inside the Bank suggested as much last Monday.

Although governor Haruhiko Kuroda has denied plans are afoot to make alterations markets are widely expecting something to happen, even if its just a heads up of a change.

Any move will amount to de facto tightening of the Bank's ultra loose monetary policy, which creates an environment of very cheap borrowing. The BOJ cannot really loosen anymore so the only way now is 'up'.

The problem with the current situation is that it is weighing on bank's margins and leading to 'financial stability risks'. The BoJ has already targeting long-term yields to help the sector but there is pressure to do more.

Amongst a panoply of different options on the table, some think the BoJ will remove its negative deposit rate.

Those at Capital Economics think the BoJ will pave the way for a change later in the year by announcing it will be 'instructing its staff to investigate' how to make its policies more "sustainable" instead.

Other possibilities are that the Bank could lower its inflation target from the current 2.0% which increasingly looks unrealistic after decades of failed attempts to reach it and a demographic revolution which make it highly unlikely the target will ever be hit without a massive rise in the birthrate.

The main risk to JPY is that the BoJ says and does nothing at all. Such a scenario would see GBP/JPY rebound strongly.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here