Dollar-Yen: "Test of 104.90 Could Now be Seen"

Image © Adobe Images

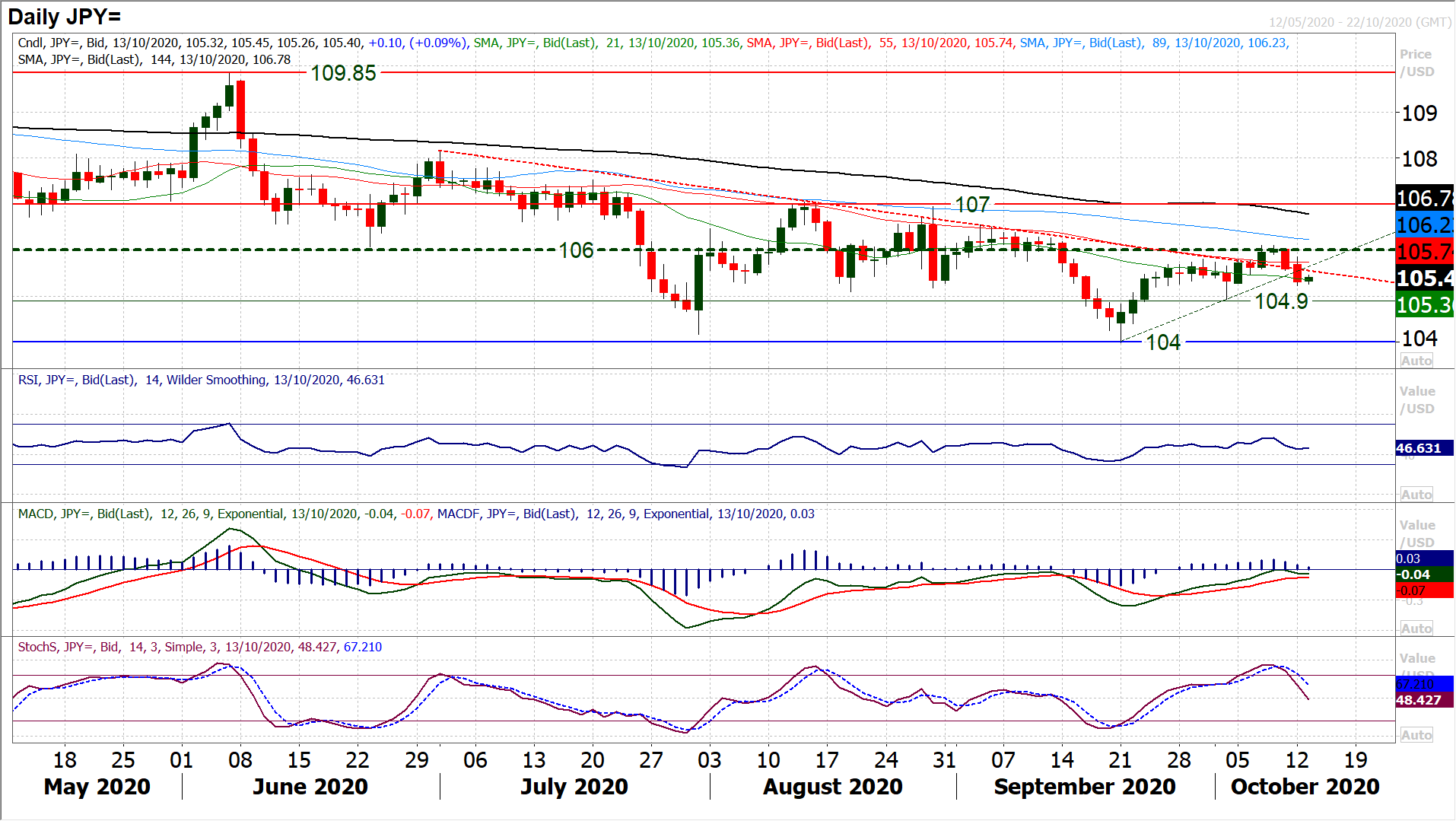

The Dollar-Yen exchange rate is quoted at 105.46 at the time of writing on Tuesday and is looking to reclaim some lost ground having fallen 0.27% on Monday. Analyst Richard Perry of Hantec Markets says any rebounds might be seen as a selling opportunity by traders.

On a day of light volumes, a second solid negative candle once more dragged the market lower yesterday.

The move has decisively broken an arguable recovery trend and means that a retreat towards a test of 104.90 could now be seen.

It comes with the renewed deterioration of momentum indicators, with Stochastics leading the way lower.

We still see a continuing medium term consolidation, between 104/107 in place now.

However, there is a mild negative bias within this range (reflected in MACD lines consistently under neutral and RSI consistently failing under 60) which leaves us to prefer a test of 104.90. Resistance is building up around 106.00 again.

It would mean that we look to use this early rebound today to see a selling opportunity. The hourly chart shows resistance between 105.50/105.80 will likely be where the next lower high is seen.

There is a mixed feel to markets today as the risk positive intent of recent sessions has begun to ebb away.

With US pharma giant Johnson & Johnson pausing its COVID-19 vaccination trial there is a jolt to recent bullishness.

Pausing trials are common practice (the AstraZeneca trial saw a similar pause for a few days about a month ago), but this has just given the bulls an excuse to pullback slightly.

As US Treasuries resume trading after a Columbus Day break, yields are ticking lower and the dollar is feeling the benefit once more.

Markets have been viewing the US fiscal support negotiations with a glass half full mentality, however, with a lack of traction there could also be some fatigue setting in.

We are seeing this today, with US index futures rolling back from a strong recent run higher. With Q3 earnings season starting in earnest today too, this adds another factor into the mix too.

A stronger dollar has weighed on the precious metals, whilst for oil, increasing second waves of COVID are a threat to demand at a time where supply is also looks to be increasing in Libya.

UK unemployment levels are now beginning to increase, although they are still at artificially low levels in light of the government furlough scheme. Sterling is relatively unmoved, with Cable focused more on dollar price action today.

There are a couple of important data points to watch out for on the economic calendar today. The German ZEW Economic Sentiment is at 1000BST is expected to decline to 73.0 in October (down from 77.4 in September). This would be driven by a deterioration in the current conditions to -60.0 (from -66.2 in September).

Then into the US session, US CPI inflation for September is at 1330BST, with headline CPI expected to see an increase to +1.8% (up from +1.7% in August), whilst core CPI is expected to also tick higher to +1.4% (from +1.3% in August).