The Chart That Shows Why Dollar-Yen is Aiming sub-140

- Written by: Gary Howes

Image © Adobe Images

The Dollar to Yen exchange rate (USD/JPY) briefly dipped below the 140 level on Monday before staging a recovery; however, one analysis suggests sub-140s is likely.

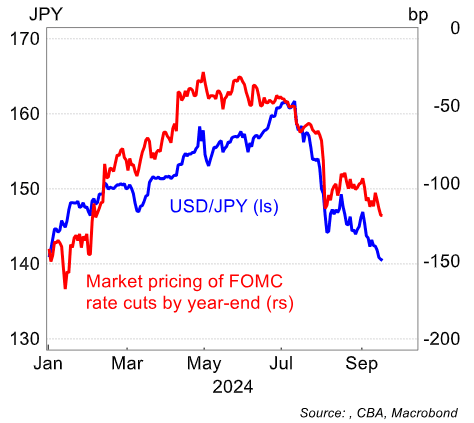

"In our view, USD/JPY can set a year to date low below 140," says Carol Kong, an Economist and Currency Strategist at Commonwealth Bank. She explains Dollar-Yen is closely following the ebb and flow of market pricing of FOMC rate cuts this year, and the trend looks to favour further downside.

From a technical perspective, 140 could offer the Dollar support in the near term, and further buying interest might yet emerge, particularly if the Dollar rallies in the wake of the midweek interest rate decision at the Federal Reserve (sell the expectation, buy the outcome).

"Every analyst on the street desperately wants USD/JPY to break below 140, everybody. I am not so sure it should, but I suppose if they cut 50bps it will, just a question for how long," says Brad Bechtel, Global Head of FX at Jefferies LLC.

"In our view, USD/JPY can set a year to date low below 140 if market participants focus on the monetary policy convergence between the FOMC and the BoJ," says Kong.

She cites the sharp 20 yen fall in USD/JPY in July/early August that can be largely attributed to the massive dovish repricing of FOMC rate cuts. At the time, the Fed Funds futures market had priced a total of 135bp of FOMC rate cuts by year-end.

"A 50bp cut, or a 25bp cut coupled with dovish language from FOMC Chair Powell, can encourage markets to increase pricing of more 50bp rate cuts at future FOMC meetings and pull USD/JPY further down. Our expectation of a hawkish on-hold decision by the Bank of Japan this week will not help USD/JPY either," says Kong.