Dollar-Yen's Rally Showing Less Conviction

- Written by: Richard Perry, Hantec Markets

Image © Adobe Stock

The USD/JPY exchange rate suffered its first daily decline in more than a week on Thursday, leading analyst Richard Perry at Hantec Markets to question just how far the near term rally can go.

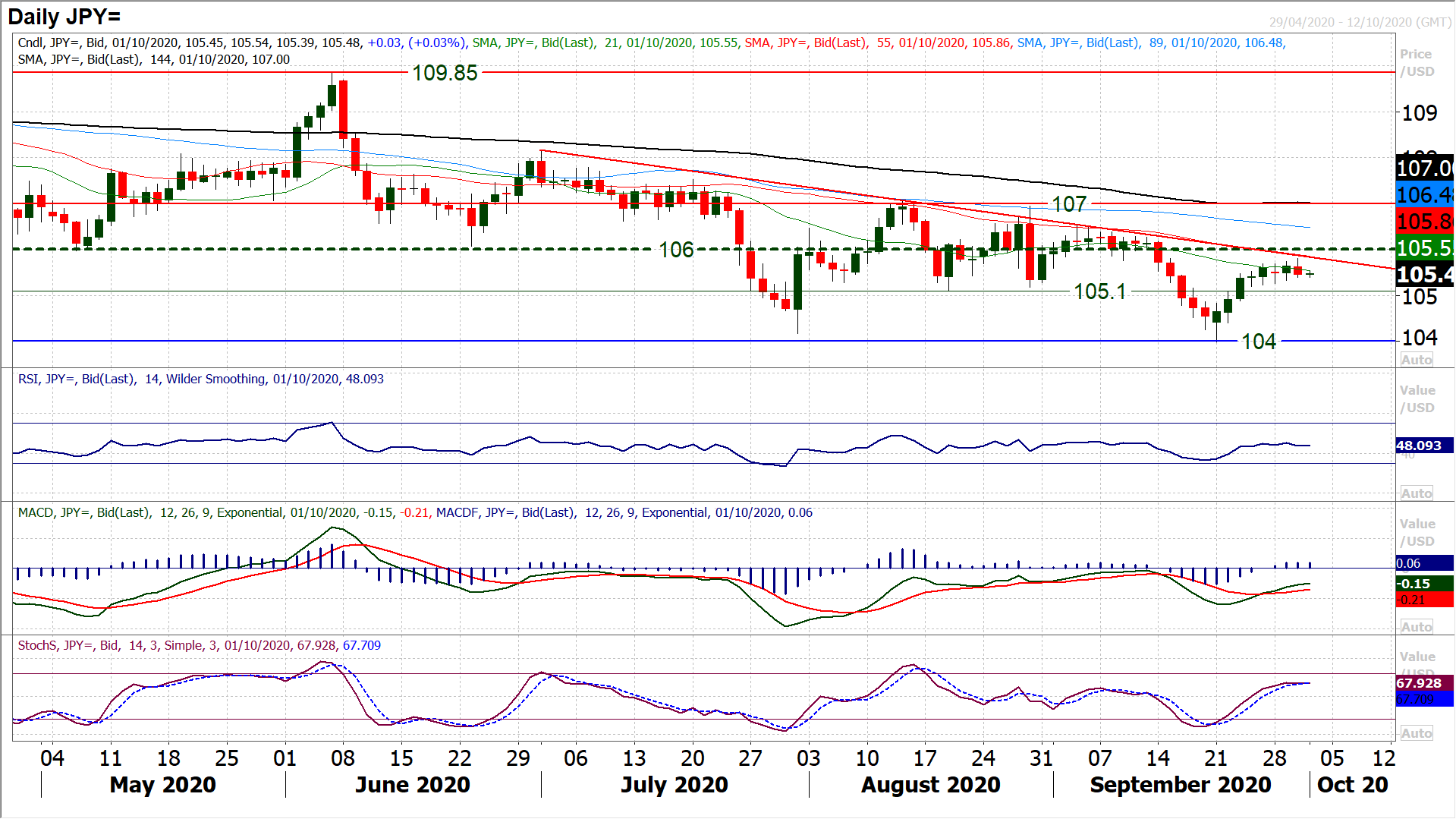

The drift higher on Dollar/Yen seems to be slowing now. Since the decisive recovery kicked in with three consecutive strong bull candles early last week, we are now seeing the rally with far less conviction.

Neutral candles have been creeping in, and now yesterday’s negative candle.

There was a previous tendency to consistently see intraday weakness bought into during the US session. This has now dried up.

The market has turned lower from yesterday’s high of 105.80 which was just under the resistance of the three month downtrend and 55 day moving average (both around 105.90 but also both a basis of resistance in recent months).

This questions just how far the near term rally can go. We now look for renewed sell signals. Hourly chart indicators show initial support at 105.20/105.30 and if this is breached then the risk is that the rally turns lower again.

Back under 105.00 risks a retreat to 104.00 again. Momentum indicators reflect the move running out of steam just at the areas where previous moves have (especially on RSI). Closing above resistance at 106.00 is needed to really push the recovery forward now.

The bulls fought back yesterday as a broadly positive tone to risk appetite trumped concerns markets are having over how the US Presidential Election could pan out.

How sustainable this improvement is could hinge on the talks between the Democrats and the White House over a fiscal support package.

The Democrats propose around $2.2trillion of funding, whilst Treasury Secretary Mnuchin and the White House propose around $1.6trillion. Although a vote was postponed last night, there is still a chance that fiscal support could be agreed upon as talks continue.

This is helping to prop up markets today.

You can also add in some broadly positive US data read through, with a better than expected ADP number boding well for Nonfarm Payrolls tomorrow.

This has pulled Treasury yields higher and the dollar is coming back under pressure once more (USD is a safe haven play primarily right now).

Subsequently, we see forex majors edging risk positive once more and equities gaining.

Watch also the precious metals ticking higher on the renewed dollar weakness. Once more we see major markets trading around dollar moves. Manufacturing PMIs are in focus now today.

The first trading day of the month is a day of the September manufacturing PMIs on the economic calendar.

The Eurozone final Manufacturing PMI is at 0900BST and is expected to be confirmed at 53.7 (53.7 flash September, 51.7 final August).

The UK final Manufacturing PMI is also expected to be unrevised at 54.3 (54.3 flash, 55.2 final August). The Eurozone Unemployment rate for August is expected to have increased to 8.1% (from 7.9% in July).

The Fed’s preferred inflation measure, US core Personal Consumption Expenditure is at 1330BST and is expected to pick up by +0.3% in August, which would increase the year on year rate to +1.4% (from +1.3% in July).

The US ISM Manufacturing is at 1500BST and is expected to tick slightly higher to 56.3 in September (from 56.0 in August).

There are another couple of Fed speakers scheduled for today. The FOMC’s John Williams (voter, centrist) speaks at 1600BST, whilst the FOMC’s Michelle Bowman (voter, leans hawkish) speaks again at 2000BST.